- Contractors

- Junior Professional

How to develop critical thinking skills in finance & accounting

Stephen Moir

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to email a link to a friend (Opens in new window)

When it comes to finance and accounting roles, employers are increasingly looking for problem solvers, not a number-crunchers. Over recent years, we have seen an increasing demand for people who can analyse and interpret data and think critically.

What is critical thinking.

A critical thinker is a problem solver. They are able to evaluate complex situations, weigh-up different options and reach logical (and often quite creative) conclusions.

Critical thinkers are highly-valued by employers as they innovate and make improvements, without taking unnecessary risks. Chartered Accountants Australia and New Zealand recently identified that it was in the top 10 attributes that will help you get noticed in the job market.

Why are critical thinking skills important?

Once you have learnt how to develop critical thinking skills you will be better able to add value to data, interpret trends within the business, understand how people and performance intersect and take-on broader commercial outlook that benefits the business.

How to develop critical thinking skills

Critical thinking comes naturally to some people, but it is also a skill than can be practiced. Here are some tips for how to develop your own critical thinking skills :

- Examine: Self-awareness is the foundation of critical thinking. It allows you to play to your strengths and address your weaknesses. Question how and why you do things the way you do.

- Analyse: Look for opportunities to grow and improve. Consider alternative solutions to the problems you encounter in your work.

- Explain: Clear communication is key. Get into the habit of talking through your reasoning and conclusions with colleagues.

- Innovate: Develop an independent mind-set. Find ways to think outside the box and challenge the status quo. Make sure your decisions are well-thought out. A critical thinker is logical as well as creative.

- Learn: Keep an open and well-oiled mind. Brush-up on your problem-solving skills by doing brain-teasers or trying to solve problems backwards. Keep up-to-date with professional learning opportunities . You may also need to unlearn past mindsets in order to grow and move forward.

How to apply critical thinking skills in your current role

Could you implement a new process or procedure that enhances performance or profitability? You might also consider volunteering for a new project or responsibility that gives you the opportunity to innovate and take on a new challenge. It’s a great way to broaden your skillset and gain exposure to other parts of the business.

Surround yourself with other critical thinkers in the organisation and work together towards achieving a problem-solving culture. Ask questions, and always look for opportunities for continual learning.

Changing roles to develop critical thinking skills

At Moir Group, we are passionate about finding the right cultural fit between people and the organisations they work with. If you are a critical thinker, it’s worth looking for a stimulating work environment that encourages innovation and non-conformist thinking when considering your next role.

How to demonstrate critical thinking skills at an interview

During an interview, use examples from your past experiences to demonstrate your problem-solving abilities. Show that you can be analytical, weigh-up pros and cons, consider other view points and be creative in your solutions. Clearly articulating your thought process is key.

Sometimes an interviewer will ask you to simplify the complex as a way of determining your clarity of thought. For example: “How would you explain the state of the economy to a kindergarten child?” In instances like these, the focus will be on how you explain your reasoning, rather than achieving a ‘right’ answer. Learn more here.

If you’re looking to take that next step in your career, we can help. Get in touch with us here .

2 Responses to “How to develop critical thinking skills in finance & accounting”

Hi Stephen,

The above is very useful and very valuable for employers. However my understanding of critical thinking is slightly different from above. I recently listened to a course in critical thinking by Professor Steven Novella of Yale School of Medicine. To keep it simple it is to do with assessing the veracity of views and statements made by oneself, others and media being constantly aware of the many biases, the flaws and fabrications of memory, half truths, unspoken truths, and even lies. So it becomes key to adopt an inquisitive mindset, to look for external evidence that supports argument and not just wishful or hopeful thinking.

Just wanting to add to the debate as this is a really important area.

Hi Richard,

We are pleased that found this article useful. Thanks for your sharing your thoughts about critical thinking.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Moir Group acknowledges Traditional Owners of Country throughout Australia and recognises the continuing connection to lands, waters and communities. We pay our respect to Aboriginal and Torres Strait Islander cultures; and to Elders past and present and encourage applications from Aboriginal and Torres Strait Islander people and people of all cultures, abilities, sex, and genders.

This site uses cookies, including third-party cookies, to improve your experience and deliver personalized content.

By continuing to use this website, you agree to our use of all cookies. For more information visit IMA's Cookie Policy .

Change username?

Create a new account, forgot password, sign in to myima.

Multiple Categories

Improving Critical Thinking Skills

November 01, 2021

By: Sonja Pippin , Ph.D., CPA ; Brett Rixom , Ph.D., CPA ; Jeffrey Wong , Ph.D., CPA

Whether working with financial statements, analyzing operational and nonfinancial information, implementing machine learning and AI processes, or carrying out many of their other varied responsibilities, accounting and finance professionals need to apply critical thinking skills to interpret the story behind the numbers.

Critical thinking is needed to evaluate complex situations and arrive at logical, sometimes creative, answers to questions. Informed judgments incorporating the ever-increasing amount of data available are essential for decision making and strategic planning.

Thus, creatively thinking about problems is a core competency for accounting and finance professionals—and one that can be enhanced through effective training. One such approach is through metacognition. Training that employs a combination of both creative problem solving (divergent thinking) and convergence on a single solution (convergent thinking) can lead financial professionals to create and choose the best interpretations for phenomena observed and how to best utilize the information going forward. Employees at any level in the organization, from newly hired staff to those in the executive ranks, can use metacognition to improve their critical assessment of results when analyzing data.

THINKING ABOUT THINKING

Metacognition refers to individuals’ ability to be aware, understand, and purposefully guide how to think about a problem (see “What Is Metacognition?”). It’s also been described as “thinking about thinking” or “knowing about knowing” and can lead to a more careful and focused analysis of information. Metacognition can be thought about broadly as a way to improve critical thinking and problem solving.

In their article “Training Auditors to Perform Analytical Procedures Using Metacognitive Skills,” R. David Plumlee, Brett Rixom, and Andrew Rosman evaluated how different types of thinking can be applied to a variety of problems, such as the results of analytical procedures, and how those types of thinking can help auditors arrive at the correct explanation for unexpected results that were found ( The Accounting Review , January 2015). The training methods they describe in their study, based on the psychological research examining metacognition, focus on applying divergent and convergent thinking.

While they employed settings most commonly encountered by staff in an audit firm, their approach didn’t focus on methods used solely by public accountants. Therefore, the results can be generalized to professionals who work with all types of financial and nonfinancial data. It’s particularly helpful for those conducting data analysis.

Their approach involved a sequential process of divergent thinking followed by convergent thinking. Divergent thinking refers to creating multiple reasons about what could be causing the surprising or unusual patterns encountered when analyzing data before a definitive rationale is used to inform what actions to take or strategy to use. Here’s an example of divergent thinking:

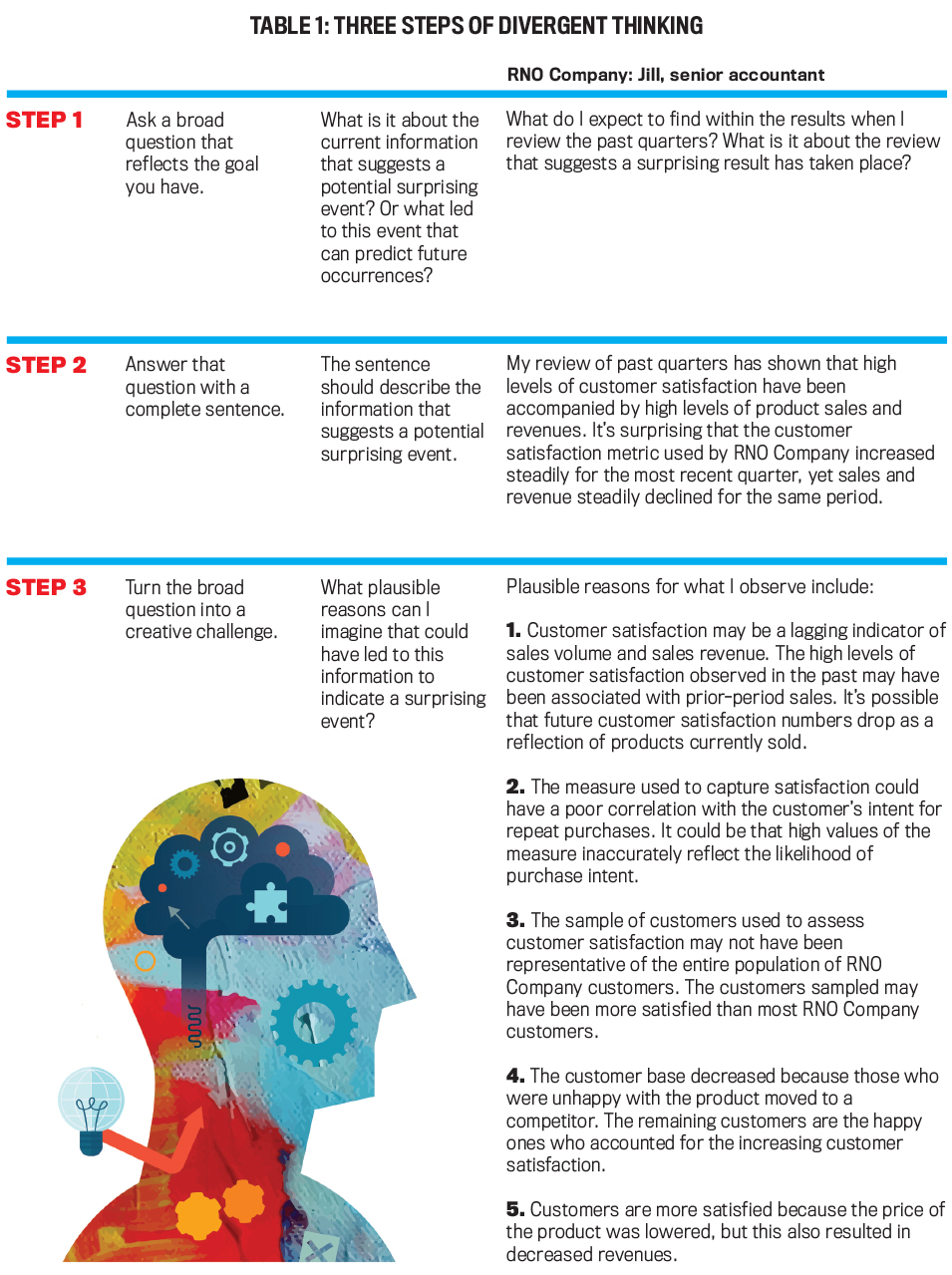

The customer satisfaction metric employed by RNO Company has increased steadily for the quarter, yet its sales numbers and revenue have declined steadily for the same period. Jill, a senior accountant, conducted ratio and trend analyses and found some of the results to be unusual. To apply divergent thinking, Jill would think of multiple potential reasons for this surprising result before removing any reason from consideration.

Convergent thinking is the process of finding the best explanation for the surprising results so that potential actions can be explored accordingly. The process consists of narrowing down the different reasons by ensuring the only reasons that are kept for consideration are ones that explain all of the surprising patterns seen in the results without explaining more than what is needed. In this way, actions can be taken to address the heart of any problems found instead of just the symptoms. On the other hand, if the surprising result is beneficial to an organization, it can make it easier to take the correct actions to replicate the benefit in other aspects of the business. Here’s an example of convergent thinking:

Washoe, Inc.’s customer satisfaction metric has increased steadily for the quarter, yet sales numbers and revenue have steadily declined for the same period. Roberto found this result to be surprising. After employing divergent thinking to identify 10 potential reasons for this result, such as “the reason that customers seem more satisfied is that the price of goods has been reduced, which also explains the reduction in sales revenue.” To apply convergent thinking, Roberto reviewed each reason that best fit. If the reason doesn’t explain the unusual results satisfactorily, then it will either be modified or discarded. For example, the reduced price of goods doesn’t explain all of the results—specifically, the decrease in units sold—so it needs to either be eliminated as a possible explanation or modified until it does explain all the results.

Exploring strategic or corrective actions based on reasons that completely explain the unusual results increases the chance of correctly addressing the actual issue behind the surprising result. Also, by making sure that the reason doesn’t contain extraneous details, unneeded actions can be avoided.

It’s important to note that a sequential process is required for these types of thinking to be most effective. When encountering a surprising or unexpected result during data analysis, accounting professionals must first focus strictly on divergent thinking—thinking about potential reasons—before using convergent thinking to choose a reason that best explains the surprising result. If convergent thinking is used before divergent thinking is completed, it can lead to reasons being picked simply because they came to mind right away.

LEARNING THE PROCESS

Improving divergent and convergent thinking can benefit employees at any level of an organization. Newer professionals who don’t have as much technical knowledge and experience to draw upon may be more likely to focus on the first explanation that comes to mind (“premature convergent thinking”) without fully considering all of the potential reasons for the surprising results. Experienced individuals such as CFOs and controllers have more technical knowledge and practical experience to rely on, but it’s possible these seasoned employees fall into habits and follow past patterns of thought without fully exploring potential causes for surprising results.

Instructing all accounting professionals on how to think about surprising results can help them have a more complete understanding of the issues at hand that will help guide actions taken in the future. It can lead to a more creative approach when analyzing information and ultimately to better problem solving.

When teaching employees to use divergent and convergent thinking, the goal is to get them to focus on what should be done once they identify information that suggests a surprising result has occurred. The first step is to learn how to properly use divergent thinking to create a set of plausible explanations more likely to contain the actual reason for the surprising results. There’s a three-step method that individuals can follow (see Table 1):

- Ask a broad question that reflects the goal you have: For instance, what is it about the current information that suggests a potential surprising event? Or what led to this event that can help predict future occurrences?

- Answer that question with a complete sentence: Be sure the answer includes a description of the information that suggests a potential surprising event.

- Turn the broad question into a creative challenge: Identify the plausible reasons that could have led to the indications of a surprising event.

Once employees have a good grasp of how to use divergent thinking, the next step is to instruct them in the proper use of convergent thinking, which involves choosing the best possible reason from the ones identified during the divergent thinking process. Potential reasons need to be narrowed down by removing or modifying those that either don’t fully explain the surprising results or that overexplain the results.

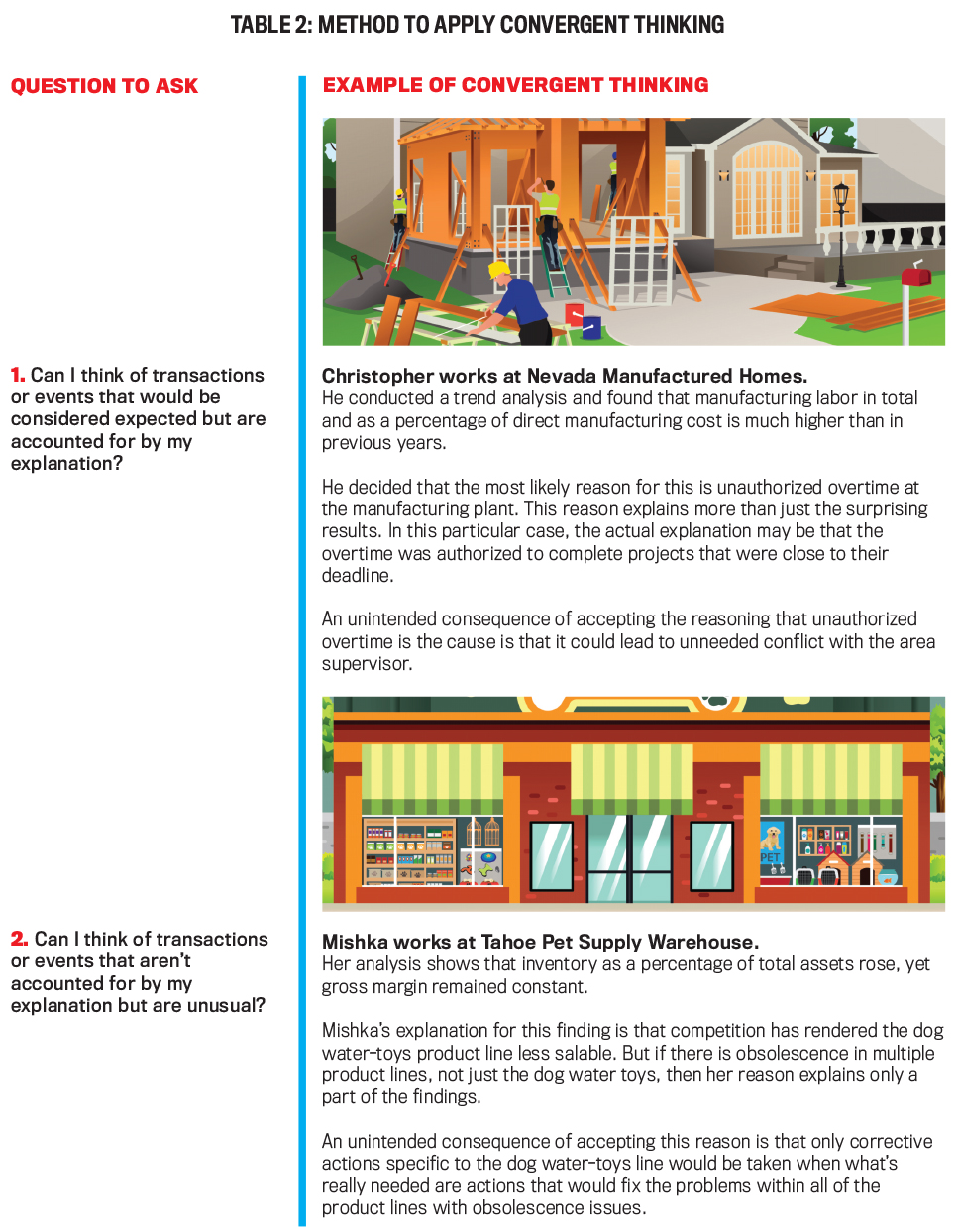

Two simple questions can help individuals screen each of the possible explanations generated in the divergent thinking process (see Table 2):

- Can I think of transactions or events that would be considered expected but are accounted for by my explanation?

- Can I think of transactions or events that aren’t accounted for by my explanation but are unusual?

The first question is designed for an individual to think about whether there are other events outside of the current issue that fit the explanation: “Does the explanation also address phenomena that aren’t related to or outside the scope of the surprising result that’s being studied?” If the answer is “yes,” then this is a case of overexplanation. Consider, for example, a scenario involving an increase in bad debts. Relaxing credit requirements may explain the increase, but they would also explain a growth in sales and falling employee morale due to working massive amounts of overtime to make products for sale.

The second question is designed to think about whether an explanation only accounts for part of the phenomenon being observed: “Does the explanation address only part of what’s being observed while leaving other important details unexplained?” If the answer is “yes,” then it’s an under-explanation. For example, consider a decline in sales. An economic downturn at the same time as the decline may be a possible explanation, but it might only be part of the problem. A drop in product quality or a drop in demand due to obsolescence could also be causing sales to decline.

If the answer to either screening question is “yes,” then the explanation needs to be discarded from consideration or modified to better address the concern. In the case of over-explanation, the reason is too general and may lead to action areas where none is needed while still not addressing the actual issue. For underexplanation, the reason is incomplete because it accounts for only a portion of the phenomenon observed, thus action may only address a symptom and not the actual root problem.

If the answer to both questions is “no,” then the explanation is viable. The chosen reason neither overexplains nor underexplains the issue at hand, making it more likely that the recommended solution or plan of action based on that reason will be more successful at addressing the actual cause of the issue.

Divergent and convergent thinking are two distinct processes that work in conjunction with each other to arrive at potential reasons for the results they observe. Yet, as previously noted, the two ways of thinking must be conducted separately and sequentially in order to obtain optimal results. Divergent thinking must be applied first in order to achieve a diverse set of potential reasons. This will maximize the probability of generating a feasible reason that explains the results correctly. After the set of potential reasons has been generated using the divergent thinking approach, convergent thinking should be used to methodically remove or modify the reasons that don’t fit with the surprising results.

If both divergent thinking and convergent thinking are done simultaneously, premature convergence can lead to a less-than-optimal reason being chosen, which may lead to taking the wrong course of action. Thus, it’s important with training to instruct employees in the use of both divergent thinking and convergent thinking and to use the types of thinking sequentially.

ORGANIZATIONAL TRAINING

Learning to apply divergent and convergent thinking can require a substantial time commitment. The process we’ve described here is designed to enhance critical thinking and problem-solving skills. It outlines a general approach that doesn’t provide specific guidance on the best methods to analyze data or complete a task but rather focuses on successful methods to think of a diverse set of reasons for any surprising results and then how to choose the best explanation for that result in order to be able to recommend the most appropriate actions or solutions.

Individuals can practice the approach we’ve described on their own, but each organization will likely have its own preferred way to approach the analyses. Plumlee, et al., used training modules in their study that could be employed in a concerted effort by a company, with supervisors training their employees. We estimate that a basic training session would take about two hours. Complete training with practice and feedback would require about four hours—which could grow longer with even more for intensive training.

One area where this training could be very effective in helping employees is data analytics. In the past decade, an increasing amount of accounting and financial work involves or relies on data analysis. Data availability has increased exponentially, and companies use or have developed software that generates sophisticated analytical results.

Typical data analysis procedures accounting professionals might be called on to perform include things such as ratio and trend analyses, which compare financial and nonfinancial data over time and against industry information to examine whether results achieved are in line with expectations for strategic actions. Additionally, analyses are forward-looking when performance measures examined are leading indicators.

In order to perform data analytics effectively, accounting professionals must exercise sufficient judgment to critically assess the implications of any surprising results that are found. The quality of judgments and understanding the best ways to conduct and interpret the information uncovered by data analytics have typically been a function of time spent on the job along with training. At the same time, however, it’s commonplace that many of these analyses are performed by newer professionals.

Training in metacognition will help these employees more effectively and creatively reach conclusions about what they’ve observed in their analysis. Since the method discussed provides general instruction, each organization can customize the approach to best fit its own operations, strategies, and goals. Implementing a training program can be worth the investment given the importance of critical thinking throughout the process of evaluating operating results. Avoiding potential failures with interpreting results that could be prevented would seem to warrant the consideration of metacognitive training.

About the Authors

November 2021

- Strategy, Planning & Performance

- Business Acumen & Operations

- Decision Analysis

- Operational Knowledge

Publication Highlights

Lessons from an Agile Product Owner

Explore more.

Copyright Footer Message

Lorem ipsum dolor sit amet

The Must-Have Finance Skills of the Future

The financial professional of the future must utilize strategic and critical thinking skills to solve complex problems, leverage new technologies, and manage ever-changing risks..

Rapid rates of transformation require finance professionals to innovate. What important skills are a must-have to succeed within the finance function? FEI Daily spoke with Corporate Financial Reporting Insights Conference (CFRI) speaker and Vice Chair of Chief Products and Technology Officer at PwC about the skills he predicts will be most in-demand.

FEI Daily: Why are upskilling/training events for senior-level financial executives important, especially this year?

I’d also encourage executives not to underestimate your organization - and your team’s - capacity to grow. At PwC, a huge contributor to our success has been what we call “citizen led” innovation. Quite simply, we put the right tools in the hands of our people and we equipped them with the knowledge and the empowerment to put them to work. We learned quickly that they have the best view of what’s possible - they brought the knowledge of their work to the task of changing their work. Not only did they benefit from a new sense of purpose and a drive to innovate, but we also benefited from their ability to apply new technologies and new skills to make the work more efficient and more effective. They became the drivers of our transformation, instead of the recipients, and they knew - as we did - that they would be better positioned for future career growth as a result.

FEI Daily: What skills do you predict will be most in-demand over the next several years (finance and otherwise)?

Atkinson : We used to talk about jobs as “tech” jobs and “non-tech” jobs, but now there are just jobs. We all have to embrace the tech. Careers today and the careers of tomorrow will require getting comfortable being uncomfortable - a mindset that allows people to explore tech, to ask the “stupid” questions and explore in a collaborative way with their coworkers what the tech means to the way they do their job.

We know we need smart, diligent accountants and financial executives who demonstrate the integrity that’s at the heart of financial reporting. Data skills, analytics, data visualization - all are critical skills to the finance function of the future. But so is agility, a “product mindset,” and an understanding of the concepts behind human centered design. These aren’t the skills we often associate with our finance functions, but if we’re going to drive true and lasting transformation, these are the additional skills we need.

FEI Daily: What skills are finance teams looking for as they face COVID-related challenges?

Atkinson : Many observers are saying that the pandemic has significantly accelerated digital transformation - and in many ways it absolutely has. But in the last few months, what we’ve really seen is great strides in how we all work and communicate remotely. We still have a great deal to do to change the way work gets done, and to create sustainable patterns of work in a post-COVID world. Many people report they’re working longer hours than ever before, and as leaders, we need to listen to that reality and do all we can to create a better experience for the talented professionals we rely on every day.

This has been a terrible and challenging time for many people. But - in the category of small silver linings - what the pandemic has demonstrated is that people have more agility and willingness to change than we as leaders typically give them credit for. None of us may be able to reliably work the mute/unmute buttons, but we are all more comfortable connecting, sharing content remotely, and driving outcomes even as we work far apart from each other. We have an opportunity to tap into that agility and empower our people to bring the next set of innovations to how we work.

FEI Daily: What do you hope attendees will take away from your session at CFRI?

Atkinson : Experience matters - organizations need steady leadership in uncertain times and the confidence that deep knowledge of our financial functions and processes brings comfort to our teams. But our teams also see the pace of change - they know the world is changing around them - and the additional burden of leadership today is to help them navigate that, even when we ourselves may also be uncomfortable with that pace of change. I hope today that participants will realize that the key takeaway is not to defer your learning. The learning curves may seem imposing, but the reality is they’re not that steep, they’re just continuous. The sooner you lean in and create the culture of learning, and empower your people to innovate with the right tools and skills, the faster you’ll unlock the ability of your teams to deliver the transformation you seek.

Visit Website

| Please enter your password to continue. |

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- CPA INSIDER

Top soft skills for accounting professionals

Soft skills are key to career advancement. one cpa at the forefront of recruitment and professional development shares tips for boosting these critical skills..

- Professional Development

Communication

- Career Development

As professionals advance in an accounting or finance career, soft skills become increasingly important. In a world that is becoming more digital, computerized, and automated, soft skills can be the differentiator between two employees competing for the same promotion or position.

In fact, in a recent survey reported by the Society for Human Resource Management, 97% of employers stated soft skills were either as important or more important than hard skills. Whether a professional is looking for a new job or seeking a promotion, focusing on and developing soft skills can help employees be more well-rounded and employable professionals.

What I am seeing, for my own team and firmwide working with hiring companies, is the importance placed on various soft skills for accounting and finance professionals, which can help take the company's work to the next level.

For professionals looking to improve their work and their employability, the four soft skills listed below are most prominent.

Time management

Time management is an essential skill for any accounting professional because of not only how deadline-focused the profession is, but also because of the time management discipline required by the large-scale shift to remote work. It can be challenging to avoid procrastination, and it is easier to get off track when working virtually.

Because of accounting's cyclical nature, employees have ample opportunities to hone time management skills. Most significant projects and deliverables will happen at the same time of year, depending on the organization. Here are a few tips I have found to help develop time management skills and stay organized.

Start with leveraging calendars and tasks. Using the organization's digital tools can help move projects along and keep them organized. For example, if working within a team setting, use a shared spreadsheet with colleagues to track each person's responsibilities for month-end close or whatever project the team has prioritized. For sole practitioners, diligently using a calendar can help with keeping on task and meeting deadlines.

Another way to develop time management skills is by talking to managers and colleagues. Ask how they keep their tasks aligned. They might be planning their days in a way that can work with other projects and tasks. CPAs who demonstrate good time management have a leg up both for new employment opportunities and for promotions within their organization.

Critical thinking

Various hiring managers we work with often request that candidates have "strong critical-thinking skills," but what does that mean for the accounting and finance profession? Critical thinking — analyzing problems and finding the causes and solutions to those problems — is a major facet of the accounting profession.

Organizations are constantly facing new financial challenges. Most recently, COVID-19 created a range of challenges for accounting and finance teams to solve. Reallocating funds and cash management, managing payroll changes, reacting to new legal changes to internal reporting practices, and other changes required employees to think critically and creatively to meet organizational needs.

While COVID-19 was unexpected, there are other challenges accounting teams can plan for. What we are seeing most employers ask for is accounting and finance professionals who not only look at the problems of the past and find solutions, but who also can predict problems before they occur. From first glance to final analysis, accounting professionals should look at all the information they have and be able to communicate why something happened and what can be done in the future to plan or account for it.

When working to develop critical thinking skills, I've found it extremely important to first question how and why processes are done the way they are and ask how they can be done better. This "professional skepticism" and general curiosity can help ensure accuracy across all tasks. Professional skepticism will make it easier to ask the right questions and find the "why" instead of just trusting information at face value.

Leveraging other successful accounting professionals' advice can hone critical thinking skills and make any accounting professional a stronger asset to their organization. Webinars, conferences, and networking with other accounting professionals can give insight into what other organizations are doing and offer vendor recommendations, process improvements, and more.

Our recruiters regularly see communication as a top skill for accounting and finance talent. Nearly every function of an organization interacts with the accounting and finance teams. Therefore, professionals need to have exceptional communication skills, both written and verbal. Important projects need to be communicated in an easy-to-understand way to executives and colleagues (especially if they are unfamiliar with accounting or finance terminology) to ensure proper completion.

If accounting and finance professionals have poor communication skills, making clear points, sharing their reports and creating action items from the findings can be difficult.

When working to develop strong communication skills, reach out to a manager for feedback. Have them review emails, reports, and other communication before sending out or sharing.

Ask them if the communication gets the point across and if they believe the end user will understand the report or the solution being communicated. It's important to recognize who your audience is and the best way to present the information.

Avoid using too much jargon and ensure that anyone can understand the information, not just accounting professionals. Along with asking a manager for help, do a self-review of any communication. For written work, read it out loud to catch errors. Hearing versus reading something has a different impact. For oral communication, practice in advance so that the meeting's goal or call is adequately communicated.

Collaboration

Collaboration with teammates and other employees is paramount for accounting professionals. Since accounting and finance teams touch every area of the business, they are expected to work cross-functionally and collaborate well with other employees. Projects that involve other employees — like budgets, cash flow projections, or strategic planning — can be complicated and require a high degree of collaboration.

While entry-level accountants might not lead these projects with other company leaders, they will eventually be expected to meet with teams across the organization, so developing this skill now is crucial for continued growth. Even for sole practitioners who work relatively independently, collaboration is absolutely key while working with clients and any other stakeholders in various projects.

One way I've found helpful in practicing to become a stronger collaborator is spending time before a meeting writing down questions and thoughts to bring to the conversation. Make speaking up in meetings and calls a regular habit, and eventually, it'll become muscle memory. Preparing questions and engaging with the topic will encourage other team members to do the same and create more dialogue and collaboration in the discussions.

— Ryan Chabus , CPA, MBA, is the controller at LaSalle Network, a staffing, recruiting, and culture firm based in the US. To comment on this article or to suggest an idea for another article, contact Drew Adamek, a JofA senior editor, at [email protected] .

Where to find September’s digital edition

The Journal of Accountancy is now completely digital.

SPONSORED REPORTS

Be prepared for tax season early

Our expert tax report highlights the important issues that tax preparers and their clients need to address for the 2024 tax year. Stay informed and proactive with guidance on critical tax considerations before year-end.

4 questions to drive your audit technology strategy

Discover how AI can revolutionize the audit landscape. This report tackles the biggest challenges in auditing and shows how AI's data-driven approach can provide solutions.

FEATURED ARTICLE

Single-owner firms: The thrill of flying solo

CPAs piloting their own accounting practices share their challenges, successes, and lessons learned.

.png)

- Get started

How to Improve Your Critical Thinking Skills as a Chief Financial Officer

Learn how to enhance your critical thinking skills as a CFO. Master decision-making, problem-solving & leadership with our tips.

As a Chief Financial Officer (CFO), you play a crucial role in driving the financial success of your organization. To achieve this, you need to have exceptional critical thinking skills that enable you to identify complex financial issues, evaluate multiple solutions, and make sound decisions. In this article, we will explore practical ways to enhance your critical thinking skills and take your CFO role to the next level.

Understanding the Importance of Critical Thinking for CFOs

As a CFO, you are responsible for managing the financial health of your organization and ensuring that it stays on track towards achieving its financial goals. Critical thinking is an essential tool in this role as it enables you to make sound decisions based on logic, analysis, and evaluation of available facts.

However, critical thinking is not just about making decisions based on data and facts. It also involves being able to identify assumptions, biases, and fallacies that may impact your decision-making process. By being aware of these potential pitfalls, you can make more informed decisions that are not influenced by personal biases or preconceptions.

The role of a CFO in decision-making

As a CFO, you are involved in decision-making at every level of your organization. Whether you are making decisions related to budgeting, investing, or risk management, critical thinking is essential to ensure that you are making informed decisions that align with your organization's goals.

Moreover, critical thinking enables you to see the bigger picture and understand how your decisions may impact other areas of your organization. By taking a holistic approach to decision-making, you can make decisions that benefit your organization as a whole rather than just one department or area.

How critical thinking impacts financial performance

Critical thinking is vital to financial performance as it enables you to identify financial risks, evaluate investment opportunities, and develop effective financial strategies that drive growth. By honing your critical thinking skills, you can make better financial decisions that contribute to the success of your organization.

However, critical thinking is not just about improving financial performance. It also helps you to identify opportunities for innovation and growth that may not be immediately apparent. By thinking critically, you can identify new markets, products, or services that can help your organization to stay ahead of the competition and achieve long-term success.

In conclusion, critical thinking is an essential skill for CFOs who want to make informed decisions that drive financial performance and contribute to the success of their organization. By developing your critical thinking skills, you can identify risks, opportunities, and innovative solutions that can help your organization to achieve its goals and stay ahead of the competition.

Developing a Growth Mindset

Growth mindset is the belief that you can develop your skills and abilities through hard work, practice, and learning. As a CFO, having a growth mindset is essential to continuously improve your critical thinking skills.

Embracing challenges and learning from failures

Challenges and failures are part of the learning process. Instead of shying away from them, embrace them as opportunities to learn and grow. By analyzing past failures, you can identify areas for improvement and make better decisions in the future.

For example, let's say your company recently experienced a financial setback. Instead of dwelling on the negative, use this as an opportunity to analyze what went wrong and how you can prevent it from happening again in the future. Perhaps you can identify areas where you need to improve your forecasting or risk management skills. By embracing this challenge and learning from your failure, you can become a stronger and more effective CFO.

Cultivating curiosity and open-mindedness

Curiosity and open-mindedness are critical to critical thinking. By staying curious and open to new ideas, you can challenge your assumptions, evaluate multiple perspectives, and make informed decisions that drive financial growth.

One way to cultivate curiosity is to regularly attend industry conferences and events. This will expose you to new ideas and perspectives, and help you stay up-to-date on the latest trends and best practices. Additionally, you can seek out mentorship from other CFOs or industry experts, who can provide valuable insights and guidance.

Open-mindedness is also important when it comes to working with your team. By encouraging diverse perspectives and ideas, you can create a culture of innovation and collaboration. This can lead to new solutions and approaches that drive financial growth and success.

In conclusion, developing a growth mindset is essential for CFOs who want to continuously improve their critical thinking skills and drive financial growth. By embracing challenges, learning from failures, cultivating curiosity, and staying open-minded, you can become a stronger and more effective leader in your organization.

Enhancing Problem-Solving Abilities

Problem-solving is a critical skill for any professional, and it is especially important for CFOs. As a CFO, you are responsible for identifying and addressing complex financial issues that can impact your organization's success. Developing your problem-solving abilities can help you identify these issues and develop effective solutions that drive growth.

There are several key strategies that you can use to enhance your problem-solving abilities:

- Break down complex issues: When faced with a complex financial issue, it can be helpful to break it down into smaller parts. This can help you identify the root cause of the issue and develop targeted solutions.

- Analyze all available information: To make informed decisions, it is important to gather and analyze all available information related to the issue at hand. This can include financial data, market trends, and input from other stakeholders.

- Evaluate potential solutions: There are often multiple solutions available for complex financial issues. By evaluating each potential solution and its potential outcomes, you can make an informed decision that drives the best financial performance for your organization.

Identifying and Analyzing Complex Financial Issues

As a CFO, you face a wide range of complex financial issues on a daily basis. These can include everything from managing cash flow and budgeting to forecasting revenue and analyzing market trends. To effectively address these issues, it is important to break them down into smaller parts and analyze all available information.

For example, if your organization is experiencing cash flow issues, you might start by analyzing your accounts receivable and accounts payable to identify any potential bottlenecks. You might also look at your sales data to identify any trends or patterns that could be impacting your cash flow. By breaking down the issue into smaller parts and analyzing all available information, you can develop targeted solutions that address the root cause of the issue.

Evaluating Multiple Solutions and Their Potential Outcomes

When faced with complex financial issues, there are often multiple solutions available. For example, if your organization is struggling to meet its revenue targets, you might consider launching a new product, expanding into a new market, or increasing your marketing efforts.

To evaluate these potential solutions, it is important to consider their potential outcomes. For example, launching a new product might require a significant investment of time and resources, but it could also generate a significant amount of revenue if successful. Similarly, expanding into a new market could be a high-risk, high-reward strategy that could drive significant growth for your organization.

By evaluating each potential solution and its potential outcomes, you can make an informed decision that drives the best financial performance for your organization.

Strengthening Emotional Intelligence

Effective decision-making is not just about logic and analysis. Emotions also play a crucial role in decision-making. As a CFO, it is important to recognize the impact of emotions on your decision-making process and strengthen your emotional intelligence to make better decisions that align with your organization's goals.

Emotions can be powerful and have the ability to cloud our judgment. When making decisions, it is important to recognize and manage your emotions to ensure that they do not negatively impact your thought process. By strengthening your emotional intelligence, you can develop strategies to manage your emotions and make informed decisions.

Understanding the impact of emotions on decision-making

Research has shown that emotions can influence decision-making in a variety of ways. For example, fear can cause individuals to avoid taking risks, while anger can lead to impulsive decisions. By understanding the impact of emotions on decision-making, you can develop strategies to manage your emotions and make informed decisions that align with your organization's goals.

One way to manage your emotions is to take a step back and evaluate your feelings before making a decision. By taking a moment to reflect on your emotions, you can better understand how they may be influencing your thought process. This can help you make a more informed decision that is based on logic and analysis, rather than emotions.

Developing empathy and effective communication skills

As a CFO, you need to communicate effectively with stakeholders at all levels. Developing empathy and effective communication skills can help you communicate with authenticity, build trust, and make informed decisions that align with your organization's values.

Empathy is the ability to understand and share the feelings of others. By developing empathy, you can better understand the perspectives of your stakeholders and make decisions that take their needs into account. Effective communication skills are also important for building trust and ensuring that your stakeholders understand your decisions.

One way to develop empathy and effective communication skills is to actively listen to your stakeholders. By listening to their concerns and perspectives, you can better understand their needs and make decisions that align with their expectations. Additionally, communicating your decisions clearly and transparently can help build trust and ensure that your stakeholders understand your thought process.

Overall, strengthening your emotional intelligence can help you make better decisions as a CFO. By understanding the impact of emotions on decision-making and developing empathy and effective communication skills, you can make informed decisions that align with your organization's goals and values.

Building Effective Decision-Making Processes

Building effective decision-making processes is crucial to enhancing your critical thinking skills as a CFO. By establishing a systematic approach to decision-making, you can make sound decisions that align with your organization's goals. But what does it take to create an effective decision-making process?

First, it's important to understand that decision-making is not a one-size-fits-all approach. Different situations call for different decision-making processes. For example, a quick decision may be necessary in a crisis situation, while a more deliberate approach may be needed for long-term planning.

Establishing a Systematic Approach to Decision-Making

Establishing a systematic approach to decision-making involves identifying the problem, analyzing available information, evaluating potential solutions, and selecting the best solution. This process can be broken down into the following steps:

- Identify the problem: Clearly define the problem you are trying to solve. This step is crucial because it sets the foundation for the entire decision-making process.

- Analyze available information: Gather and analyze all relevant information related to the problem. This may involve reviewing financial data, market trends, and customer feedback.

- Evaluate potential solutions: Consider all possible solutions to the problem and evaluate their pros and cons. This step may involve brainstorming, conducting research, and seeking input from others.

- Select the best solution: Based on the analysis and evaluation of potential solutions, choose the best course of action. This decision should be based on sound reasoning and aligned with the organization's goals.

By following a systematic approach, you can make sound decisions that lead to financial success.

Encouraging Collaboration and Diverse Perspectives

Collaboration and diverse perspectives are essential to effective decision-making. By encouraging collaboration and listening to diverse perspectives, you can gain new insights, challenge assumptions, and make informed decisions that contribute to the financial success of your organization.

Collaboration involves working with others to solve a problem or make a decision. This may involve brainstorming sessions, team meetings, or seeking input from subject matter experts. By involving others in the decision-making process, you can gain new perspectives and insights that you may not have considered otherwise.

Diverse perspectives refer to the idea that people with different backgrounds, experiences, and expertise can contribute unique insights to the decision-making process. By seeking out diverse perspectives, you can challenge assumptions and avoid groupthink, which can lead to better decision-making.

In conclusion, building effective decision-making processes involves establishing a systematic approach to decision-making and encouraging collaboration and diverse perspectives. By following these principles, you can make sound decisions that contribute to the financial success of your organization.

In Conclusion

Enhancing your critical thinking skills is essential to becoming a successful CFO. By understanding the importance of critical thinking, cultivating a growth mindset, enhancing your problem-solving abilities, strengthening your emotional intelligence, and building effective decision-making processes, you can make sound decisions that drive the financial success of your organization.

Ready to build an advisory board?

- Q1: Why is critical thinking important for CFOs? Critical thinking is important for CFOs as it enables them to make sound decisions based on logic, analysis, and evaluation of available facts. It also helps in identifying assumptions, biases, and fallacies that may impact the decision-making process.

- Q2: What is the role of a CFO in decision-making? CFOs are involved in decision-making at every level of the organization. Whether it is related to budgeting, investing, or risk management, critical thinking is essential to ensure that informed decisions are being made that align with the organization's goals.

- Q3: How does critical thinking impact financial performance? Critical thinking is vital to financial performance as it enables identifying financial risks, evaluating investment opportunities and developing effective financial strategies that drive growth. It also helps in identifying opportunities for innovation and growth that may not be immediately apparent.

- Q4: How can CFOs enhance their problem-solving abilities? CFOs can enhance their problem-solving abilities by breaking down complex issues, analyzing all available information, and evaluating potential solutions. This helps in identifying the root cause of the issue and developing targeted solutions.

- Q5: How can emotional intelligence help in effective decision-making? Emotional intelligence can help in effective decision-making as it helps in recognizing the impact of emotions on the decision-making process. By developing empathy and effective communication skills, CFOs can communicate with authenticity, build trust and make informed decisions that align with their organization's values.

Build your advisory board today

See how easy we've made it to build an advisory board

See what boards you're qualified for

See what you qualify for with our 2-minute assessment

Similar Articles

How to Improve Your Critical Thinking Skills as a VP of Information Technology

How to Improve Your Customer Service Skills as a VP of Security

How to Improve Your Teamwork Skills as a VP of Procurement

How to Improve Your Active Listening Skills as a VP of Innovation

How to Improve Your Active Listening Skills as a Chief Marketing Officer

How to Improve Your Adaptability Skills as a VP of Human Resources

How to Improve Your Project Management Skills as a Chief Human Resources Officer

How to Improve Your Technical Skills as a VP of Sustainability

How to Improve Your Technical Skills as a VP of Corporate Communications

How to Improve Your Networking Skills as a General Counsel

How to Improve Your Leadership Skills as a Chief Data Officer

How to Improve Your Adaptability Skills as a VP of Operations

How to Improve Your Analytical Skills as a VP of Compliance

How to Improve Your Leadership Skills as a Chief Human Resources Officer

How to Improve Your Critical Thinking Skills as a Chief Procurement Officer

Start an advisory board.

Join an advisory board

Critical Thinking and Personal Finance: A Smart Approach to Money Management

In today’s fast-paced world, personal finance is more crucial than ever for long-term financial success and stability. It’s not enough to simply follow traditional financial advice; individuals must apply critical thinking skills to their money management decisions. By analyzing and evaluating their financial situation, people can make informed choices that will improve their overall financial well-being.

Additionally, it’s essential to stay informed about new opportunities and potential challenges in the financial world. By staying current with economic trends and financial news, individuals can better discern which strategies will work best for their unique situation, reducing the risk of financial setbacks and increasing their chances of long-term financial success.

Understanding Personal Finance

Income and expenses, debt and credit, savings and investments.

By focusing on these critical aspects of personal finance— income and expenses, debt and credit, and savings and investments—you can develop a solid foundation for financial success and security. Remember to review and adjust your financial plan regularly to ensure you stay on track and make informed decisions for your future.

Critical Thinking in Finance

Emotional factors, decision-making process, budgeting and cash flow, creating a budget, managing monthly expenses.

Managing your monthly expenses effectively is crucial for maintaining a healthy cash flow and staying within your budget. Start by tracking your spending to identify any patterns or areas where you may be overspending. Use budgeting apps or tools to help you categorize and monitor your expenses. Prioritize essential living expenses and consider cutting back on non-essential items to maintain a positive cash flow.

Dealing with Debt

Debt management strategies.

Dealing with debt requires a confident and knowledgeable approach. It’s important to develop a clear plan to tackle existing debt while preventing further accumulation. Consider the following debt management strategies:

Credit Card Debt

Student loans, income diversification, side hustles.

Exploring side hustles can be a great way to create multiple streams of income and improve financial stability. Having a side hustle not only provides extra income but also can act as a safety net in times of financial uncertainty. Some common side hustles include freelancing, selling handmade products, or offering consulting services. It is essential to focus on activities that leverage your skills and align with your interests to ensure long-term commitment and success.

Investment Diversification

Planning for the future, retirement planning.

Retirement planning is a crucial aspect of personal finance to ensure a comfortable and secure future. Establish clear financial goals and start saving and investing early in various retirement accounts, such as 401(k)s, IRAs, or annuities. Diversification in investment options like stocks, bonds, and mutual funds can help generate consistent returns, minimize risks, and build a robust portfolio over time. Keep revisiting and adjusting your retirement plan as needed to stay aligned with your financial goals and market changes.

Family Planning

Navigating financial challenges.

When it comes to personal finance, it’s important to have a strategy in place to deal with various financial challenges. Two such challenges that have the potential to significantly impact personal finances are recessions and economic uncertainty, as well as pandemics. By understanding these challenges and how to address them, you can make more informed decisions to safeguard your financial well-being.

Recessions and Economic Uncertainty

Pandemic and finances.

Pandemics, like the recent COVID-19 outbreak, can pose unique financial challenges. These events can lead to sudden income loss and increased expenses, making it essential to reassess your financial plans:

Making Smart Purchases

Housing and mortgages.

When considering housing options, it’s essential to be mindful of the costs associated with purchasing a home. One critical aspect to think about is obtaining a mortgage . It’s vital to shop around and compare different lenders’ interest rates and terms to ensure you get the best deal possible. Also, make sure to consider the overall cost of the mortgage, including any fees and closing costs.

Vehicle Ownership

Another essential factor in vehicle ownership is deciding between buying or leasing a car. A lease can be an attractive option for those who want to drive a new car for a lower monthly payment and not have to worry about its resale value. However, leasing can also come with mileage restrictions and may not be the best option for those who plan to keep their vehicle for an extended period.

Managing Financial Products

Bank accounts.

A checking account typically allows for unlimited transactions, providing flexibility in money management. This type of account is beneficial for everyday expenses, bill payments, and managing cash flow. It is crucial to track transactions to avoid overdrafts and maintain a healthy financial status.

Insurance Options

Health insurance is essential in managing potential medical costs. It’s crucial to find a plan that meets one’s needs and budget. Factors to consider when selecting a health insurance plan include the coverage provided, out-of-pocket costs, provider networks, and any additional benefits. Maintain awareness of deductibles, copays, and policy changes.

Tax and Wage Considerations

Income tax planning.

One of the essential aspects of personal finance is effective income tax planning . This involves considering the timing of income, the size of income, and planning for expenditures. By saving for retirement in an Individual Retirement Account (IRA) or other tax-advantaged accounts, you can reduce your taxable income and plan for a more financially secure future. Furthermore, taking advantage of deductions and tax credits can help to minimize the tax burden and provide additional resources for personal financial goals.

Salary and Wage Factors

In today’s complex financial world, it is essential to think critically about personal finance management. Making informed decisions and having a solid financial plan can ensure long-term financial stability and security.

Besides managing debt and savings, investment in oneself plays a significant role in personal finance. Acquiring new skills, pursuing higher education, and staying updated with industry trends can lead to better job opportunities and income growth. This, in turn, contributes to long-term financial well-being.

Frequently Asked Questions

How can i improve my financial decision-making skills.

Improving financial decision-making skills involves increasing your financial literacy and being objective in evaluating options. Consider reading books or attending seminars on personal finance, and consult with a financial advisor to gain further insights. Continually analyzing your spending habits and making necessary adjustments will contribute to better decision-making skills.

What methods can I use to create a successful budget?

How can i effectively manage debt and credit, what should i consider when planning for long-term financial goals.

When planning for long-term financial goals, consider factors such as anticipated income, expected expenses, inflation, and investment returns. Start by defining clear and realistic goals, such as saving for a down payment on a house or planning for retirement. Develop a strategic plan to reach those goals and review your progress periodically.

How do I build an emergency fund?

How can i make informed investment choices, you may also like, unleashing your creativity: associative thinking techniques explained, thinking critically about new information, master cognitive biases and improve your critical thinking.

Does social media affect critical thinking skills?

Download this free ebook.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

7 Finance Skills Employers Look for on a Resume

- 07 Jun 2022

There's a shortage of talent in today's job market. While some believe it's caused by factors like the pandemic or "Great Resignation," the finance field is experiencing a talent shortage largely due to changing industry trends.

According to Robert Half Talent Solutions , 65 percent of senior managers in finance and accounting are hiring for permanent positions in the first half of 2022. Yet, only 33 percent are hiring for vacant roles, meaning many positions are newly created, largely due to the changing skill sets needed.

Are you interested in breaking into finance but not sure what your resume should include? Here are the top finance skills employers want, why they're essential to the job market, and how you can obtain them.

Access your free e-book today.

What Are Finance Skills?

Finance skills are often associated with industry-specific positions, such as accountants and finance managers. This definition only scratches the surface when examining finance's role in business. Finance skills are soft and hard skills that enable stakeholders to manage and navigate financial decision-making and problem-solving.

Some common roles that require financial skills on a resume are:

- Accountants

- Financial analysts

- Chief financial officers (CFOs)

- Underwriters

- Finance managers

Each role requires varying skills and experience levels. Yet, several skills are important, and often mandatory, across all positions. Here's an overview of what finance skills employers want and what you can do to enhance your resume.

Finance Skills You Need on Your Resume

1. accounting skills.

The first, and perhaps most important, finance skill employers ask for is accounting. This doesn't mean you need to have previous experience as an accountant, but rather proficiency in reading and understanding financial documents , including:

- Balance sheets

- Income statements

- Cash flow statements

- Annual reports

The data points extracted from these financial documents inform finance and business leaders about a company's financial health and its future initiatives.

For example, cash flow management —tracking a company's assets as they move in and out of the business—is an incredibly important metric. Leadership and key stakeholders use it to predict how much money will be available at any given time and how much is needed to cover outstanding debts.

Since accounting is fundamental in tracking a company's performance, employers tend to offer a competitive salary to those who possess these skills. According to Emsi Burning Glass data, prospective finance professionals with accounting skills can expect a median salary of $80,320 or more.

2. Analytical Thinking Skills

While employers need team members who build financial statements, business leaders need experience analyzing and leveraging this information. This is called financial statement analysis , the process of reviewing key financial documents to better understand a company's performance.

This is done by analyzing performance metrics found on various financial statements and through financial ratios. Some important ratios include:

- Current ratio , which measures a company's ability to pay off its short-term commitments

- Quick ratio , which calculates whether a company can pay off its short-term obligations with liquid assets

- Debt-to-equity ratio , which evaluates a company's financial efficacy by dividing a company's total liabilities by shareholder equity

Analytical thinking has quickly become a high commodity in the finance job market. Some of the top employers advertise finance job postings that require analytical thinking. According to Emsi Burning Glass data, the top 10 companies that require this skill include:

- Travelers Insurance

- Charles Schwab

- JPMorgan Chase & Co.

- Anthem Blue Cross Blue Shield

- Wells Fargo

- The Hartford

- Health Care Service Corporation

3. Financial Decision-Making Skills

Decision-making is an essential skill for aspiring leaders. While business leaders often take time to understand an organization's goals, initiatives, and mission, finance is crucial to positioning a company for success.

Managers in any department can benefit from finance knowledge. For example, estimating a project's financial impact is a common responsibility, often done by calculating its return on investment (ROI) .

Data-driven financial decision-making creates a clear framework for company leadership to reference and provides the building blocks to a far more elusive finance skill: intuition. For this reason, it's invaluable to include on your resume.

4. Management Skills

Like most industries, employers in the finance sector always look for applicants with management skills and experience. These skills are needed for managing people as well as the various moving parts of a company's capital structure and reporting processes.

This skill doesn't apply solely to mid- and high-level managers. For example, preparing an organization's budget requires management skills. Whether a quarterly budget for performance tracking or a budget proposal to recommend future initiatives, the preparation of this essential document calls for collaboration, regular communication, and clear direction.

According to Emsi Burning Glass data, some top finance job titles that require management skills include:

- Financial managers

- Personal service managers

- Financial and investment analysts

- Financial risk specialists

- Financial specialists

- General managers

- Operations managers

- Securities sales agents

- Commodities sales agents

- Financial services sales agents

5. Financial Reporting Skills

Many finance professionals deal with historical data, but looking to the future is equally as crucial.

Financial forecasting predicts a company's financial future by examining historical performance data, such as revenue, cash flow, expenses, or sales. This is an incredibly important skill to include on a resume since it often assists business leaders in major decisions around areas like hiring, budgeting, and strategic planning.

Cash flow forecasting is a particularly important form of forecasting. These predictions help support a company's stability by determining whether it will have enough cash to cover future expenses. As a result, these skills are often synonymous with "forward-thinking"—a valuable characteristic of prospective finance employees.

6. Communication Skills

Most prospective finance professionals understand the importance of accounting and analysis skills, but many minimize the role of effective communication.

This skill can take the form of strong oral communication in meetings or written communication in financial documents. Being an effective communicator also requires explaining financial jargon in simple terms. This is accomplished through financial literacy —the understanding and use of financial terminology, statements, and concepts.

Since many stakeholders and clients are outside the financial sector, companies often select candidates who can communicate complex industry language to others. Emsi Burning Glass shows a steady increase in finance job postings requiring communication skills over the past year.

7. Investing Skills

In today's market, most employers know profits made from their goods and services aren't enough to sustain long-term growth. Investing as one form of capital allocation is a great way for companies to generate even more money outside of their operations.

Since investing is a riskier endeavor than releasing a new product to market, it's important for employers to hire individuals with a keen eye for investing. For example, a company that has numerous alternative investments should hire people who understand these assets and can assess the varying risks.

Another aspect of this industry that's grown in popularity and demand is sustainable investing . This trend of purpose-driven investing has created a need for financial leaders who value and understand environmental, social, and corporate governance (ESG) factors when deciding whether resources should be contributed to a venture.

How to Improve Your Finance Skills

Finance skills are essential for industry leaders and managers. These positions require an intuitive knowledge of financial principles and statements to unlock critical insights into a company's performance and potential.

One of the best ways to develop these high-demand skills is by taking an online course. These courses can offer a solid foundation in finance and accounting concepts while giving you the tools and processes to tackle some of the biggest financial challenges companies face.

Are you looking to strengthen your finance resume? Check out our finance and accounting courses , including Leading with Finance , Financial Accounting , Sustainable Investing , and Alternative Investments , to acquire the skills needed to land an interview. If you aren't sure which course is the right fit, download our free course flowchart to determine which best aligns with your goals.

About the Author

Markets We Serve

Course ID: CTFAF

Critical thinking for accounting and finance.

No skill is more important in business today than the ability to understand, analyze, and act on information effectively and responsibly. Finance and Accounting professionals who are also savvy, sharp critical thinkers can cut through ambiguity and information overload to quickly zero in on what is really important. This session shares cognitive techniques and critical thinking tools to enhance decision-making under pressure and strengthen your impact.

Learning Objectives

Examine cognitive techniques and critical thinking tools to enhance decision-making under pressure and strengthen your impact

Major Topics

- Cognitive techniques

- Critical thinking tools

- Decision making under pressure

Who Should Attend

Leaders in an organization who want to improve their communication and critical thinking skills

Fields of Study

Prerequisites, cpe credits, this course is available for your group as:, let's roll.

To learn more or customize this course for your group, complete this form and a BLI team member will get back with you shortly.

Your browser is out-of-date!

Update your browser to view this website correctly.

Update my browser now

- Kreyòl Ayisyen

Financial knowledge and decision-making skills

Financial knowledge and decision-making skills help people make informed financial decisions through problem-solving, critical thinking, and an understanding of key financial facts and concepts.

Building financial knowledge and decision-making skills

How do we learn to make good financial choices? Learn more about the financial knowledge and decision-making skills building block and how it can help young people make the right decisions for their situation.

Importance of financial knowledge and decision-making skills

Strong financial knowledge and decision-making skills help people weigh options and make informed choices for their financial situations, such as deciding how and when to save and spend, comparing costs before a big purchase, and planning for retirement or other long-term savings.

Development of this building block

Financial knowledge and decision-making skills typically don’t develop until adolescence and young adulthood. During these years, they become more relevant, especially for youth who start to earn money, buy things on their own, manage a bank account, or borrow for education.

The tables that follow show what this building block looks like at three stages of development and how the skills and abilities relate to adult behavior associated with financial well-being.

Early childhood (ages 3–5)

| Milestones for financial knowledge and decision-making skills | What it may look like in adulthood |

|---|---|

Has early math skills like counting and sorting | Calculates change owed at point of sale, categorizes spending for budgeting, tracks cash flow |

Grasps very basic financial concepts like money and trading | Estimates costs, calculates discounts or sales tax |

Middle childhood (ages 6–12)

| Milestones for financial knowledge and decision-making skills | What it may look like in adulthood |

|---|---|

Understands basic financial concepts | Has a realistic idea of how much things cost, saves a portion of earnings, pays bills on time, makes a budget |

Successfully manages money (like their allowance) or other resources to reach personal goals | Spends to meet needs before wants, follows a budget, saves for big purchases or events (e.g., vacation) |

Adolescence and early adulthood (ages 13–21)

| Milestones for financial knowledge and decision-making skills | What it may look like in adulthood |

|---|---|

Understands advanced financial concepts and processes | Understands risks and benefits of investing, uses credit wisely, manages debt |

Routinely manages money or other resources to reach personal goals | Spends with values and goals for today and the future in mind, pays day-to-day and month-to-month expenses, saves for retirement, has financial flexibility to splurge once in a while |

Identifies trusted sources of financial information and accurately uses them to compare and make decisions | Seeks credible information (e.g., “Consumer Reports,” product labels, store ads), compares features and costs before making big purchases, consults trusted advisers, knows the difference between a bargain and a scam |

Teaching this building block

Schools can provide opportunities for youth to practice financial behaviors, make financial decisions, and reflect on the outcomes and consequences of those decisions. Across the curriculum, teachers can provide opportunities for students to learn how to find and recognize reliable financial information, compare financial products, and do purposeful financial research in order to analyze options and make decisions.

Instructional strategies

Research shows that the following strategies can be effective to help people develop financial knowledge and decision-making skills.

- Competency-based learning: Student-centered learning that encourages students to progress toward well-defined benchmarks to give them a sense of mastery and ownership over the skills and knowledge they are learning

- Direct instruction: A structured, straightforward, teacher-directed approach that focuses on an explicit skill and typically includes a lecture, demonstration, or discussion

- Personalized instruction: Teacher assesses each student’s needs, then tailors instruction to the individual student, including focusing and differentiating resources, strategies, supports, and pacing on that student’s needs to individualize learning

- Project-based learning: A hands-on strategy in which students actively explore real-world challenges, answer meaningful questions, and accomplish relevant tasks and, in doing so, are encouraged to make their own decisions, perform their own research, overcome obstacles, and present their work to others

- Simulation: Hands-on learning activities that use real-world scenarios to promote critical thinking and application of learning

Learning activities