- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

LLC Formation

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

LIMITED TIME OFFER

Ink Business Unlimited® Credit Card

Table of Contents

How to make a business plan

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

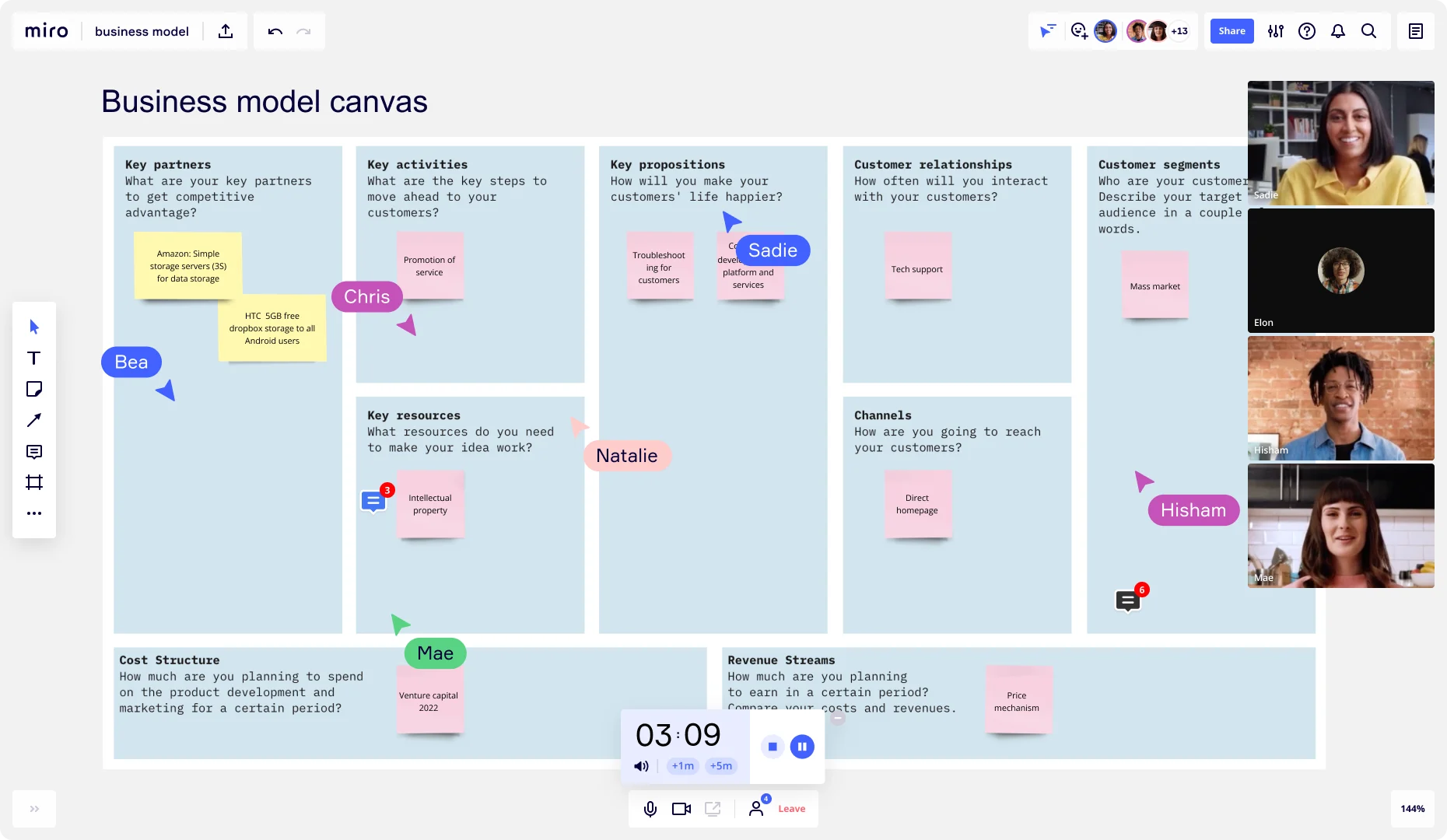

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Plans and pricing.

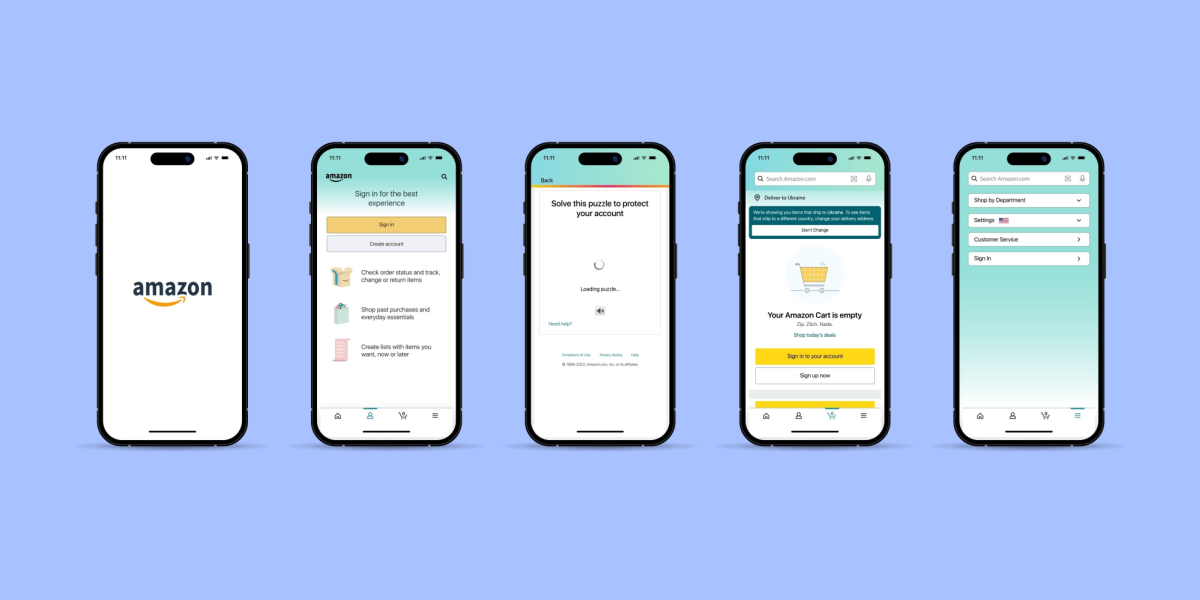

Build A Profitable EComm Business For Just $1

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, how to write a business plan (tips, templates, examples).

Written by Jesse Sumrak | May 14, 2023

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Business plans might seem like an old-school stiff-collared practice, but they deserve a place in the startup realm, too. It’s probably not going to be the frame-worthy document you hang in the office—yet, it may one day be deserving of the privilege.

Whether you’re looking to win the heart of an angel investor or convince a bank to lend you money, you’ll need a business plan. And not just any ol’ notes and scribble on the back of a pizza box or napkin—you’ll need a professional, standardized report.

Bah. Sounds like homework, right?

Yes. Yes, it does.

However, just like bookkeeping, loan applications, and 404 redirects, business plans are an essential step in cementing your business foundation.

Don’t worry. We’ll show you how to write a business plan without boring you to tears. We’ve jam-packed this article with all the business plan examples, templates, and tips you need to take your non-existent proposal from concept to completion.

Table of Contents

What Is a Business Plan?

Tips to Make Your Small Business Plan Ironclad

How to Write a Business Plan in 6 Steps

Startup Business Plan Template

Business Plan Examples

Work on Making Your Business Plan

How to Write a Business Plan FAQs

What is a business plan why do you desperately need one.

A business plan is a roadmap that outlines:

- Who your business is, what it does, and who it serves

- Where your business is now

- Where you want it to go

- How you’re going to make it happen

- What might stop you from taking your business from Point A to Point B

- How you’ll overcome the predicted obstacles

While it’s not required when starting a business, having a business plan is helpful for a few reasons:

- Secure a Bank Loan: Before approving you for a business loan, banks will want to see that your business is legitimate and can repay the loan. They want to know how you’re going to use the loan and how you’ll make monthly payments on your debt. Lenders want to see a sound business strategy that doesn’t end in loan default.

- Win Over Investors: Like lenders, investors want to know they’re going to make a return on their investment. They need to see your business plan to have the confidence to hand you money.

- Stay Focused: It’s easy to get lost chasing the next big thing. Your business plan keeps you on track and focused on the big picture. Your business plan can prevent you from wasting time and resources on something that isn’t aligned with your business goals.

Beyond the reasoning, let’s look at what the data says:

- Simply writing a business plan can boost your average annual growth by 30%

- Entrepreneurs who create a formal business plan are 16% more likely to succeed than those who don’t

- A study looking at 65 fast-growth companies found that 71% had small business plans

- The process and output of creating a business plan have shown to improve business performance

Convinced yet? If those numbers and reasons don’t have you scrambling for pen and paper, who knows what will.

Don’t Skip: Business Startup Costs Checklist

Before we get into the nitty-gritty steps of how to write a business plan, let’s look at some high-level tips to get you started in the right direction:

Be Professional and Legit

You might be tempted to get cutesy or revolutionary with your business plan—resist the urge. While you should let your brand and creativity shine with everything you produce, business plans fall more into the realm of professional documents.

Think of your business plan the same way as your terms and conditions, employee contracts, or financial statements. You want your plan to be as uniform as possible so investors, lenders, partners, and prospective employees can find the information they need to make important decisions.

If you want to create a fun summary business plan for internal consumption, then, by all means, go right ahead. However, for the purpose of writing this external-facing document, keep it legit.

Know Your Audience

Your official business plan document is for lenders, investors, partners, and big-time prospective employees. Keep these names and faces in your mind as you draft your plan.

Think about what they might be interested in seeing, what questions they’ll ask, and what might convince (or scare) them. Cut the jargon and tailor your language so these individuals can understand.

Remember, these are busy people. They’re likely looking at hundreds of applicants and startup investments every month. Keep your business plan succinct and to the point. Include the most pertinent information and omit the sections that won’t impact their decision-making.

Invest Time Researching

You might not have answers to all the sections you should include in your business plan. Don’t skip over these!

Your audience will want:

- Detailed information about your customers

- Numbers and solid math to back up your financial claims and estimates

- Deep insights about your competitors and potential threats

- Data to support market opportunities and strategy

Your answers can’t be hypothetical or opinionated. You need research to back up your claims. If you don’t have that data yet, then invest time and money in collecting it. That information isn’t just critical for your business plan—it’s essential for owning, operating, and growing your company.

Stay Realistic

Your business may be ambitious, but reign in the enthusiasm just a teeny-tiny bit. The last thing you want to do is have an angel investor call BS and say “I’m out” before even giving you a chance.

The folks looking at your business and evaluating your plan have been around the block—they know a thing or two about fact and fiction. Your plan should be a blueprint for success. It should be the step-by-step roadmap for how you’re going from Point A to Point B.

How to Write a Business Plan—6 Essential Elements

Not every business plan looks the same, but most share a few common elements. Here’s what they typically include:

- Executive Summary

- Business Overview

- Products and Services

- Market Analysis

- Competitive Analysis

- Financial Strategy

Below, we’ll break down each of these sections in more detail.

1. Executive Summary

While your executive summary is the first page of your business plan, it’s the section you’ll write last. That’s because it summarizes your entire business plan into a succinct one-pager.

Begin with an executive summary that introduces the reader to your business and gives them an overview of what’s inside the business plan.

Your executive summary highlights key points of your plan. Consider this your elevator pitch. You want to put all your juiciest strengths and opportunities strategically in this section.

2. Business Overview

In this section, you can dive deeper into the elements of your business, including answering:

- What’s your business structure? Sole proprietorship, LLC, corporation, etc.

- Where is it located?

- Who owns the business? Does it have employees?

- What problem does it solve, and how?

- What’s your mission statement? Your mission statement briefly describes why you are in business. To write a proper mission statement, brainstorm your business’s core values and who you serve.

Don’t overlook your mission statement. This powerful sentence or paragraph could be the inspiration that drives an investor to take an interest in your business. Here are a few examples of powerful mission statements that just might give you the goosebumps:

- Patagonia: Build the best product, cause no unnecessary harm, use business to inspire and implement solutions to the environmental crisis.

- Tesla: To accelerate the world’s transition to sustainable energy.

- InvisionApp : Question Assumptions. Think Deeply. Iterate as a Lifestyle. Details, Details. Design is Everywhere. Integrity.

- TED : Spread ideas.

- Warby Parker : To offer designer eyewear at a revolutionary price while leading the way for socially conscious businesses.

3. Products and Services

As the owner, you know your business and the industry inside and out. However, whoever’s reading your document might not. You’re going to need to break down your products and services in minute detail.

For example, if you own a SaaS business, you’re going to need to explain how this business model works and what you’re selling.

You’ll need to include:

- What services you sell: Describe the services you provide and how these will help your target audience.

- What products you sell: Describe your products (and types if applicable) and how they will solve a need for your target and provide value.

- How much you charge: If you’re selling services, will you charge hourly, per project, retainer, or a mixture of all of these? If you’re selling products, what are the price ranges?

4. Market Analysis

Your market analysis essentially explains how your products and services address customer concerns and pain points. This section will include research and data on the state and direction of your industry and target market.

This research should reveal lucrative opportunities and how your business is uniquely positioned to seize the advantage. You’ll also want to touch on your marketing strategy and how it will (or does) work for your audience.

Include a detailed analysis of your target customers. This describes the people you serve and sell your product to. Be careful not to go too broad here—you don’t want to fall into the common entrepreneurial trap of trying to sell to everyone and thereby not differentiating yourself enough to survive the competition.

The market analysis section will include your unique value proposition. Your unique value proposition (UVP) is the thing that makes you stand out from your competitors. This is your key to success.

If you don’t have a UVP, you don’t have a way to take on competitors who are already in this space. Here’s an example of an ecommerce internet business plan outlining their competitive edge:

FireStarters’ competitive advantage is offering product lines that make a statement but won’t leave you broke. The major brands are expensive and not distinctive enough to satisfy the changing taste of our target customers. FireStarters offers products that are just ahead of the curve and so affordable that our customers will return to the website often to check out what’s new.

5. Competitive Analysis

Your competitive analysis examines the strengths and weaknesses of competing businesses in your market or industry. This will include direct and indirect competitors. It can also include threats and opportunities, like economic concerns or legal restraints.

The best way to sum up this section is with a classic SWOT analysis. This will explain your company’s position in relation to your competitors.

6. Financial Strategy

Your financial strategy will sum up your revenue, expenses, profit (or loss), and financial plan for the future. It’ll explain how you make money, where your cash flow goes, and how you’ll become profitable or stay profitable.

This is one of the most important sections for lenders and investors. Have you ever watched Shark Tank? They always ask about the company’s financial situation. How has it performed in the past? What’s the ongoing outlook moving forward? How does the business plan to make it happen?

Answer all of these questions in your financial strategy so that your audience doesn’t have to ask. Go ahead and include forecasts and graphs in your plan, too:

- Balance sheet: This includes your assets, liabilities, and equity.

- Profit & Loss (P&L) statement: This details your income and expenses over a given period.

- Cash flow statement: Similar to the P&L, this one will show all cash flowing into and out of the business each month.

It takes cash to change the world—lenders and investors get it. If you’re short on funding, explain how much money you’ll need and how you’ll use the capital. Where are you looking for financing? Are you looking to take out a business loan, or would you rather trade equity for capital instead?

Read More: 16 Financial Concepts Every Entrepreneur Needs to Know

Startup Business Plan Template (Copy/Paste Outline)

Ready to write your own business plan? Copy/paste the startup business plan template below and fill in the blanks.

Executive Summary Remember, do this last. Summarize who you are and your business plan in one page.

Business Overview Describe your business. What’s it do? Who owns it? How’s it structured? What’s the mission statement?

Products and Services Detail the products and services you offer. How do they work? What do you charge?

Market Analysis Write about the state of the market and opportunities. Use date. Describe your customers. Include your UVP.

Competitive Analysis Outline the competitors in your market and industry. Include threats and opportunities. Add a SWOT analysis of your business.

Financial Strategy Sum up your revenue, expenses, profit (or loss), and financial plan for the future. If you’re applying for a loan, include how you’ll use the funding to progress the business.

5 Frame-Worthy Business Plan Examples

Want to explore other templates and examples? We got you covered. Check out these 5 business plan examples you can use as inspiration when writing your plan:

- SBA Wooden Grain Toy Company

- SBA We Can Do It Consulting

- OrcaSmart Business Plan Sample

- Plum Business Plan Template

- PandaDoc Free Business Plan Templates

Get to Work on Making Your Business Plan

If you find you’re getting stuck on perfecting your document, opt for a simple one-page business plan —and then get to work. You can always polish up your official plan later as you learn more about your business and the industry.

Remember, business plans are not a requirement for starting a business—they’re only truly essential if a bank or investor is asking for it.

Ask others to review your business plan. Get feedback from other startups and successful business owners. They’ll likely be able to see holes in your planning or undetected opportunities—just make sure these individuals aren’t your competitors (or potential competitors).

Your business plan isn’t a one-and-done report—it’s a living, breathing document. You’ll make changes to it as you grow and evolve. When the market or your customers change, your plan will need to change to adapt.

That means when you’re finished with this exercise, it’s not time to print your plan out and stuff it in a file cabinet somewhere. No, it should sit on your desk as a day-to-day reference. Use it (and update it) as you make decisions about your product, customers, and financial plan.

Review your business plan frequently, update it routinely, and follow the path you’ve developed to the future you’re building.

Keep Learning: New Product Development Process in 8 Easy Steps

What financial information should be included in a business plan?

Be as detailed as you can without assuming too much. For example, include your expected revenue, expenses, profit, and growth for the future.

What are some common mistakes to avoid when writing a business plan?

The most common mistake is turning your business plan into a textbook. A business plan is an internal guide and an external pitching tool. Cut the fat and only include the most relevant information to start and run your business.

Who should review my business plan before I submit it?

Co-founders, investors, or a board of advisors. Otherwise, reach out to a trusted mentor, your local chamber of commerce, or someone you know that runs a business.

Ready to Write Your Business Plan?

Don’t let creating a business plan hold you back from starting your business. Writing documents might not be your thing—that doesn’t mean your business is a bad idea.

Let us help you get started.

Join our free training to learn how to start an online side hustle in 30 days or less. We’ll provide you with a proven roadmap for how to find, validate, and pursue a profitable business idea (even if you have zero entrepreneurial experience).

Stuck on the ideas part? No problem. When you attend the masterclass, we’ll send you a free ebook with 100 of the hottest side hustle trends right now. It’s chock full of brilliant business ideas to get you up and running in the right direction.

About Jesse Sumrak

Jesse Sumrak is a writing zealot focused on creating killer content. He’s spent almost a decade writing about startup, marketing, and entrepreneurship topics, having built and sold his own post-apocalyptic fitness bootstrapped business. A writer by day and a peak bagger by night (and early early morning), you can usually find Jesse preparing for the apocalypse on a precipitous peak somewhere in the Rocky Mountains of Colorado.

Related Posts

6 Steps to Create Effective Retargeting Campaigns

How to Build a Subscription Box Business

What is a Silent Partner? Everything You Need To Know

The Power of Storytelling in Marketing

5 Ways to Leverage Customer Reviews to Increase Sales

Brand Authenticity: How User-Generated Content Can Give You a Much-Needed Boost

Ways to Build a Community Around Your Brand

Bootstrapping vs. External Funding: What’s Right For You?

7 Steps to Turn Your Hobby into a Profitable Business

6 Time Management Hacks for Busy Entrepreneurs

5 Ways to Use Generative AI to Scale Your Startup

Customer Engagement: The Secret to Long-Term Success

Giveaway Ideas: 4 Tried and Tested Approaches from a 7-Figure Ecommerce Expert

How to List Products on Amazon: Everything You Need to Know

Is Selling On Amazon Worth it? Get Your Questions Answered

Accelerate Your Ecommerce Journey for Just $1

Step-by-Step Guidance from World-Class Entrepreneurs to Build, Grow, and Scale Your Ecommerce Brand

Don't Miss Out! Get Instant Access to foundr+ for Just $1!

1000+ lessons. customized learning. 30,000+ strong community..

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers

Financial analysis is an essential part of your business plan. If you’re already in business that includes your profit and loss statement , cash flow statement and balance sheet .

These financial projections will give investors and lenders an understanding of the financial health of your business and the potential return on investment.

You may want to work with a financial professional to ensure your financial projections are realistic and accurate.

Step 7: Finalize your business plan

Once you’ve completed everything, it's time to finalize your business plan. This involves reviewing and editing your plan to ensure that it is clear, concise, and easy to understand.

You should also have someone else review your plan to get a fresh perspective and identify any areas that may need improvement. You could even work with a free SCORE mentor on your business plan or use a SCORE business plan template for more detailed guidance.

Compare the Top Small-Business Banks

Data effective 1/10/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The takeaway

Writing a business plan is an essential process for any forward-thinking entrepreneur or business owner. A business plan requires a lot of up-front research, planning, and attention to detail, but it’s worthwhile. Creating a comprehensive business plan can help you achieve your business goals and secure the funding you need.

Related content

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

- How to Get a Business License: What You Need to Know

- What Is a Cash Flow Statement?

Best Small Business Loans

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Write a One-Page Business Plan

Noah Parsons

5 min. read

Updated July 29, 2024

What’s the most challenging part of writing a business plan? Getting started. That’s why you should create a one-page plan as a starting point.

The one-page business plan is simple to create, easy to update, and built for adaptation. It includes all of the essential components of a traditional plan but is far briefer and more focused.

Think of it like you’re tweeting about your business. You have a limited number of characters to work with and are intentionally making it easy to digest. If you need additional support, try downloading our free one-page business plan template .

- What is a one-page business plan?

The one-page business plan is a simplified version of traditional operational plans that focuses on the core aspects of your business. While it may be a shorter business plan, it still follows the structure of a standard business plan and serves as a beefed-up pitch document.

There’s really not much difference between a single-page business plan and a good executive summary. In fact, as you create a more detailed plan you may even be able to use it as your executive summary .

- What to include in your one-page plan

Here are the eight necessary sections to include when developing your one-page business plan.

Try and keep each section limited to 1-2 sentences or 3-4 bullet points to ensure that you stay within one page. It’s always easier to add more later rather than cutting back from lengthy sections.

The problem

A description of the problem or need your customers have and any relevant data that supports your claim.

The solution

Your product or service and how it solves the problem.

Business model

How you will make money—including the costs of production and selling, and the price that customers will pay.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Target market

Who is your customer and how many of them are there? Define your ideal customer by starting with a broad audience and narrowing it down. This provides investors with a clear picture of your thought process and understanding of the greater consumer market.

Competitive advantage

What makes you different from the competition? Explain how this will lead to greater success, customer loyalty, etc.

Management team

The management structure of your business, including currently filled roles, ideal candidates, and any management gaps.

Financial summary

Key financial metrics include your profit and loss, cash flow, balance sheet, and sales forecast. This section may be the most difficult part to condense, so try and focus on visualization and standard business ratios to get the point across. You can always share broader financial information if requested.

Funding required

Have what funding total you need front and center to clearly display what you are asking from investors.

Why you should start with a one-page plan

There are plenty of good reasons to write a business plan . There are even more reasons why your first step should be writing a one-page plan.

1. It’s faster

Instead of slogging away for hours, days, or even weeks tackling a formal business plan—the one-page format helps you get your ideas down much faster. In fact, with the right process and preparation, you can write a working one-page business plan in under an hour .

2. A great format for feedback

Need quick feedback from business partners, colleagues, potential customers, or your spouse? Provide them with a one-page plan instead of a lengthy in-depth version for better results.

The one-page plan is more likely to be read and reviewed. And since all of your business information is available at a glance, you’ll receive far more valuable and timely feedback.

3. Easy to update

Entrepreneurs never get things right the first time. You’ll constantly be learning and receiving feedback—requiring you to iterate and revise your business concept. Instead of updating a large document every time, you can do it in minutes with a one-page plan.

4. Direct and to-the-point

Learning to communicate your ideas clearly and directly is critical. You need to be sure that anyone can really understand the essence of your business. Delivering your entire business concept on a single page is a great way to practice this, as it forces you to be succinct.

5. Works as an idea validation tool

Initially, your business is just a set of assumptions that you need to validate. Do your potential customers have the problem you assume they have? Do they like your solution and are they willing to pay for it? What marketing and sales tactics will work?

As you validate these assumptions, you leave them in your plan. But, assumptions that end up being wrong will quickly fall off the page.

6. Becomes an outline for your detailed plan

By “detailed” we don’t mean “long.” If you do need to create a detailed business plan document for investors or business partners, you can use your one-page plan as your core outline. You will just expand and provide more details for each section.

7. No one really reads long business plans

A common problem with traditional business plans is that they are simply too long and overly complex. Even when investors ask for a detailed document, chances are that they won’t actually read every word. They may read certain sections, but often just want to see if you’ve thought through the details of your business, how it will operate, and how it will grow.

8. Useful for any business stage

A one-page plan is useful for business owners that are mulling over ideas, just starting, actively managing, or looking to grow a business. It can help validate a business idea, work as an internal strategy document, or as a flexible management tool that can be adapted over time.

Resources to help you write a business plan

While I highly recommend that you at least start with a one-page business plan, there are times where a more traditional business plan is necessary—such as applying for a loan or pitching to investors.

For additional support, check out our guide on writing a detailed business plan and download our free business plan template .

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Why start with a one-page plan

Related Articles

8 Min. Read

What Type of Business Plan Do You Need?

14 Min. Read

How to Write a Five-Year Business Plan

6 Min. Read

Differences Between Single-Use and Standing Plans Explained

13 Min. Read

How to Write a Nonprofit Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

IMAGES

VIDEO

COMMENTS

In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

The seven steps to writing a business plan include: Write a brief executive summary; Describe your products and services. Conduct market research and compile data into a cohesive market analysis. Describe your …

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business. A well-crafted business plan can help you define your vision, clarify …

We’ll show you how to write a business plan without boring you to tears. We’ve jam-packed this article with all the business plan examples, templates, and tips you need to take your non-existent proposal from concept …

A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure …

There are plenty of good reasons to write a business plan. There are even more reasons why your first step should be writing a one-page plan. 1. It’s faster. Instead of slogging away for hours, days, or even weeks tackling a …