- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

How To Create Financial Projections for Your Business Plan

Building a financial projection as you write out your business plan can help you forecast how much money your business will bring in.

Planning for the future, whether it’s with growth in mind or just staying the course, is central to being a business owner. Part of this planning effort is making financial projections of sales, expenses, and—if all goes well—profits.

Even if your business is a startup that has yet to open its doors, you can still make projections. Here’s how to prepare your business plan financial projections, so your company will thrive.

What are business plan financial projections?

Business plan financial projections are a company’s estimates, or forecasts, of its financial performance at some point in the future. For existing businesses, draw on historical data to detail how your company expects metrics like revenue, expenses, profit, and cash flow to change over time.

Companies can create financial projections for any span of time, but typically they’re for between one and five years. Many companies revisit and amend these projections at least annually.

Creating financial projections is an important part of building a business plan . That’s because realistic estimates help company leaders set business goals, execute financial decisions, manage cash flow , identify areas for operational improvement, seek funding from investors, and more.

What are financial projections used for?

Financial forecasting serves as a useful tool for key stakeholders, both within and outside of the business. They often are used for:

Business planning

Accurate financial projections can help a company establish growth targets and other goals . They’re also used to determine whether ideas like a new product line are financially feasible. Future financial estimates are helpful tools for business contingency planning, which involves considering the monetary impact of adverse events and worst-case scenarios. They also provide a benchmark: If revenue is falling short of projections, for example, the company may need changes to keep business operations on track.

Projections may reveal potential problems—say, unexpected operating expenses that exceed cash inflows. A negative cash flow projection may suggest the business needs to secure funding through outside investments or bank loans, increase sales, improve margins, or cut costs.

When potential investors consider putting their money into a venture, they want a return on that investment. Business projections are a key tool they will use to make that decision. The projections can figure in establishing the valuation of your business, equity stakes, plans for an exit, and more. Investors may also use your projections to ensure that the business is meeting goals and benchmarks.

Loans or lines of credit

Lenders rely on financial projections to determine whether to extend a business loan to your company. They’ll want to see historical financial data like cash flow statements, your balance sheet , and other financial statements—but they’ll also look very closely at your multi-year financial projections. Good candidates can receive higher loan amounts with lower interest rates or more flexible payment plans.

Lenders may also use the estimated value of company assets to determine the collateral to secure the loan. Like investors, lenders typically refer to your projections over time to monitor progress and financial health.

What information is included in financial projections for a business?

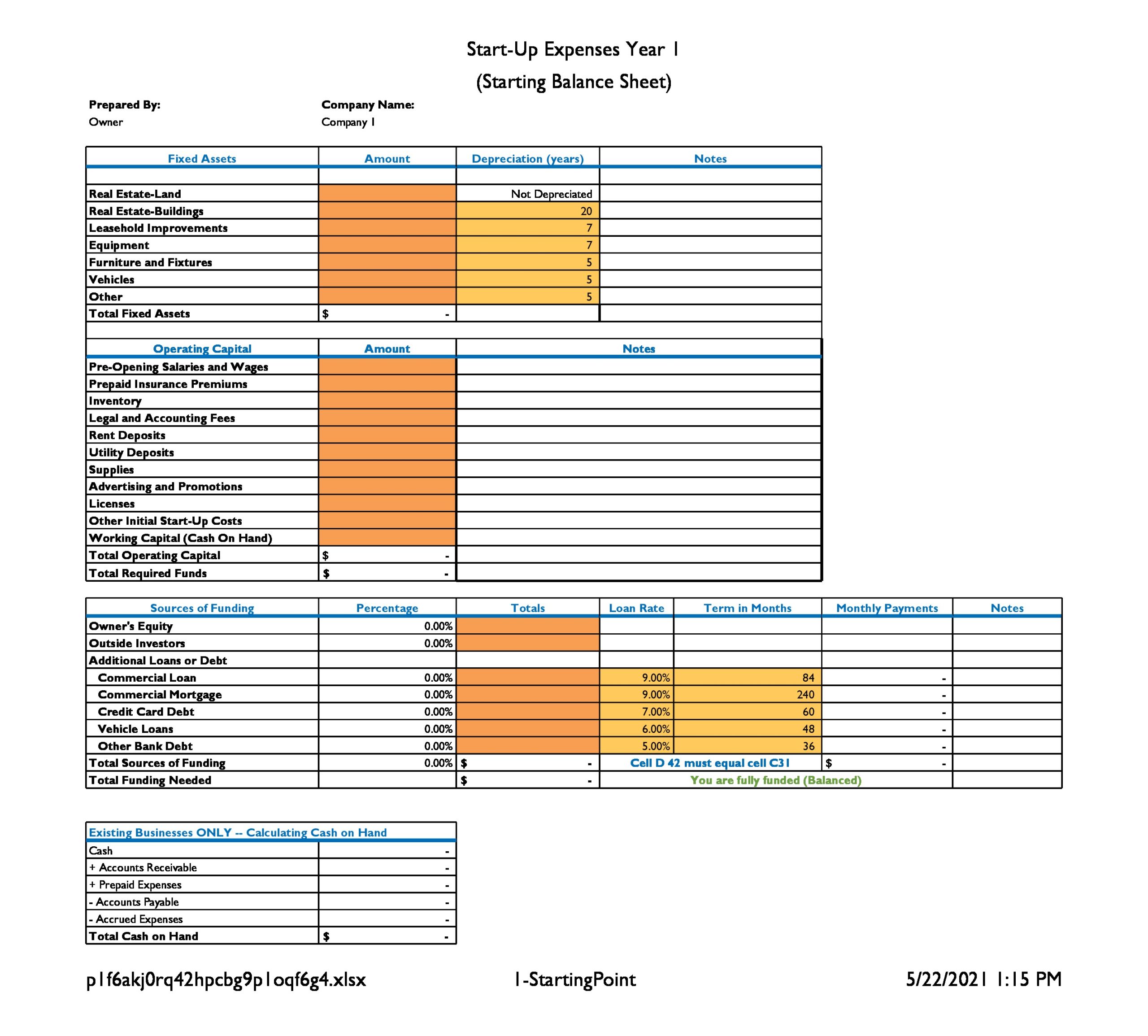

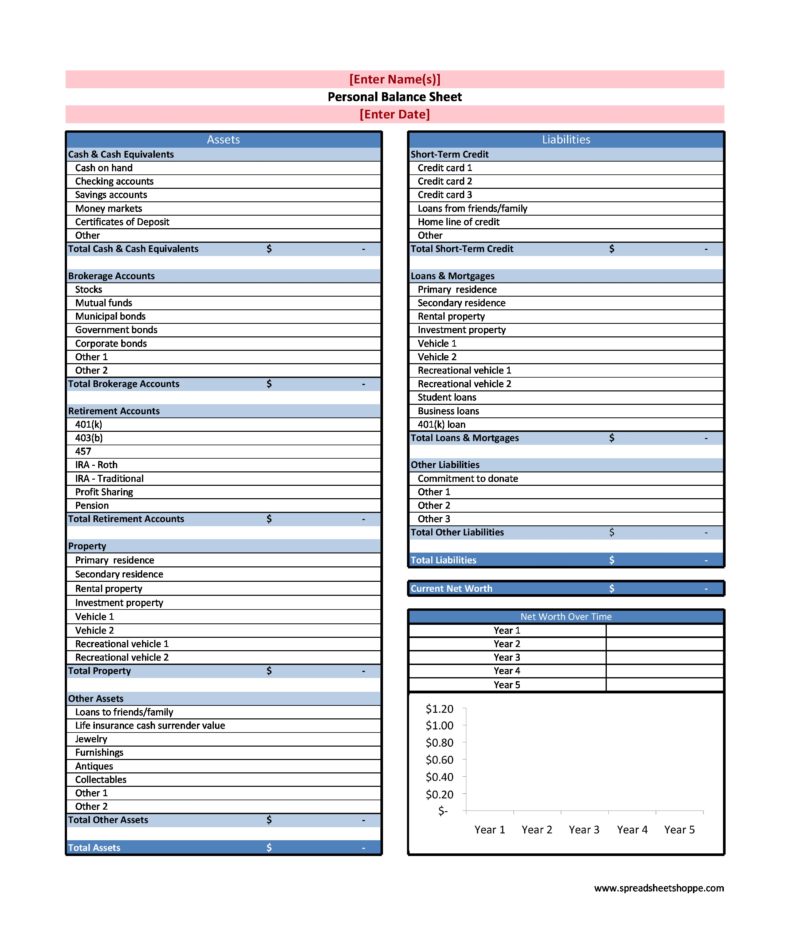

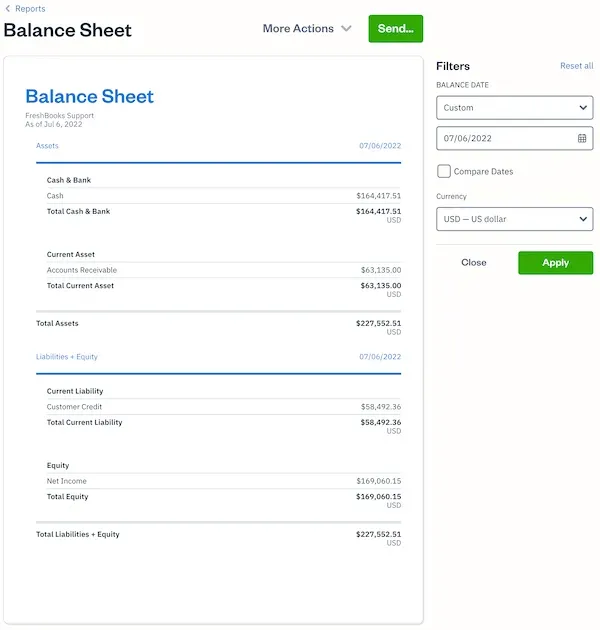

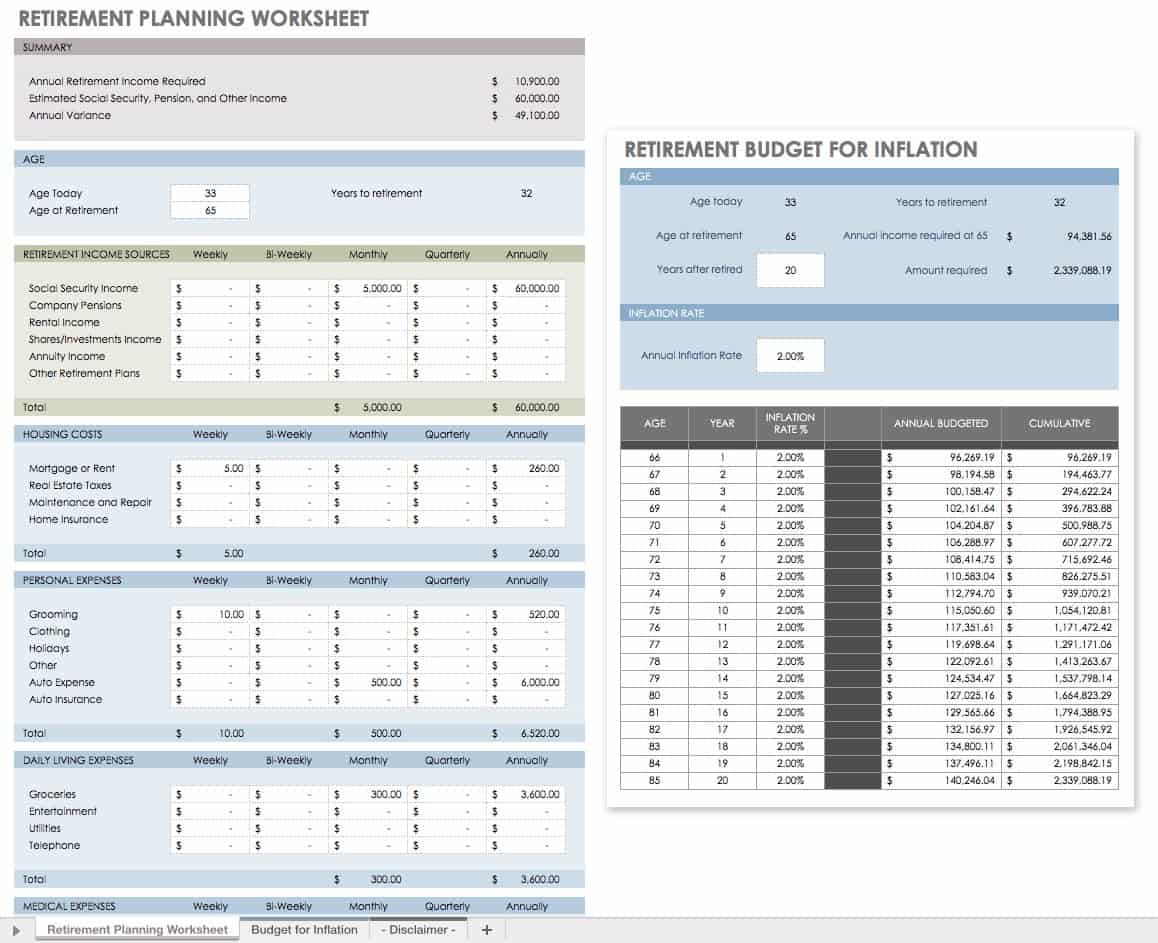

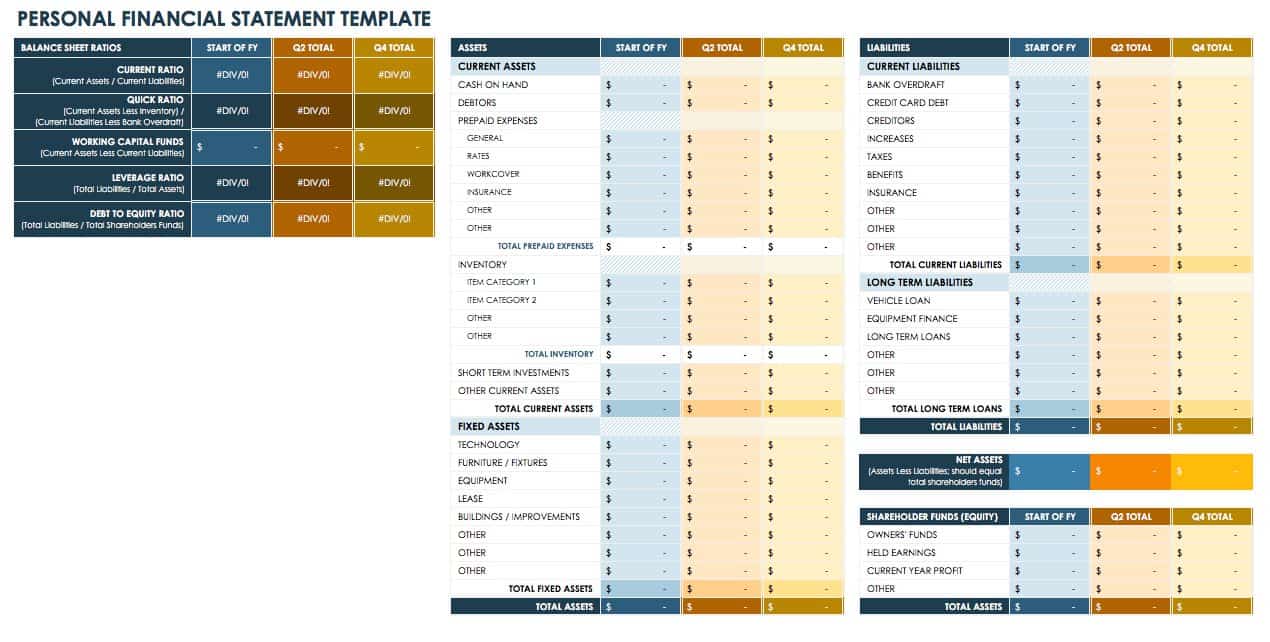

Before sitting down to create projections, you’ll need to collect some data. Owners of an existing business can leverage three financial statements they likely already have: a balance sheet, an annual income statement , and a cash flow statement .

A new business, however, won’t have this historical data. So market research is crucial: Review competitors’ pricing strategies, scour research reports and market analysis , and scrutinize any other publicly available data that can help inform your projections. Beginning with conservative estimates and simple calculations can help you get started, and you can always add to the projections over time.

One business’s financial projections may be more detailed than another’s, but the forecasts typically rely on and include the following:

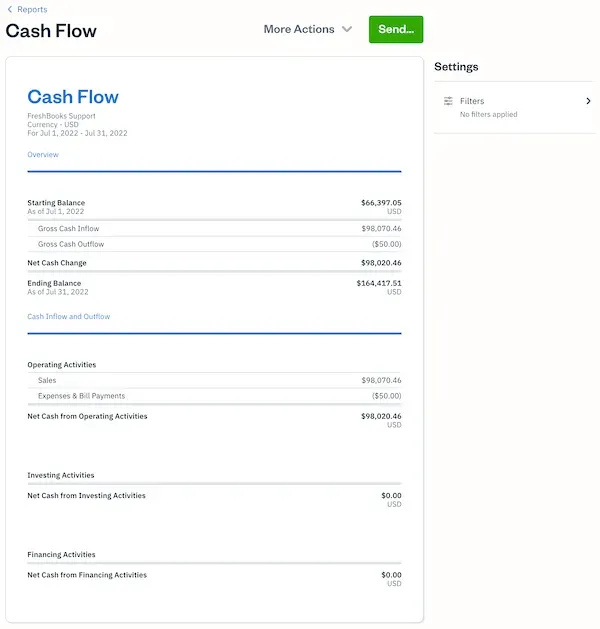

True to its name, a cash flow statement shows the money coming into and going out of the business over time: cash outflows and inflows. Cash flows fall into three main categories:

Income statement

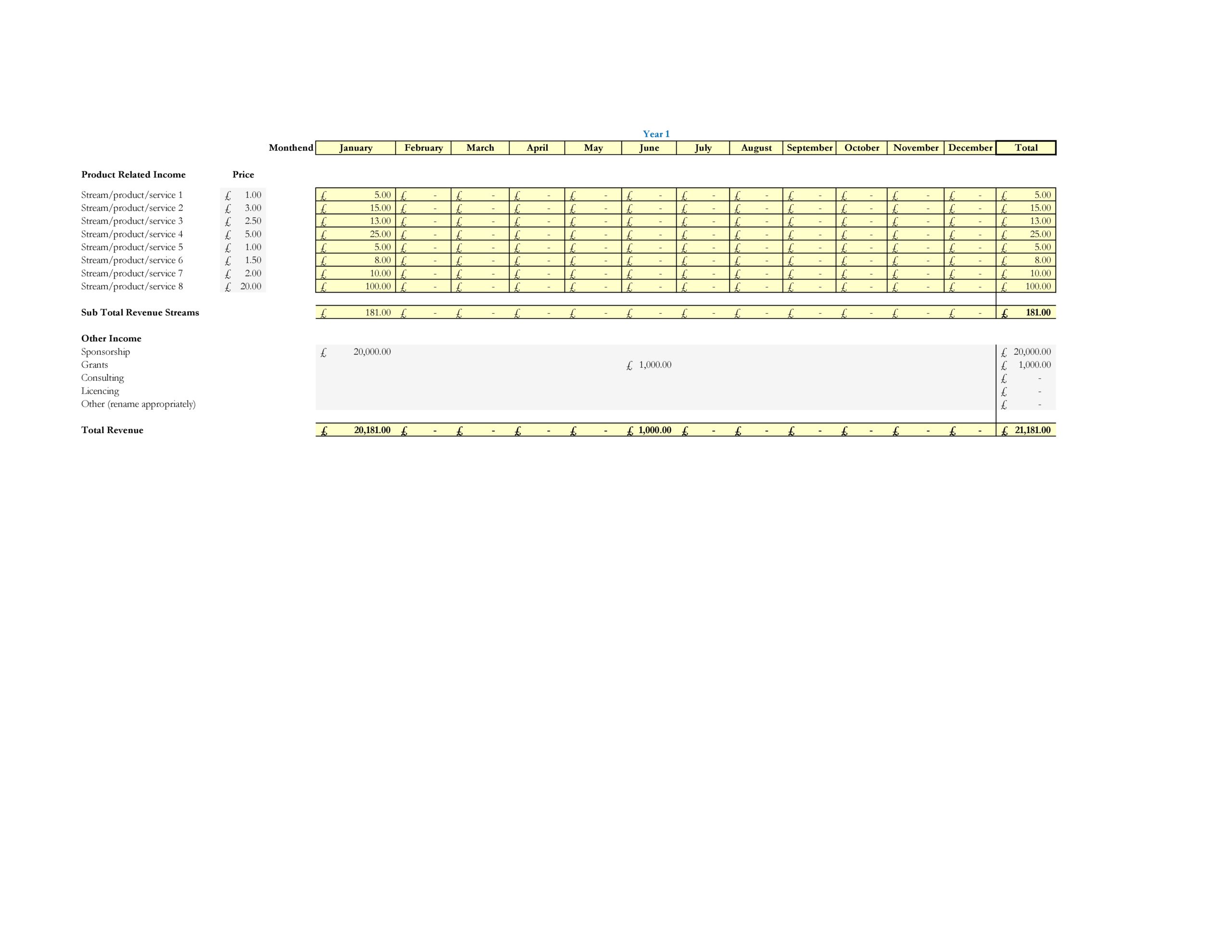

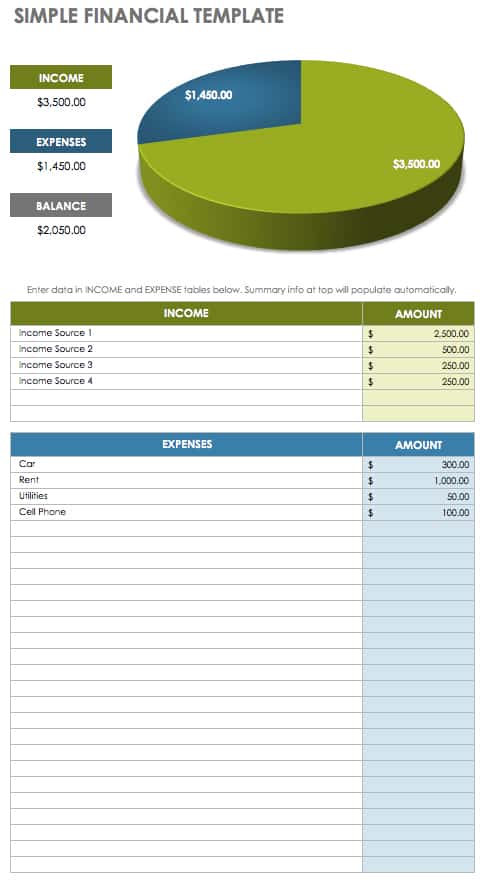

Projected income statements, also known as projected profit and loss statements (P&Ls), forecast the company’s revenue and expenses for a given period.

Generally, this is a table with several line items for each category. Sales projections can include the sales forecast for each individual product or service (many companies break this down by month). Expenses are a similar setup: List your expected costs by category, including recurring expenses such as salaries and rent, as well as variable expenses for raw materials and transportation.

This exercise will also provide you with a net income projection, which is the difference between your revenue and expenses, including any taxes or interest payments. That number is a forecast of your profit or loss, hence why this document is often called a P&L.

Balance sheet

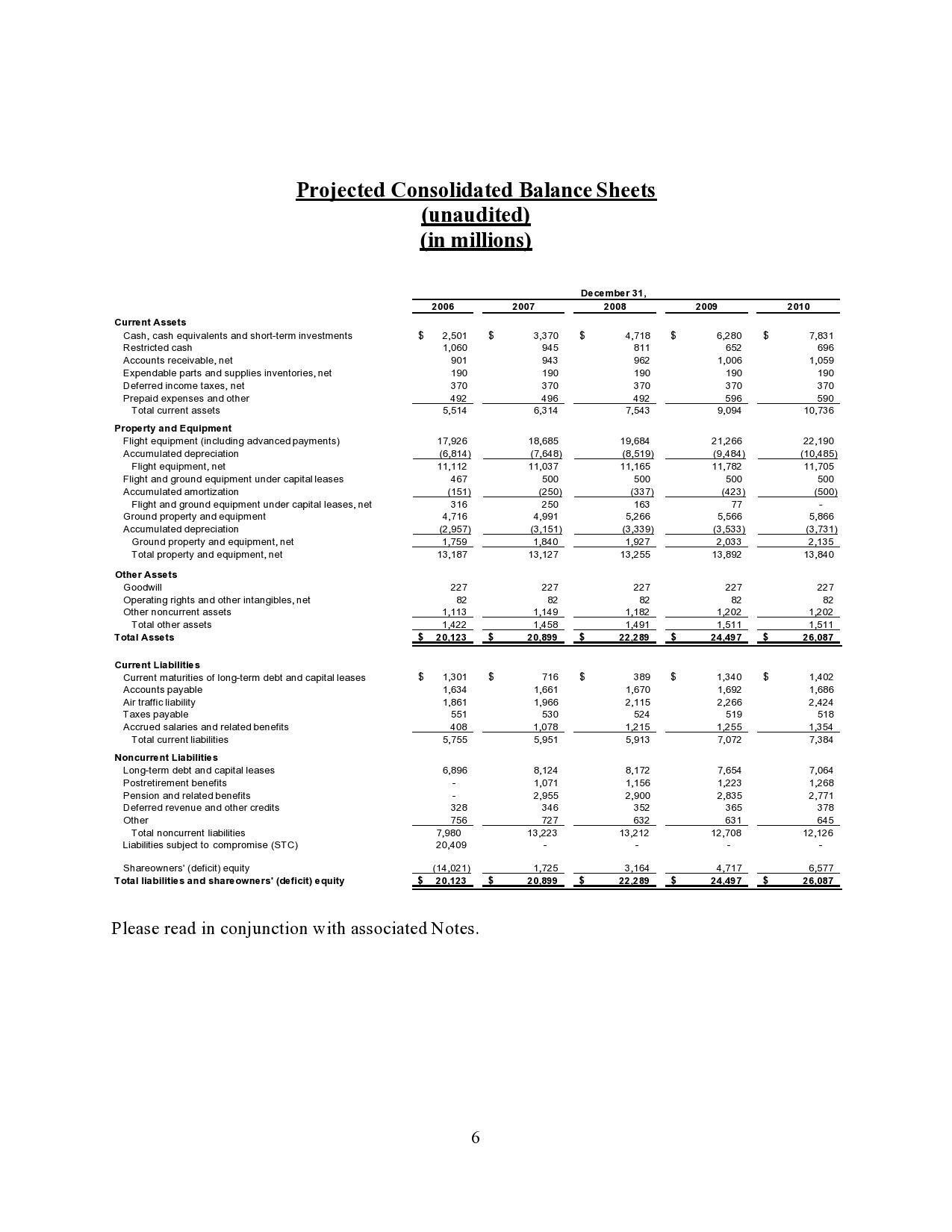

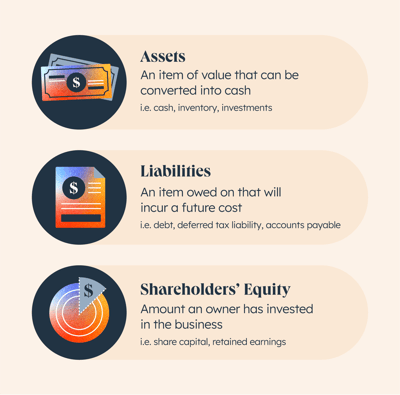

A balance sheet shows a snapshot of your company’s financial position at a specific point in time. Three important elements are included as balance sheet items:

- Assets. Assets are any tangible item of value that the company currently has on hand or will in the future, like cash, inventory, equipment, and accounts receivable. Intangible assets include copyrights, trademarks, patents and other intellectual property .

- Liabilities. Liabilities are anything that the company owes, including taxes, wages, accounts payable, dividends, and unearned revenue, such as customer payments for goods you haven’t yet delivered.

- Shareholder equity. The shareholder equity figure is derived by subtracting total liabilities from total assets. It reflects how much money, or capital, the company would have left over if the business paid all its liabilities at once or liquidated (this figure can be a negative number if liabilities exceed assets). Equity in business is the amount of capital that the owners and any other shareholders have tied up in the company.

They’re called balance sheets because assets always equal liabilities plus shareholder equity.

5 steps for creating financial projections for your business

- Identify the purpose and timeframe for your projections

- Collect relevant historical financial data and market analysis

- Forecast expenses

- Forecast sales

- Build financial projections

The following five steps can help you break down the process of developing financial projections for your company:

1. Identify the purpose and timeframe for your projections

The details of your projections may vary depending on their purpose. Are they for internal planning, pitching investors, or monitoring performance over time? Setting the time frame—monthly, quarterly, annually, or multi-year—will also inform the rest of the steps.

2. Collect relevant historical financial data and market analysis

If available, gather historical financial statements, including balance sheets, cash flow statements, and annual income statements. New companies without this historical data may have to rely on market research, analyst reports, and industry benchmarks—all things that established companies also should use to support their assumptions.

3. Forecast expenses

Identify future spending based on direct costs of producing your goods and services ( cost of goods sold, or COGS) as well as operating expenses, including any recurring and one-time costs. Factor in expected changes in expenses, because this can evolve based on business growth, time in the market, and the launch of new products.

4. Forecast sales

Project sales for each revenue stream, broken down by month. These projections may be based on historical data or market research, and they should account for anticipated or likely changes in market demand and pricing.

5. Build financial projections

Now that you have projected expenses and revenue, you can plug that information into Shopify’s cash flow calculator and cash flow statement template . This information can also be used to forecast your income statement. In turn, these steps inform your calculations on the balance sheet, on which you’ll also account for any assets and liabilities .

Business plan financial projections FAQ

What are the main components of a financial projection in a business plan.

Generally speaking, most financial forecasts include projections for income, balance sheet, and cash flow.

What’s the difference between financial projection and financial forecast?

These two terms are often used interchangeably. Depending on the context, a financial forecast may refer to a more formal and detailed document—one that might include analysis and context for several financial metrics in a more complex financial model.

Do I need accounting or planning software for financial projections?

Not necessarily. Depending on factors like the age and size of your business, you may be able to prepare financial projections using a simple spreadsheet program. Large complicated businesses, however, usually use accounting software and other types of advanced data-management systems.

What are some limitations of financial projections?

Projections are by nature based on human assumptions and, of course, humans can’t truly predict the future—even with the aid of computers and software programs. Financial projections are, at best, estimates based on the information available at the time—not ironclad guarantees of future performance.

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The point of sale for every sale.

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

Financial projections use existing or estimated financial data to forecast your business’s future income and expenses. They often include different scenarios to see how changes to one aspect of your finances (such as higher sales or lower operating expenses) might affect your profitability.

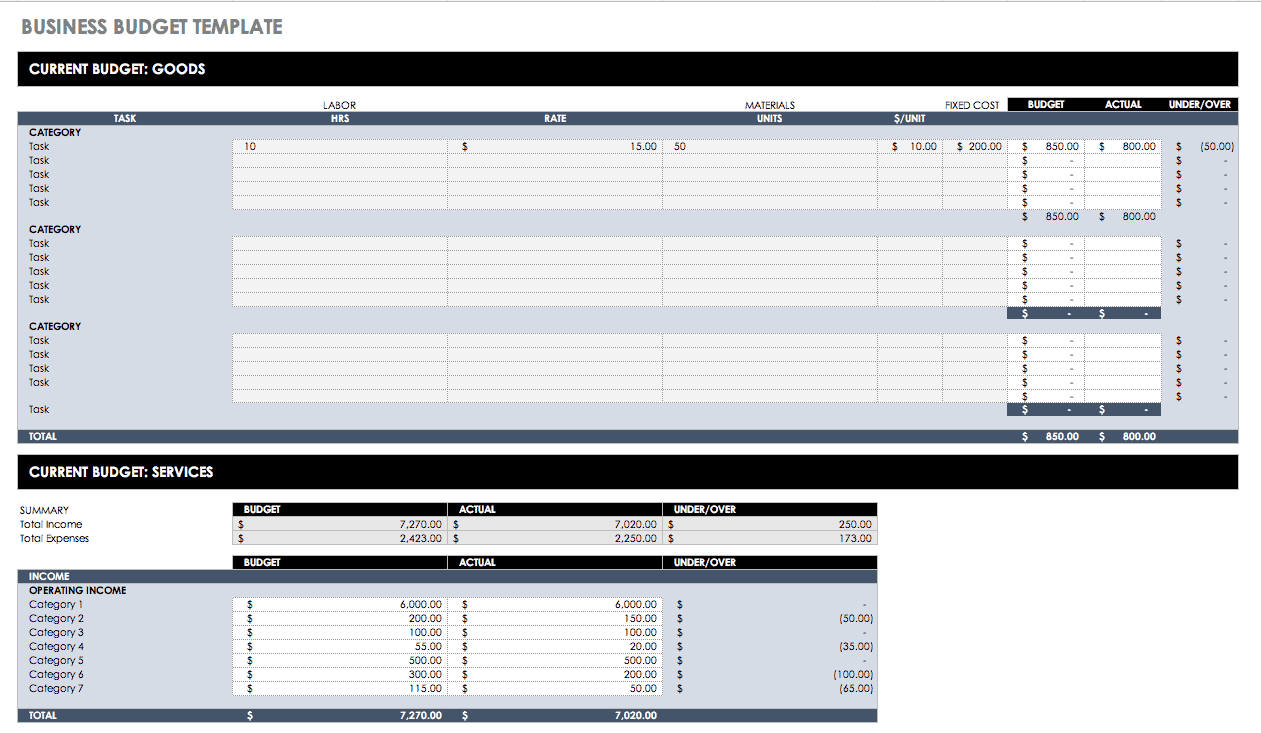

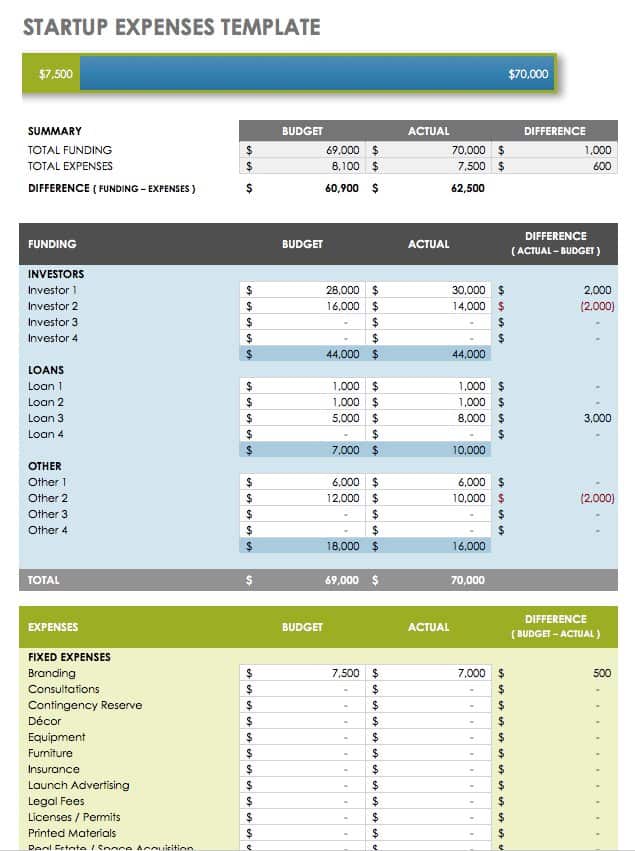

If you need to create financial projections for a startup or existing business, this free, downloadable template includes all the necessary tools.

What Are Financial Projections Used for?

Financial projections are an essential business planning tool for several reasons.

- If you’re starting a business, financial projections help you plan your startup budget, assess when you expect the business to become profitable, and set benchmarks for achieving financial goals.

- If you’re already in business, creating financial projections each year can help you set goals and stay on track.

- When seeking outside financing, startups and existing businesses need financial projections to convince lenders and investors of the business’s growth potential.

What’s Included in Financial Projections?

This financial projections template pulls together several different financial documents, including:

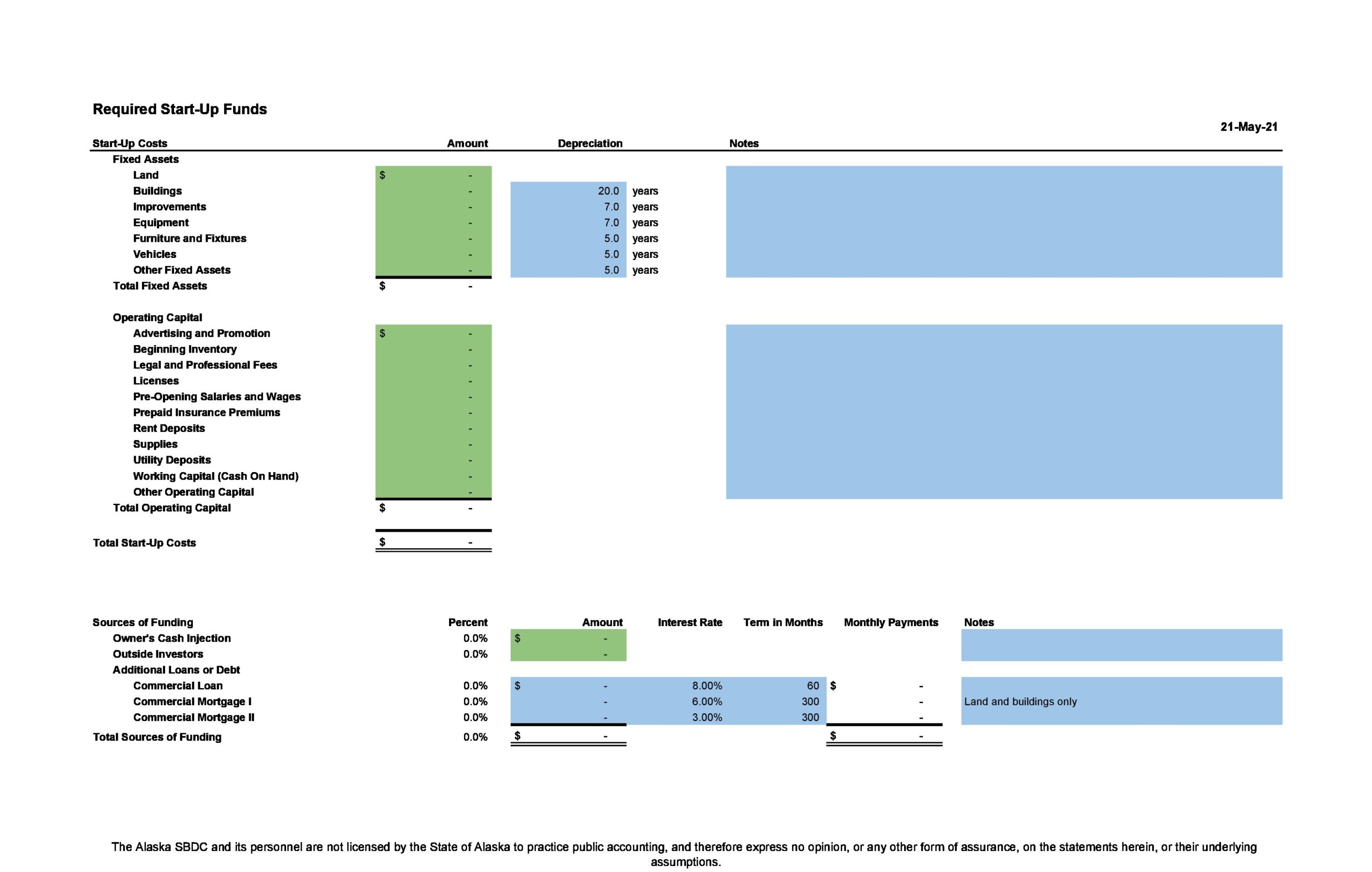

- Startup expenses

- Payroll costs

- Sales forecast

- Operating expenses for the first 3 years of business

- Cash flow statements for the first 3 years of business

- Income statements for the first 3 years of business

- Balance sheet

- Break-even analysis

- Financial ratios

- Cost of goods sold (COGS), and

- Amortization and depreciation for your business.

You can use this template to create the documents from scratch or pull in information from those you’ve already made. The template also includes diagnostic tools to test the numbers in your financial projections and ensure they are within reasonable ranges.

These areas are closely related, so as you work on your financial projections, you’ll find that changes to one element affect the others. You may want to include a best-case and worst-case scenario for all possibilities. Make sure you know the assumptions behind your financial projections and can explain them to others.

Startup business owners often wonder how to create financial projections for a business that doesn’t exist yet. Financial forecasts are continually educated guesses. To make yours as accurate as possible, do your homework and get help. Use the information you unearthed in researching your business plans, such as statistics from industry associations, data from government sources, and financials from similar businesses. An accountant with experience in your industry can help fine-tune your financial projections. So can business advisors such as SCORE mentors.

Once you complete your financial projections, don’t put them away and forget about them. Compare your projections to your financial statements regularly to see how well your business meets your expectations. If your projections turn out to be too optimistic or too pessimistic, make the necessary adjustments to make them more accurate.

*NOTE: The cells with formulas in this workbook are locked. If changes are needed, the unlock code is "1234." Please use caution when unlocking the spreadsheets. If you want to change a formula, we strongly recommend saving a copy of this spreadsheet under a different name before doing so.

We recommend downloading the Financial Projections Template Guide in English or Espanol .

Do you need help creating your financial projections? Take SCORE’s online course on-demand on financial projections or connect with a SCORE mentor online or in your community today.

Simple Steps for Starting Your Business: Financial Projections In this online module, you'll learn the importance of financial planning, how to build your financial model, how to understand financial statements and more.

Business Planning & Financial Statements Template Gallery Download SCORE’s templates to help you plan for a new business startup or grow your existing business.

Why Projected Financial Statements Are Essential to the Future Success of Startups Financial statements are vital to the success of any company but particularly start-ups. SCORE mentor Sarah Hadjhamou shares why they are a big part of growing your start-up.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

- TemplateLab

Financial Projections Templates

34 simple financial projections templates (excel,word).

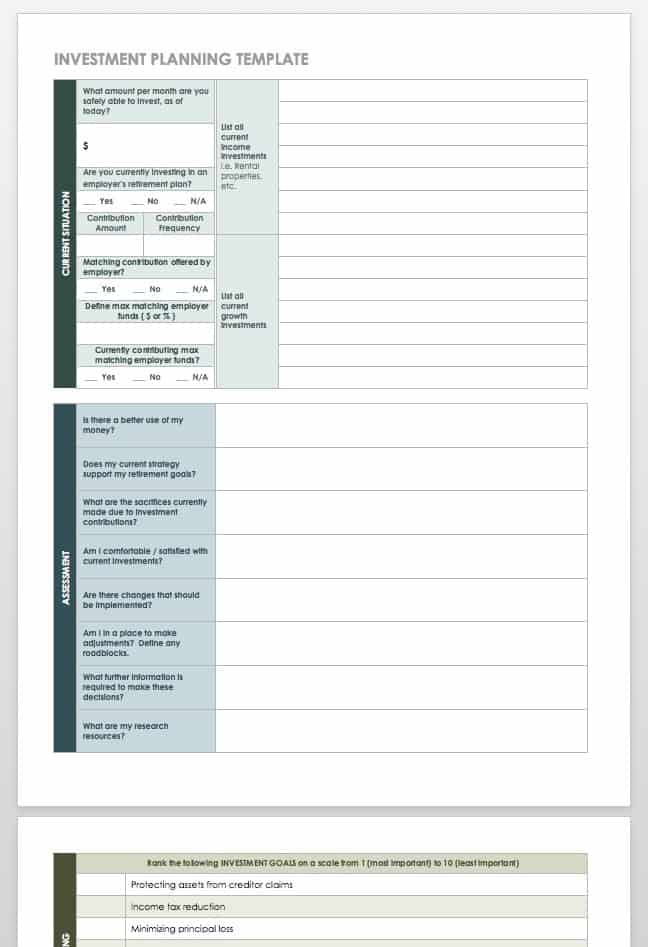

A financial projections template is a tool that is an essential part of managing businesses as it serves as a guide for the various team to achieve the desired goals. The preparation of these projections seems like a difficult task, especially for small businesses. If you can come up with financial statements , then you can also make financial projections.

Table of Contents

- 1 Financial Projections Templates

- 2 When do you need a financial projections template?

- 3 Business Projections Templates

- 4 What to include in financial projections?

- 5 Financial Forecast Templates

- 6 How do I make a financial projection?

- 7 Revenue Projection Templates

When do you need a financial projections template?

A financial projections template uses estimated or existing financial information to forecast the future expenses and income of your business. These projections don’t just consider a single scenario but different ones so you can determine how the changes in one part of your finances might affect the profitability of your company.

If you have to create a financial business projections template for your business, you can download a template to make the task easier. Financial projection has become an important tool in business planning for the following reasons:

- If you’re starting a business venture, a financial projection helps you plan your start-up budget.

- If you already have a business, a financial projection helps you set your goals and stay on track.

- If you’re thinking about getting outside financing, you need a financial projection to convince investors or lenders of the potential of your business.

Business Projections Templates

What to include in financial projections?

A financial projections template usually includes a few financial statements that will help you achieve better financial performance for your business:

- Income Statement Also called the Profit and Loss Statement , this focuses on your company’s expenses and revenues generated for a specific period of time. A typical income statement includes expenses, revenue, losses, and gains. The sum of all these is the net income, a measure of your company’s profitability.

- Cash Flow Statement Taking a look at a cash flow statement makes you understand how your company’s operations work. The statement explains in detail how much money goes in and out of your business in the form of either expense or income. This document includes the following: Operating Activities The cash flow from operating activities reports cash outflows and inflows from your company’s daily operations. This includes changes in accounts receivable, cash, inventory, accounts payable, and depreciation. Investing Activities You use the cash flows from investing activities for your company’s investments into the long-term future. This includes cash outflows for purchases of fixed assets like equipment and property and cash inflows for sales of assets. Financing Activities The financial activities in a cash flow statement show your business’ sources of cash from either banks or investors along with expenditures of cash you have paid to your shareholders. Total these at the end of each period to determine either a loss or a profit. The cash flow statement gets connected to the income statement through net income. To make this document, it requires the reconciliation of the two documents. You can calculate net profitability or income in the income statement which you then use to start the cash flow from the operations category in your cash flow statement.

- Balance Sheet This is a statement of your business’ liabilities, assets, and capital at a specific point in time. It details the balance of expenditure and income over the preceding period. This document provides you with a general overview of your business’ financial health. Here is an overview of these components: Assets These are your business’ resources with economic value that your business owns and which you believe will provide some benefit in the future. Examples of such future benefits include reducing expenses, enhancing sales, or generating cash flow. Assets typically include inventory, property, and cash. Liabilities In general, these refer to the obligations of your business to other entities. In more common terms, these are the debts that your business incurs in your daily operations. It typically includes loans and accounts payable. You can classify liabilities either as short-term or long-term. Owner’s Equity This is the amount you have left after you have paid off your liabilities. It is usually classified as retained earnings – the sum of your net income earned minus all the dividends you have paid since the start of your business.

Together with your break-even analysis and financial statements, you can include any other document that will help explain the assumptions behind your cash flow and financial forecast template.

Financial Forecast Templates

How do I make a financial projection?

The creation of a financial projections template requires the same information to use whether your business is still in its planning stages or it’s already up and running. The difference is whether you’re creating your revenue projection template using historical financial information or if you need to start from scratch.

This includes the creation of projections based on your own experiences or by conducting market research in the industry in which your business will operate. Here are some tips for creating an effective business plan financial projections template:

- Create the sales projection An important component of your business projections template is the sales projections. A business that’s already running can base its projections on its past performance, which you can derive from financial statements. When creating your sales projections, you must consider some external factors like the projected and current health of your company, if your inventory will get affected by additional tariffs, or if there is a downturn in your industry. Even if you want to remain optimistic about your business, you have to make realistic plans.

- Create the expense projection At the onset, the creation of an expense projection seems simpler because it’s much easier to predict the possible expenses of your business than it is to predict potential customers or their buying habits. If you have experience working in a certain industry, you can predict with some degree of accuracy what your fixed expenses are and any recurring expenses. But when it comes to one-time expenses that have the potential to bring down your business, these are much harder to predict. The best thing you can do in this scenario is to project expenses to the best of your ability then increase this value by 15%.

- Come up with a balance sheet for your financial projections template If you have a business that has been in operation for a couple of months, you can come up with a balance sheet using accounting software. The balance sheet shows your business’ financial status, listing its liabilities, equity, and assets balance for a certain time period. Use the current totals in your balance sheet when making your financial projections, In doing so, you will make better predictions on where your business will be a few years in the future. If you’re still in the planning stage of a business, you can create a balance sheet based on the data you’ve gathered from industry research.

- Create the income statement projection If you have a business that is currently in operation, you can create an income statement projection using your existing income statements to create an estimate of your business’ projected numbers. This is a logical move since an income statement provides a picture of your business’s net income after subtracting things like taxes, cost of goods, and other expenses. One of the main purposes of the income statement is to provide an idea of your business’ current performance. It also serves as the basis for estimating your net income for the next couple of years. If your business is still in the planning stages, the creation of a potential income statement shows that you have conducted extensive research and created a diligent and well-crafted estimate of your income in the next couple of years. If you have uncertainties on how to start creating an income statement projection, you can consult with market research firms in your locale. They can provide you with an overview of your targeted industry which includes target markets, expected and current industry growth levels, and sales.

- Come up with a cash flow projection The creation of this document is the final step leading to the completion of your financial projection. The cash flow statement is directly connected to the balance sheet and the net income statement, showing any cash-related or cash activities that can affect your industry. One of the purposes of this statement is to show how much money your business spends. This is a must for businesses obtaining financing or looking for investors. You can use this cash flow statement if your business has been in operation for a minimum of six months, but if your business is still in the planning stages, you can use the information you have gathered to create a credible projection. To make things easier for you, consider using spreadsheet software. Chances are, you’re already using spreadsheets. Using a spreadsheet will be the starting point for your financial projections. In addition, it offers flexibility that allows you to quickly judge alternative scenarios or change assumptions. Be as clear and reasonable as possible with your financial projections. Remember that financial projection is as much science as art. At some point, you will have to make assumptions on certain things like how administrative costs and raw materials will grow, revenue growth, and how efficient you will be at gathering accounts receivable for your business.

Revenue Projection Templates

More Templates

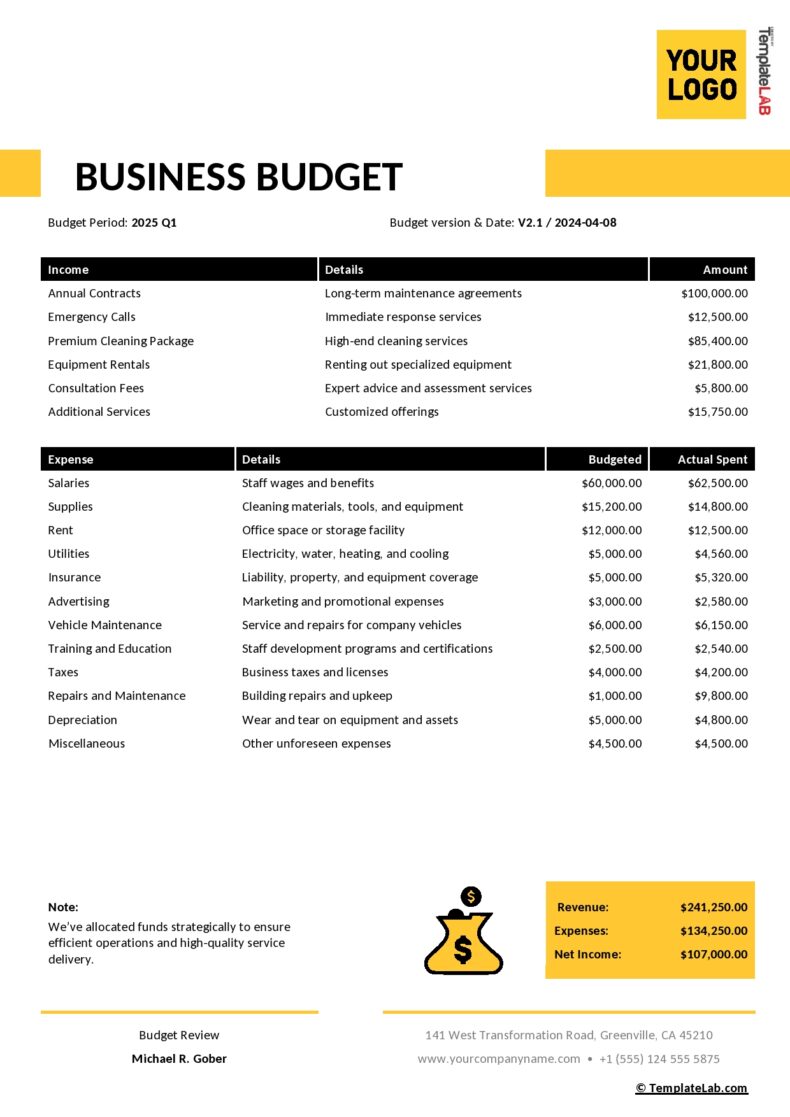

Business Budget Templates

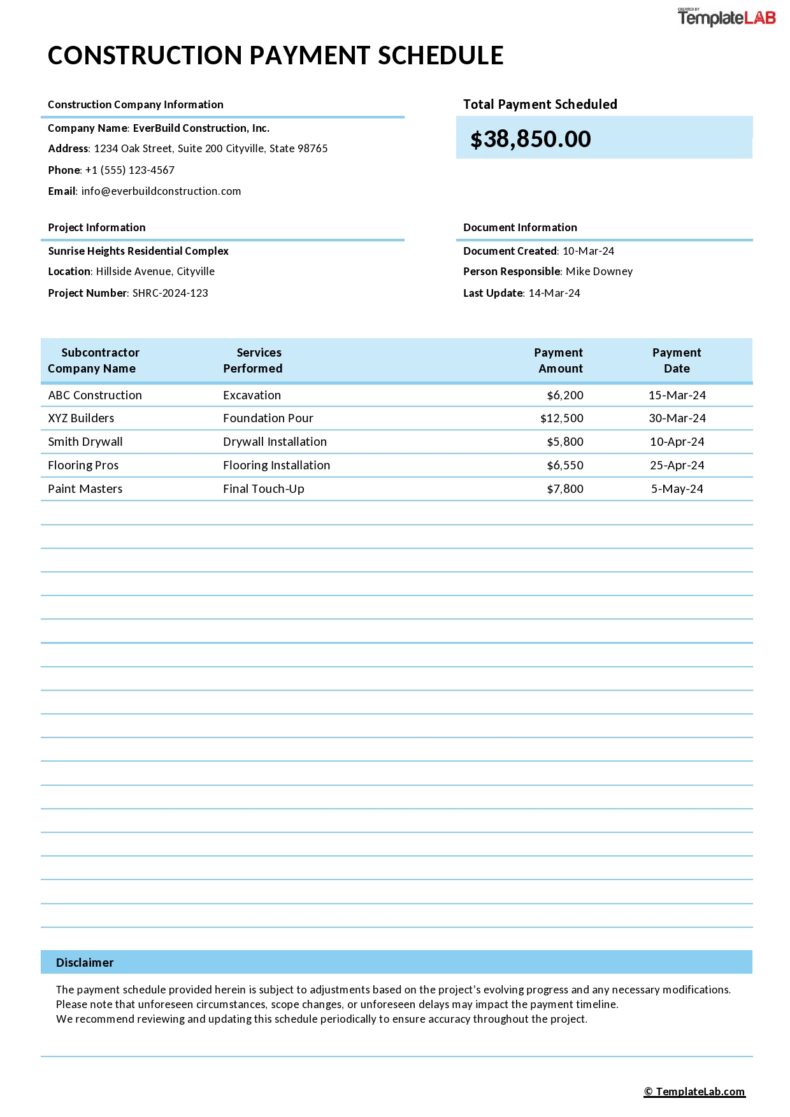

Payment Schedule Templates

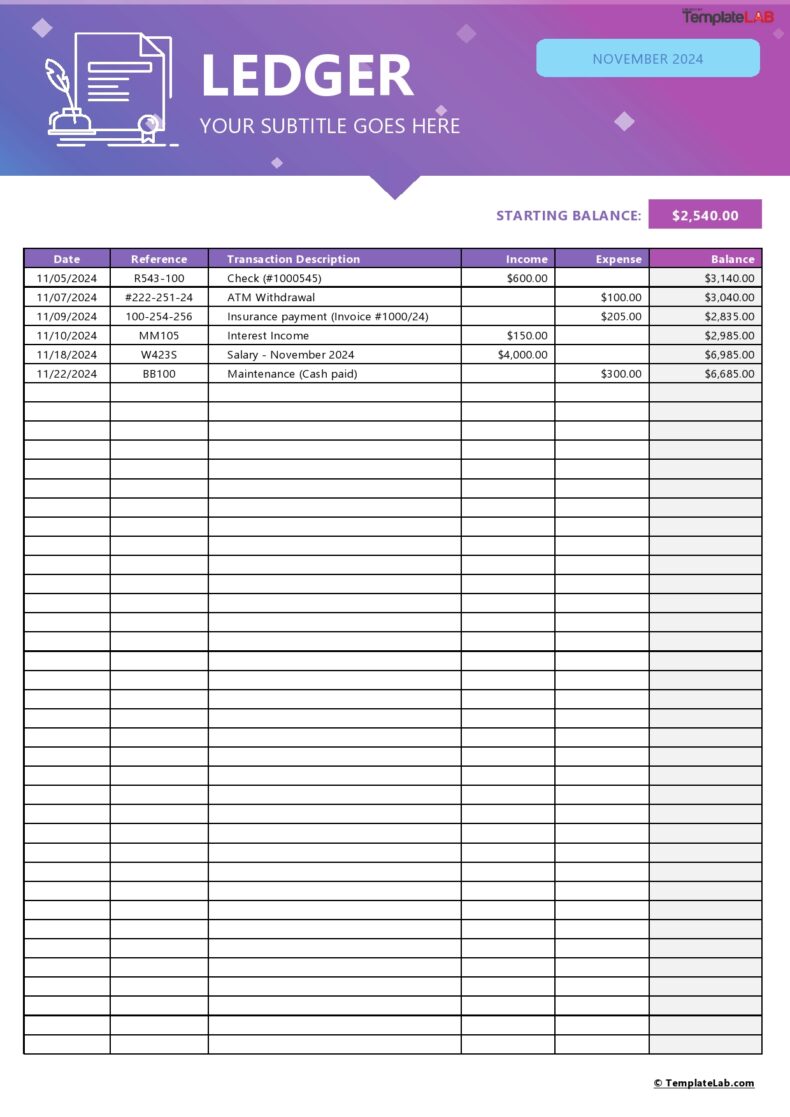

General Ledger Templates

Bill Pay Checklists

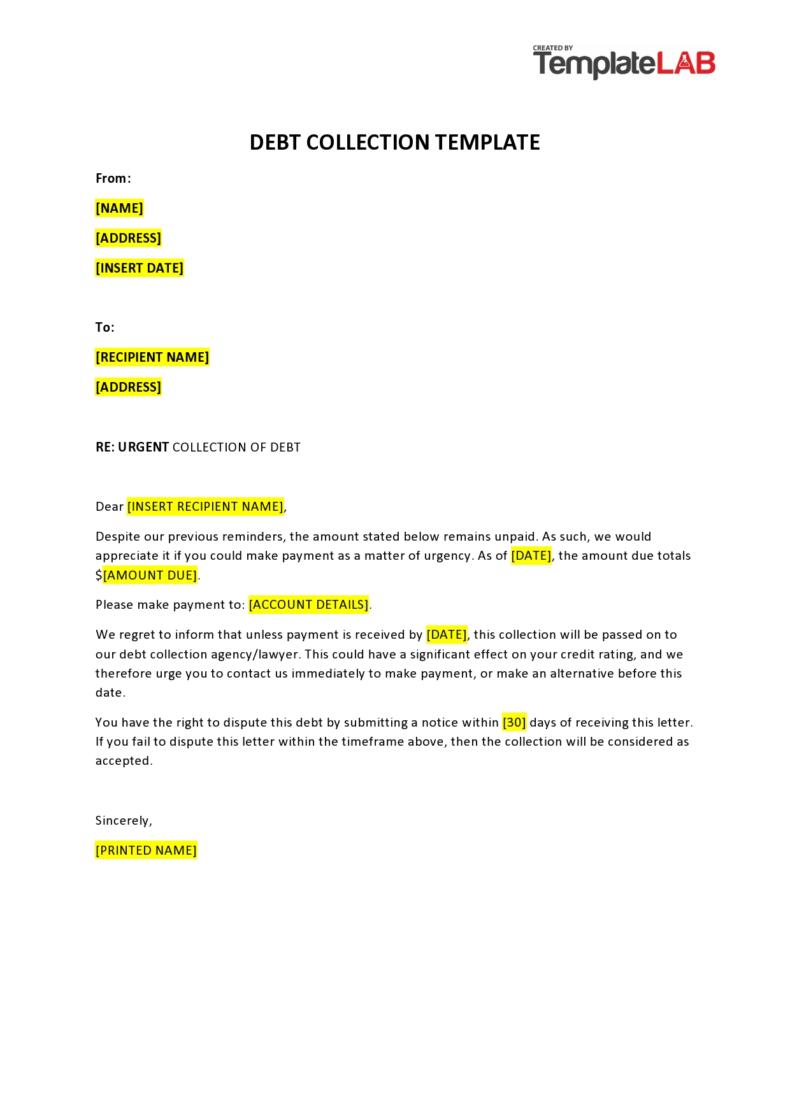

Collection Letter Templates

Personal Balance Sheets

Plan Projections

ideas to numbers .. simple financial projections

Home > Financial Projections Template Excel

Financial Projections Template Excel

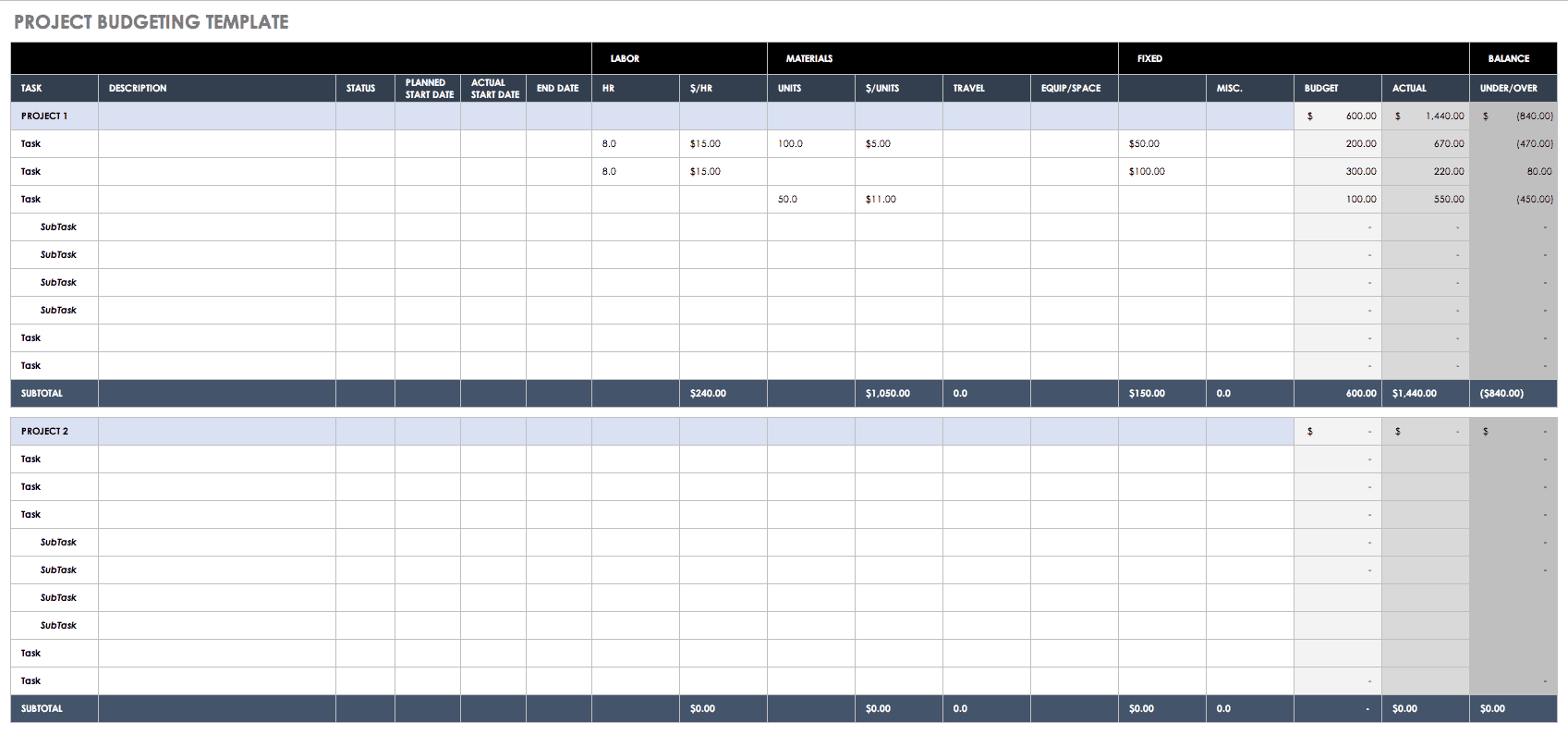

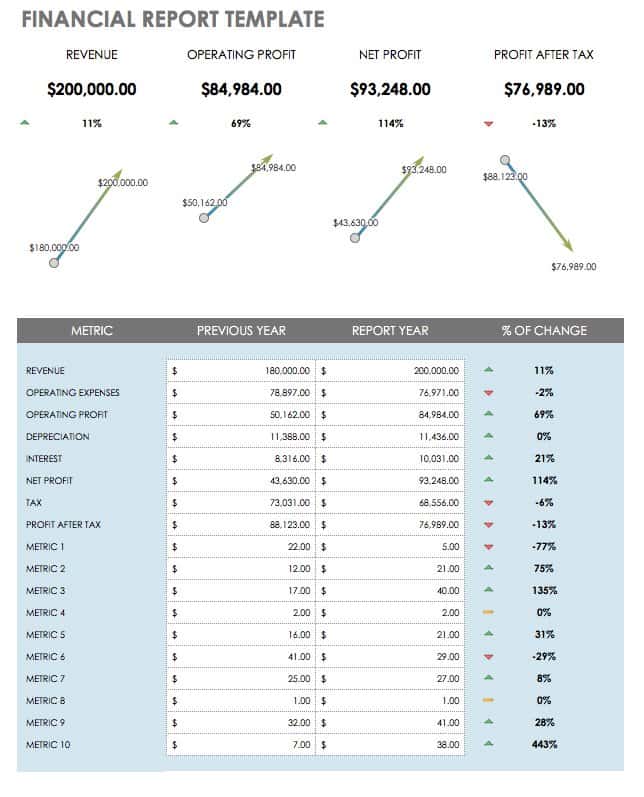

This free 4 page Excel business plan financial projections template produces annual income statements, balance sheets and cash flow projections for a five year period for any business.

Financial Projections Template Download

What’s included in the financial projection template, 1. income statements.

The first page of the financial projection template shows income statements for the business for 5 years.

2. Balance Sheets

3. Cash Flow Statements

The third page provides the cash flow statements for 5 years.

4. Ratios and Graphs

The final page of the financial projections template contains a selection of useful financial ratios for comparison purposes. In addition it shows revenue, net income, cash balance, and cumulative free cash flow by year in graph form for easy reference.

How to use the Financial Projections Template

If you want to know how to use the financial projections template, then we recommend reading our How to Make Financial Projections post, which explains each step in detail.

More Financial Projections Templates and Calculators

Select a category from the menu to the right or chose one of the templates or calculators below.

Popular Revenue Projection Templates

- Retail Store Revenue Projection

- Drop Shipping Business Revenue Projection

- Sandwich Shop Revenue Projection

- Salon Business Plan Revenue Projection

- Microbrewery Business Plan Revenue Projection

Popular Calculators

- Days Sales Outstanding Calculator

- Return on Investment Calculator

- Sales Forecast Spreadsheet

- Gross Margin Calculator

- Business Operating Expenses Template

Financial projections are critical to the success of your business plan, particularly if the purpose is to raise finance. Accordingly we have designed our financial projection for startup template to help you test your business idea and create a five year business plan financial projection.

The financial projection template will help you to carry out your own financial projections and test your business idea. Therefore simply amend the highlighted input elements to suit your purposes, and the financial projection template does the rest.

Alternatively, you can use our online calculator to provide a quick and easy way to test the feasibility of your business idea.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. Michael has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a BSc from Loughborough University.

- Design for Business

- Most Recent

- Presentations

- Infographics

- Data Visualizations

- Forms and Surveys

- Video & Animation

- Case Studies

- Digital Marketing

- Design Inspiration

- Visual Thinking

- Product Updates

- Visme Webinars

- Artificial Intelligence

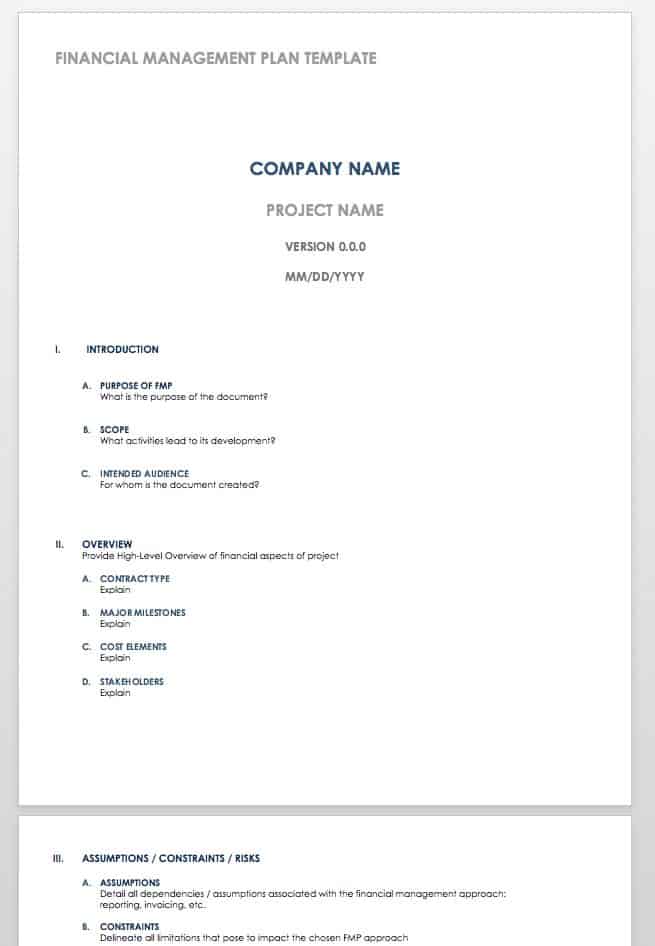

Financial Projection Templates to Help You with Planning

Written by: Raja Mandal

Evaluating your company’s financial performance is great. But planning for the future is just as important.

Sound financial projections give startups and established businesses a significant boost in making informed decisions and preparing for unexpected events. It forecasts estimated cash flow, sales, expenses, profit and other financial results you plan to achieve.

But that’s not all. When seeking funding, financial projections not only validate your business to investors or partners but also convince them of its growth potential.

So, how do you create one? Financial projection templates make the entire process a breeze. In this article, we’ve compiled 14 financial projection templates to simplify your financial planning process and help you make well-informed business decisions.

Table of Contents

What is a financial projection.

- What Should be Included in Financial Projections?

- 14 Financial Project Templates to Use

How to Create Financial Projections with Visme

Financial projections faqs.

- A financial projection is an estimate of future revenue, expenses and profits for a business. It helps decision-makers plan and strategize based on these predicted financial outcomes.

- The critical elements of a financial projection are the income statements, cash flow and balance sheet.

- Choose from Visme's financial projection and budget templates , ranging from presentations and reports to tables and dashboards.

- Customize your templates using Visme's advanced tools and features, like the dynamic fields, brand wizard, collaboration tools and more.

- Sign up for a free Visme account to create your financial projections easily.

A financial projection is a forecast of a business's future financial performance. It helps you estimate critical financial figures, such as revenues, expenses and profits, over a specific period.

By creating financial projections, business owners can plan, make informed decisions, and prepare for various possibilities. These predictions also act as a roadmap to guide growth, attract investors and estimate profitability.

Therefore, financial projections are necessary to run a business successfully, regardless of size and type.

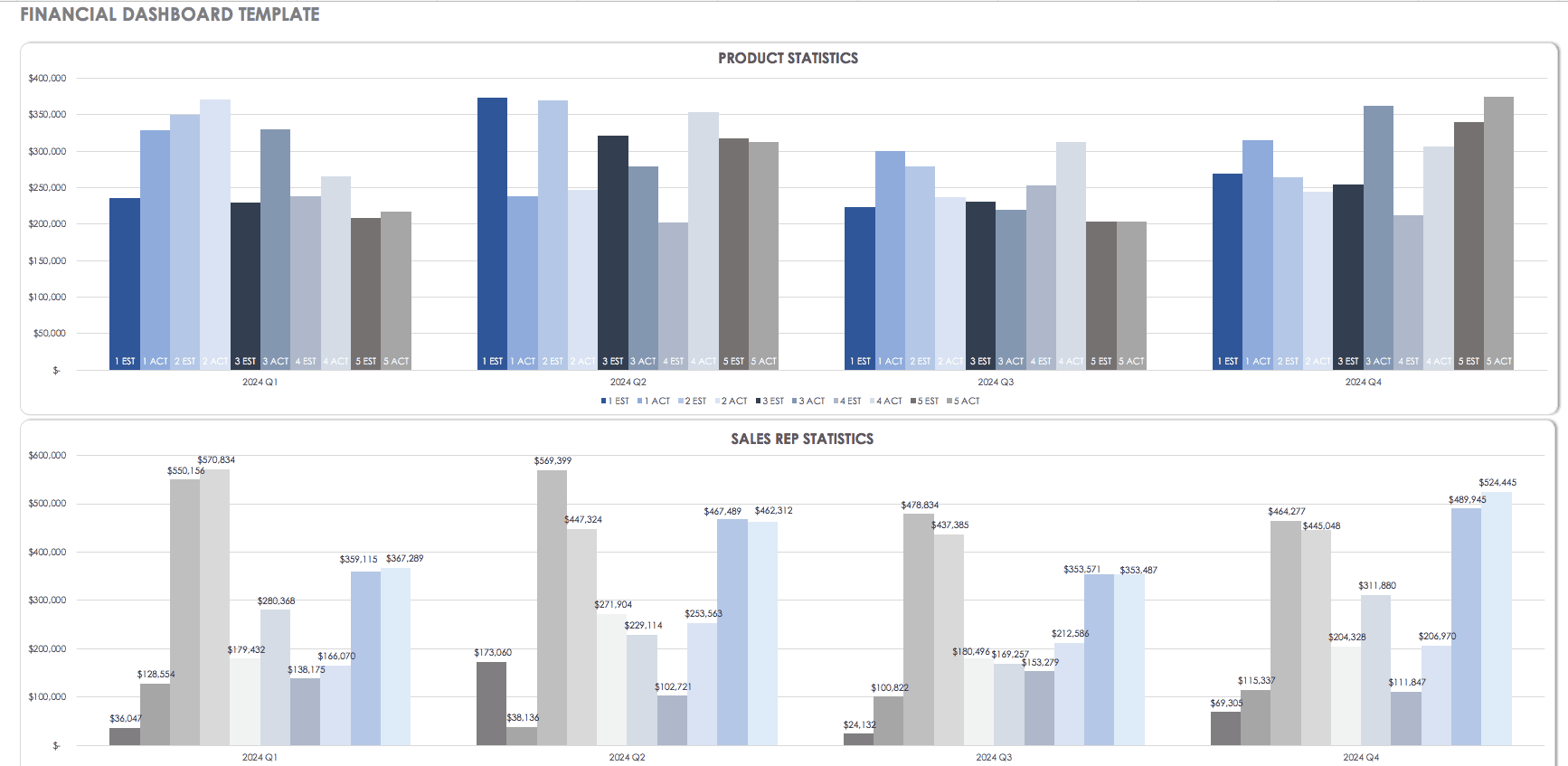

Here's an example of what a financial projection document looks like and the insights it offers.

What Should Be Included in Financial Projections?

When creating a financial projection, there are three main sections you should focus on. These are the income statements, cash flow projections and balance sheet projections.

1. Income Statements

This is the storyteller of your company's performance, focusing on four essential items: revenue, expenses, gains and losses over a specific period. It reflects the results of your business operations and provides insights into whether you are losing or making money.

The income statements display your company's revenue, gross margin, costs, gross profit, taxes paid, marketing and other expenses.

This example shows your projected income statements.

2. Cash Flow Projections

Cash flow projections forecast the amount of money expected to come in and go out over a specific period. This report will help you manage your business operations and payments more effectively, especially during negative cash flow.

Additionally, it provides a quick overview of your company's liquidity and short-term financial stability.

3. Balance Sheet Projections

The balance sheet projection gives you a bird's eye view of your business's financial health. It forecasts your assets, liabilities and equity. By incorporating it into your financial projection, you can predict your financial status, plan for funding requirements and assure stakeholders about the financial stability of your business.

RELATED READING: 11 Best Financial Dashboards to Track Sales, KPIs & Metrics

14 Financial Projection Templates

Use these comprehensive templates to analyze and forecast your business's financial future. The templates are fully customizable, ranging from presentations and reports to budgets and tables.

Choose your template wisely and customize it using Visme’s budget planner .

Visme's tools and templates have enabled thousands of businesses across the globe to create valuable documents even with little or no design knowledge.

But don’t just take our word for it. Here's what one of our satisfied users has to say about Visme.

Helene Dunbar and Amanda Aultman

Internal Communications Specialists, HouseCalls

You can read the full case study about How a Communications Team Was Able to Create Visual Content 60% Faster With Visme.

1. Financial Projections Presentation Template

This financial projection template is designed to transform your data into meaningful insights. It provides a clear and concise overview of your financial projections, including income statements, balance sheets, assets, liabilities and equity.

The tool offers unique features—such as radial gauges for income statement predictions and a dual chart—that visually illustrate total liabilities and equity. Additionally, the template showcases balance sheet ratios across different countries using an innovative vertical bar graph, providing a global perspective.

Visme's AI presentation maker can help you create professional-looking financial projection presentations in just a few minutes. This advanced tool simplifies the design process and helps you reduce the time spent on presentation design.

Provide your prompt, choose your preferred style, and the tool will generate everything - including the text, images and illustrations.

2. Financial Projections Presentation Modern Template

Here's a template that looks similar to the previous one but comes in a different color. However, with Visme, you don't have to restrict yourself to a limited color palette. In the editor, you can use the color wheel to create your own unique colors, apply a specific HEX code or choose from any of the color presets available.

3. Balance Sheet Presentation Template

Whether reviewing your company's finances or presenting to stakeholders, this balance sheet presentation template is a great way to show your financial projection.

It's designed with separate slides for different financial aspects, such as assets, liabilities and stockholder equity. The template also separates current and long-term liabilities into distinct slides and tables, making it easy to organize your financial data.

Turn numbers and statistics from your balance sheet into beautiful, meaningful visuals using Visme's data visualization tools . Visme offers 30+ data widgets such as radial gauges, progress bars, population arrays and many others to help you visualize data.

For larger data sets, you can choose from 20+ types of charts and graphs, including bar graphs , line graphs , pie charts and more.

4. Financial Audit Report Template

A well-audited financial report is crucial for financial projections and this template provides a classic way to communicate your findings effectively without drowning in numbers.

This comprehensive template presents asset data, including current and fixed assets and other elements such as income statements, cash flow, liabilities and partners' capital deficits. It displays detailed information in organized tables, with the added clarity of table and bar graphs for income statements.

Using this template makes it easy for you to spot trends and make forecasts in your business finances.

Are you looking for a way to save time on report creation? Visme's AI report writer is the solution you need. Whether you are compiling a quarterly financial summary or an end-of-year financial analysis, the tool guides you through the process.

All you need to do is generate your first draft report using a prompt. Once you've done that, you can choose a style and the tool will generate text, graphics and visuals to match. And if you want to make further tweaks, customize the template until you're happy with the final design.

5. Financial Statements Presentation Template

Illustrate your company's financial performance to ensure accuracy for tax, financing or investing purposes using this financial statement presentation template.

This template combats information overload by focusing on key facts, presented with minimal text and maximized data visibility. The creative use of icons and images reinforces information, making it more digestible and engaging. It's the perfect tool to present complex financial figures and estimates in an appealing and easy-to-understand format.

And if you need help writing the content for your financial projection templates, Visme’s AI writer is here to help. It can draft an entire financial statement, create a structure for your presentation and even proofread your text for grammatical or syntax mistakes.

Need to summarize a hefty report? Visme AI Writer can do it. Need persuasive CTAs for your stakeholders? It has you covered. All you need to do is explain what you want the tool to do for you and you're good to go.

6. Financial Analysis Presentation Template

The financial analysis presentation template empowers you to create a vivid, compelling narrative about your organization's financial health. It focuses on critical financial elements such as the profit vs. loss landscape, project earning capacity, assets and the operating profitability ratio.

With this template, you can easily translate complex figures into a simplified visual language that anyone can understand. You can quickly and efficiently explain your financial standpoints by examining assets and disclosing your operating profitability ratio.

Apply your brand's visual identity to your financial projection templates easily using Visme's brand design tool .

Simply copy and paste your website URL and the brand wizard will extract your brand colors , brand fonts and company logo from your website. Once saved, anyone from your team can apply your branding elements to any design with a single click.

This will help you establish credibility and reinforce your brand identity while presenting financial insights to stakeholders and team members.

7. Company Finance Report Template

The company finance report template simplifies how you analyze your business's finances. It clarifies the amount of money your company has and the amount it owes by breaking down assets and liabilities. It also allows you to compare your expected financial outcomes with the actual results, guiding you to stay on track.

Additionally, it summarizes financial market movements, helping you understand how your company fits into the larger financial landscape. It makes tracking your monthly operational expenses smoother, enabling you to manage costs effectively.

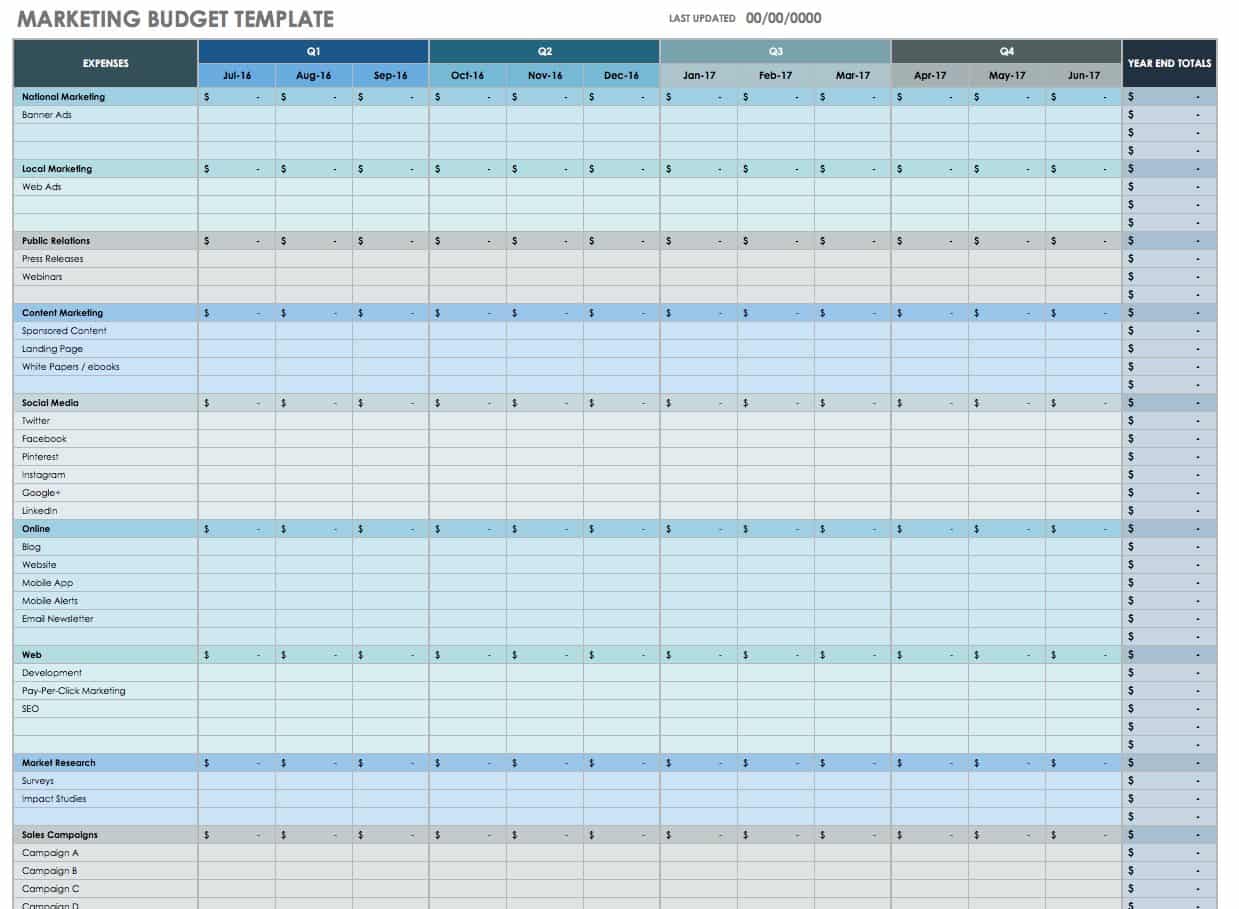

8. Company Financial Budget Template

A budget template makes it easy for you to plan and control financial activities in your business.

This company financial budget template helps you navigate the crucial aspects of budgeting, such as salaries, operating expenses and other miscellaneous costs. It strengthens your budgeting process with detailed income statements, ensuring you have a comprehensive view of your cash inflows, outflows and net cash flow.

Use Visme's dynamic fields feature to maintain consistency across all your financial projection documents. Create custom fields such as costs, revenue projections, profit margins or anything else you want.

Whenever you update the information, the tool automatically updates all the other documents or projects containing these fields. This way, you can ensure that your financial projections are always up-to-date and accurate.

9. Company Operating Budget Template

Use this template to plan your company's operating budget and create the sales forecast, the crucial elements for financial projections. It provides a detailed revenue and expense expectations plan, enabling you to predict future financial performance, strategically allocate resources and make informed decisions to achieve your financial goals.

It helps you simplify your company's cash flow and guides you toward fiscal targets with precision for upcoming periods or long-term planning.

Creating financial projection documents can be a complex task. It often requires the active collaboration of different members across an organization.

Visme's design collaboration tools can help simplify this process. It brings transparency, efficiency and security to the task.

With Visme, you can share the financial projection template with your team by sending email invitations or sharing a project link. It allows them to leave comments, annotate specific elements and edit the document together.

10. Company Expenses Report Template

Accurate tracking of expenses and smart budgeting are essential for the success of any business. This company expenses report template is designed to be your perfect companion in achieving this. It helps you systematically categorize your major corporate expenses, such as employee, office and marketing.

This template is not just a record of what you spend. It's also a tool to help you identify potential areas where you could better allocate the budget. It highlights sections where the expenditure proves beneficial, deserving more allocation and points out those costs you could cut.

With Visme's workflow management features , customizing your financial project and expense reports templates becomes more efficient and organized. You can assign specific tasks to team members and manage roles, tasks, progress and deadlines in one place.

11. Financial Projection Model Table Consulting Template

Forecasting a company’s financial future is no small task. The financial projection template is a comprehensive yet concise one-pager that provides a data tableau for each year over a specific period.

It features information about debts, liabilities, overdue amounts, assets and a detailed snapshot of your company’s financial status.

This template ensures key stakeholders can quickly grasp your financial standing and predict future trends. Besides the concise presentation, the template can be a valuable tool for strategists and analysts conducting in-depth studies on the company’s financial health.

12. Cash Flow Financial Model Table Template

The cash flow financial model table template is an easy-to-use tool that helps you manage and comprehend your business' finances. This template includes sections for all of your financial activities. It begins with the income earned from sales, grants and refunds.

Then, there is a segment that lists all the expenses of running your business, from buying supplies to paying for advertisements or investing in the growth of your business. All of this data allows you to determine whether you are earning more money than you are spending or the opposite.

13. Monthly Operating Expenses Dashboard Template

The monthly operating expenses dashboard template is an invaluable resource for keeping track of your financial activity and budget effectively. This template visually represents your company's monthly expenses, clearly showing expenditures across different categories, such as salaries, utilities and office supplies.

Using this organized and concise dashboard, you can quickly assess your spending, identify cost-saving opportunities and make more informed operational decisions to maintain financial stability.

With Visme's animation and interactivity tools , you can bring your financial projection templates to life.

With these tools, you can create interactive elements such as clickable menus, pop-ups, hover effects and more. You can add animated icons, illustrations and special effects to make the document more engaging.

14. Financial Performance Dashboard Template

With an intuitive and visually appealing layout and bar graphs, this dashboard displays critical financial metrics, including revenue, net profit and cash flow. The dashboard makes it easy for financial analysts to compare the current and previous month's performance and calculate the month-on-month change.

Seamlessly integrate your favorite applications like HubSpot , Salesforce and Mailchimp with Visme. This integration lets you export your charts, graphs and dashboards into third-party platforms for real-time insights into your financial performance.

For instance, you can integrate Salesforce data into your Visme documents to get live sales pipeline data and customer behavior that directly influences your financial projections.

Creating financial projections is straightforward with Visme. Just follow these three simple steps:

Step 1: Login to Visme and Choose Your Template

First things first, head over to the Visme website. If you're new, sign up for an account using your name and email address. If you already have an account, simply log in.

Once you're in, browse through Visme's collection of templates and pick one for financial projections. You’ll find a design that aligns well with your business needs and aesthetics.

Step 2: Customize the Template

The next step is to make that template yours. There are many ways to customize your templates in Visme.

Adjust the numbers/figures

One of the first steps in customizing the template includes adjusting the projected revenue forecasts, expense estimates and other figures. You'll find preset numerical values you can replace with your own to make the document valid for your business.

Modify the company details

Insert your company's name, address, and other details into the template. This will make the template uniquely yours and aid in better business recognition.

Change the fonts and colors

Visme lets you change fonts and colors according to your liking or brand image. You can use Visme's color wheel to create your own colors, copy-paste a HEX code or choose from the color presets.

Also, Visme comes with various fonts and font combinations that you can choose from.

Add or edit graphs and charts

To visualize more extensive data sets, you can choose from 20+ types of charts and graphs . Or, use the data widgets like progress bars, population arrays and radial gauges to visualize smaller data sets.

Edit the existing data visualizations to input your own values just by clicking on them and changing them from the sidebar.

Step 3: Download, Share, or Publish Your Document

After fine-tuning your financial projection, it's time to download and share it . Download your document in formats like PDF, JPG or PNG for offline use.

If you want to share it directly with colleagues or stakeholders online, Visme allows you to generate a shareable link. You can even publish your work online by generating a snippet of code to embed it on your website or landing page.

Q. Why Are Financial Projections Important?

Financial projections are crucial for several reasons:

- They help businesses establish goals and create a roadmap for achieving them.

- Projections guide businesses in allocating resources and managing cash flow, ensuring they remain financially stable.

- They allow businesses to make informed decisions based on their financial outlook, helping them mitigate risks and capitalize on opportunities.

- Investors and lenders constantly require financial projections to evaluate a business's potential for success, growth and ability to repay loans.

- Regularly updating and comparing projections with actual financial results can help identify areas where a business is underperforming and needs improvement.

Q. What Are Financial Projections Used for?

Businesses use financial projections for these purposes below

- Estimate the future financial performance of a business based on historical data and future assumptions

- Plan and make decisions about budgeting, investments, and overall financial strategy.

- Identify potential risks and opportunities, and can also be used to attract investors or secure financing.

- Forecast their financial future and make informed decisions based on that forecast.

- When a business or individual is planning to start a new venture, launch a new product or service or expand an existing operation.

Q. How to Calculate Financial Projections for Business Plan

To calculate financial projections for a business plan, you will need to estimate the future revenue, expenses and cash flow of your business.

- Start by creating a sales forecast based on market research and historical sales data.

- Then, estimate your cost of goods sold, operating expenses, and capital expenditures.

- Use these estimates to calculate your projected profit and loss statement, balance sheet and cash flow statement.

- Review and adjust your financial projections regularly as your business evolves and market conditions change.

Q. What Is a 3-Year Financial Projection?

A 3 year financial projection is a document that estimates a company's future financial position based on expected revenues, expenses and cash flow over a three-year period.

Q. How to Do a 3-Year Financial Projection?

Here's how you can make a 3-year financial projection:

- Sales Projection: Analyze past sales data, observe current market trends, and consider the impact of your potential marketing or strategic initiatives. Use these to forecast your sales for the next three years.

- Expense Projection: Identify all business costs, including raw materials, labor, marketing, rent, utilities, etc., and gather them over three years. Remember to consider expected inflation or cost increases.

- Balance Sheet Projection: Project your assets, liabilities and equity for each year based on your sales and expense forecasts.

- Income Statement Projection: Use your sales and expense projections to estimate yearly net income and sales.

- Cash Flow Projection: Forecast all cash inflows and outflows and keep track of your closing cash balance at the end of each year. This helps identify when you need additional funding.

Q. Is Financial Projection the Same as Financial Plan?

No, a financial projection is not the same as a financial plan. A financial projection forecasts future revenue and expenses, estimating how much money the company may make or spend. A financial plan is broader; it outlines the business's financial goals and how to achieve them, including savings, investments and budgeting.

Q. Are Financial Forecasts and Financial Projections the Same?

No, though often used interchangeably, financial forecasts and financial projections are not the same. A financial forecast predicts the financial outcomes in the near future based on current conditions and expected short-term trends. In comparison, a financial projection is a calculation that shows what could happen if the business performs in a certain way.

In other words, a forecast is based on current conditions, whereas projections are based on potential scenarios.

Plan, Report & Strategize Finances with Visme

A financial projection is like a weather forecast but for your business! It's your best guess of how much money your business will make (revenues), how much it will spend (expenses), and what will be left after paying everything off (profits) in the future.

Creating financial projections is always challenging and time-consuming. But it's worth the effort to create a financial projection to help you make better decisions about your business.

With Visme, crafting financial projections becomes straightforward. All you need is your financial data, a Visme account, and a few minutes. You can use the financial projection templates provided in this article as a starting point and customize them using Visme’s advanced tools.

Besides financial documents, Visme also helps create various documents for different teams, such as marketing , human resources , training and development , and others. This way, Visme ensures you have all the documents you need to run and grow your business successfully.

Sign up for Visme today and take your financial projections to the next level.

Create beautiful and insightful financial reports with Visme

Trusted by leading brands

Recommended content for you:

Create Stunning Content!

Design visual brand experiences for your business whether you are a seasoned designer or a total novice.

About the Author

Raja Antony Mandal is a Content Writer at Visme. He can quickly adapt to different writing styles, possess strong research skills, and know SEO fundamentals. Raja wants to share valuable information with his audience by telling captivating stories in his articles. He wants to travel and party a lot on the weekends, but his guitar, drum set, and volleyball court don’t let him.

Falling leaves. Falling prices 🍂 70% Off for 3 Months. Buy Now & Save

70% Off for 3 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Partners Hub

- Help Center

- 1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to make financial projections for business.

Writing a solid business plan should be the first step for any business owner looking to create a successful business.

As a small business owner, you will want to get the attention of investors, partners, or potential highly skilled employees. It is, therefore, important to have a realistic financial forecast incorporated into your business plan.

We’ll break down a financial projection and how to utilize it to give your business the best start possible.

Key Takeaways

Accurate financial projections are essential for businesses to succeed. In this article, we’ll explain everything you need to know about creating financial projections for your business. Here’s what you need to know about financial projections:

- A financial projection is a group of financial statements that are used to forecast future performance

- Creating financial projections can break down into 5 simple steps: sales projections, expense projections, balance sheet projections, income statement projections, and cash flow projections

- Financial projections can offer huge benefits to your business, including helping with forecasting future performance, ensuring steady cash flow, and planning key moves around the growth of the business

Here’s What We’ll Cover:

What Is a Financial Projection?

How to Create a Financial Projection

What goes into a financial projection, what are financial projections used for.

Financial Projections Advantages

Frequently Asked Questions

What Is Financial Projection?

A financial projection is essentially a set of financial statements . These statements will forecast future revenues and expenses.

Any projection includes your cash inflows and outlays, your general income, and your balance sheet.

They are perfect for showing bankers and investors how you plan to repay business loans. They also show what you intend to do with your money and how you expect your business to grow.

Most projections are for the first 3-5 years of business, but some include a 10-year forecast too.

Either way, you will need to develop a short and mid-term projection broken down month by month.

As you are just starting out with your business, you won’t be expected to provide exact details. Most financial projections are rough guesses. But they should also be educated guesses based on market trends, research, and looking at similar businesses.

It’s incredibly important for financial statements to be realistic. Most investors will be able to spot a fanciful projection from a mile away.

In general, most people would prefer to be given realistic projections, even if they’re not as impressive.

Financial projections are created to help business owners gain insight into the future of their company’s financials.

The question is, how to create financial projections? For business plan purposes, it’s important that you follow the best practices of financial projection closely. This will ensure you get accurate insight, which is vital for existing businesses and new business startups alike.

Here are the steps for creating accurate financial projections for your business.

1. Start With A Sales Projection

For starters, you’ll need to project how much your business will make in sales. If you’re creating a sales forecast for an existing business, you’ll have past performance records to project your next period. Past data can provide useful information for your financial projection, such as if your sales do better in one season than another.

Be sure also to consider external factors, such as the economy at large, the potential for added tariffs and taxes in the future, supply chain issues, or industry downturns.

The process is almost the same for new businesses, only without past data to refer to. Business startups will need to do more research on their industry to gain insight into potential future sales.

2. Create Your Expense Projection

Next, create an expense projection for your business. In a sense, this is an easier task than a sales projection since it seems simpler to predict your own behaviors than your customers. However, it’s vital that you expect the unexpected.

Optimism is great, but the worst-case scenario must be considered and accounted for in your expense projection. From accidents in the workplace to natural disasters, rising trade prices, to unexpected supply disruptions, you need to consider these large expenses in your projection.

Something always comes up, so we suggest you add a 10-15% margin on your expense projection.

3. Create Your Balance Sheet Projection

A balance sheet projection is used to get a clear look at your business’s financial position related to assets, liabilities , and equity, giving you a more holistic view of the company’s overall financial health.

For startup businesses, this can prove to be a lot of work since you won’t have existing records of past performance to pull from. This will need to be factored into your industry research to create an accurate financial projection.

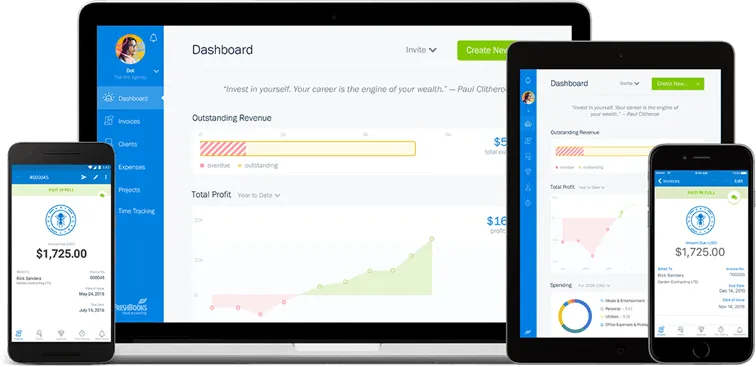

For existing businesses, it will be more straightforward. Use your past and current balance sheets to predict your business’s position in the next 1-3 years. If you use a cloud-based, online accounting software with the feature to generate balance sheets, such as the one offered by FreshBooks, you’ll be able to quickly create balance sheets for your financial projection within the app.

Click here to learn more about the features of FreshBooks accounting software.

4. Make Your Income Statement Projection

Next up, create an income statement projection. An income statement is used to declare the net income of a business after all expenses have been made. In other words, it states the profits of a business.

For currently operating businesses, you can use your past income statements and the changes between them to create accurate predictions for the next 1-3 years. You can also use accounting software to generate your income statements automatically.

You’ll need to work on rough estimates for new businesses or those still in the planning phase. It’s vital that you stay realistic and do your utmost to create an accurate, good-faith projection of future income.

5. Finally, Create Your Cash Flow Projection

Last but not least is to generate your projected cash flow statement. A cash flow projection forecasts the movement of all money to and from your business. It’s intertwined with a business’s balance sheet and income statement, which is no different when creating projections.

If your business has been operating for six months or more, you can create a fairly accurate cash flow projection with your past cash flow financial statements. For new businesses, you’ll need to factor in this step of creating a financial forecast when doing your industry research.

It needs to include five elements to ensure an accurate, useful financial forecast for your business. These financial statements come together to provide greater insight into the projected future of a business’s financial health. These include:

Income Statement

A standard income statement summarizes your company’s revenues and expenses over a period. This is normally done either quarterly or annually.

The income statement is where you will do the bulk of your forecasting.

On any income statement, you’re likely to find the following:

- Revenue: Your revenue earned through sales.

- Expenses: The amount you’ve spent, including your product costs and your overheads.

- Pre-Tax Earnings: This is your income before you’ve paid tax.

- Net Income: The total revenues minus your total expenses.

Net income is the most important number. If the number is positive, then you’re earning a profit, if it’s negative, it means your expenses outweigh your revenue and you’re making a loss.

Cash Flow Statement

Your cash flow statement will show any potential investor whether you are a good credit risk. It also shows them if you can successfully repay any loans you are granted.

You can break a cash flow statement into three parts:

- Cash Revenues: An overview of your calculated cash sales for a given time period.

- Cash Disbursements: You list all the cash expenditures you expect to pay.

- Net Cash Revenue: Take the cash revenues minus your cash disbursements.

Balance Sheet

Your balance sheet will show your business’s net worth at a given time.

A balance sheet is split up into three different sections:

- Assets: An asset is a tangible object of value that your company owns. It could be things like stock or property such as warehouses or offices.

- Liabilities: These are any debts your business owes.

- Equity: Your equity is the summary of your assets minus your liabilities.

Looking for an easy-to-use yet capable online accounting software? FreshBooks accounting software is a cloud-based solution that makes financial projections simple. With countless financial reporting features and detailed guides on creating accurate financial forecasts, FreshBooks can help you gain the insight you need to let your business thrive. Click here to give FreshBooks a try for free.

Financial projections have many uses for current business owners and startup entrepreneurs. Provided your financial forecasting follows the best practices for an accurate projection, your data will be used for:

- Internal planning and budgeting – Your finances will be the main factor in whether or not you’ll be able to execute your business plan to completion. Financial projections allow you to make it happen.

- Attracting investors and securing funding – Whether you’re receiving financing from bank loans, investors, or both, an accurate projection will be essential in receiving the funds you need.

- Evaluating business performance and identifying areas for improvement – Financial projections help you keep track of your business’s financial health, allowing you to plan ahead and avoid unwelcome surprises.

- Making strategic business decisions – Timing is important in business, especially when it comes to major expenditures (new product rollouts, large-scale marketing, expansion, etc.). Financial projections allow you to make an informed strategy for these big decisions.

Financial Projections Advantages

Creating clear financial projections for your business startup or existing company has countless benefits. Focusing on creating (and maintaining) good financial forecasting for your business will:

- Help you make vital financial decisions for the business in the future

- Help you plan and strategize for growth and expansion

- Demonstrate to bankers how you will repay your loans

- Demonstrate to investors how you will repay financing

- Identify your most essential financing needs in the future

- Assist in fine-tuning your pricing

- Be helpful when strategizing your production plan

- Be a useful tool for planning your major expenditures strategically

- Help you keep an eye on your cash flow for the future

Your financial forecast is an essential part of your business plan, whether you’re still in the early startup phases or already running an established business. However, it’s vital that you follow the best practices laid out above to ensure you receive the full benefits of comprehensive financial forecasting.

If you’re looking for a useful tool to save time on the administrative tasks of financial forecasting, FreshBooks can help. With the ability to instantly generate the reports you need and get a birds-eye-view of your business’s past performance and overall financial help, it will be easier to create useful financial projections that provide insight into your financial future.

FAQs on Financial Projections

More questions about financial forecasting, projections, and how these processes fit into your business plan? Here are some frequently asked questions by business owners.

Why are financial projections important?

Financial projections allow you to gain insight into your business’s economic trajectory. This helps business owners make financial decisions, secure funding, and more. Additionally, financial projections provide early warning of roadblocks and challenges that may lay ahead for the company, making it easier to plan for a clear course of action.

What is an example of a financial projection?

A projection is an overall look at a business’s forecasted performance. It’s made up of several different statements and reports, such as a cash flow statement, income statement, profit and loss statement, and sales statement. You can find free templates and examples of many of these reports via FreshBooks. Click here to view our selection of accounting templates.

Are financial forecasts and financial projections the same?

Technically, there is a difference between forecasting and projections, though many use the terms interchangeably. Financial forecasting often refers to shorter-term (<1 year) predictions of financial performance, while financial projections usually focus on a larger time scale (2-3 years).

What is the most widely used method for financial forecasting?

The most common method of accurate forecasting is the straight-line forecasting method. It’s most often used for projecting the growth of a business’s revenue growth over a set period. If you notice that your records indicate a 4% growth of revenue per year for five years running, it would be reasonable to assume that this will continue year-over-year.

What is the purpose of a financial projection?

Projection aims to get deeper, more nuanced insight into a business’s financial health and viability. It allows business owners to anticipate expenses and profit growth, giving them the tools to secure funding and loans and strategize major business decisions. It’s an essential accounting process that all business owners should prioritize in their business plans.

Michelle Alexander, CPA

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

How To Create Startup Financial Projections [+Template]

Businesses run on revenue, and accurate startup financial projections are a vital tool that allows you to make major business decisions with confidence. Financial projections break down your estimated sales, expenses, profit, and cash flow to create a vision of your potential future.

In addition to decision-making, projections are huge for validating your business to investors or partners who can aid your growth. If you haven’t already created a financial statement, the metrics in this template can help you craft one to secure lenders.

Whether your startup is in the seed stage or you want to go public in the next few years, this financial projection template for startups can show you the best new opportunities for your business’s development.

In this article:

- What is a startup financial projection?

- How to write a financial projection

- Startup expenses

- Sales forecasts

- Operating expenses

- Income statements

- Balance sheet

- Break-even analysiFinancial ratios Startup financial

- rojections template

What is a financial projection for startups?

A financial projection uses existing revenue and expense data to estimate future cash flow in and out of the business with a month-to-month breakdown.

These financial forecasts allow businesses to establish internal goals and processes considering seasonality, industry trends, and financial history. These projections cover three to five years of cash flow and are valuable for making and supporting financial decisions.

Financial projections can also be used to validate the business’s expected growth and returns to entice investors. Though a financial statement is a better fit for most lenders, many actuals used to validate your forecast are applied to both documents.

Projections are great for determining how financially stable your business will be in the coming years, but they’re not 100% accurate. There are several variables that can impact your revenue performance, while financial projections identify these specific considerations:

- Internal sales trends

- Identifiable risks

- Opportunities for growth

- Core operation questions

To help manage unforeseeable risks and variables that could impact financial projections, you should review and update your report regularly — not just once a year.

How do you write a financial projection for a startup?

Financial projections consider a range of internal revenue and expense data to estimate sales volumes, profit, costs, and a variety of financial ratios. All of this information is typically broken into two sections:

- Sales forecasts : includes units sold, number of customers, and profit

- Expense budget : includes fixed and variable operating costs

Financial projections also use existing financial statements to support your estimated forecasts, including:

- Income stateme

- Cash flow document

Gathering your business’s financial data and statements is one of the first steps to preparing your complete financial projection. Next, you’ll import that information into your financial projection document or template.

This foundation will help you build the rest of your forecast, which includes:

- Cash flow statements

- Break-even analysis

- Financial ratios

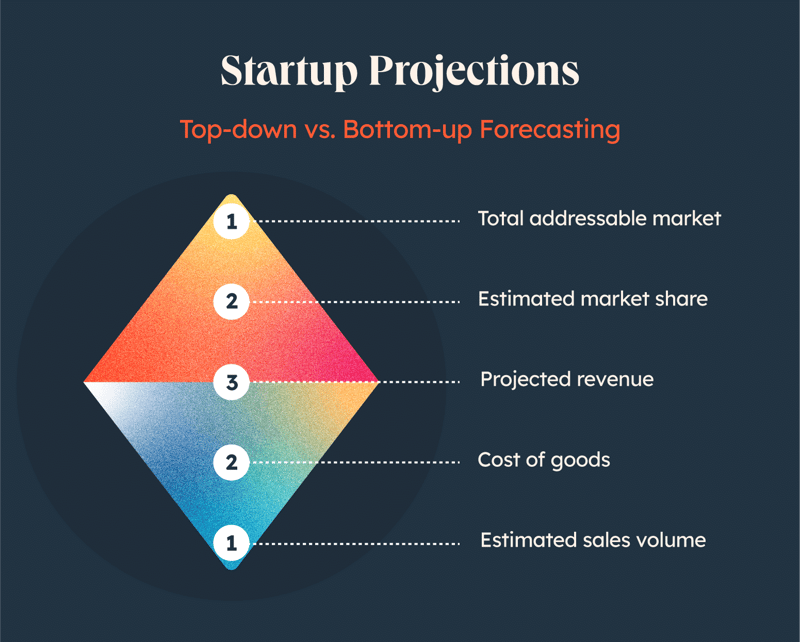

Once all of your data is gathered, you can organize your insights via a top-down or bottom-up forecasting methods.

The top-down approach begins with an overview of your market, then works into the details of your specific revenue. This can be especially valuable if you have a lot of industry data, or you’re a startup that doesn’t have existing sales to build from. However, this relies on a lot of averages and trends will be generalized.

Bottom-up forecasting begins with the details of your business and assumptions like your estimated sales and unit prices. You then use that foundation to determine your projected revenue. This process focuses on your business’s details across departments for more accurate reporting. However, mistakes early in forecasting can compound as you “build up.”

1. Startup expenses

If your startup is still in the seed stage or expected to grow significantly in the next few quarters, you’ll need to account for these additional expenses that companies beyond the expansion phase may not have to consider.

Depending on your startup stage, typical costs may include:

- Advertising and marketing

- Lawyer fees

- Licenses and permits

- Market research

- Merchandise

- Office space

- Website development

Many of these costs also fall under operating expenses, though as a startup, items like your office space lease may have additional costs to consider, like a down payment or renovation labor and materials.

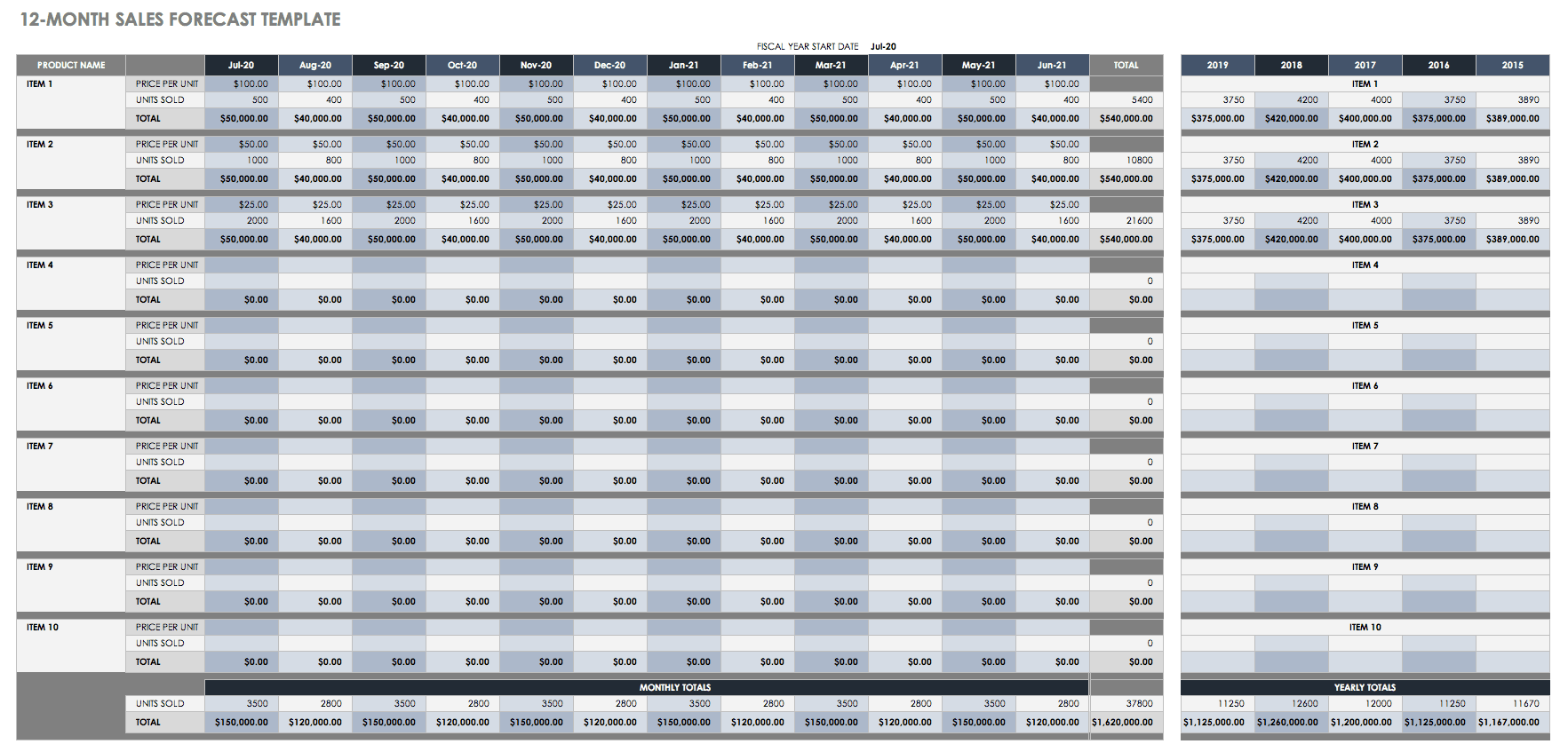

2. Sales forecasts

Sales forecasts can be created using a number of different forecasting methods designed to determine how much an individual, team, or company will sell in a given amount of time.

This data is similar to your financial projections in that it helps your organization set targets, make informed business decisions, and identify new opportunities. A sales forecast report is just much more niche, using industry knowledge and historical sales data to determine your future sales. Gather data to include:

- Customer acquisition cost (CAC)

- Cost of goods sold (COGS)

- Sales quotas and attainment

- Pipeline coverage

- Customer relationship management (CRM) score

- Average Revenue Per User (ARPU), typically used for SaaS companies

Sales forecasts should consider interdepartmental trends and data, too. In addition to your sales process and historical details, connect with other teams to apply insights from:

- Marketing strategies for the forecast period

- New product launches

- Financial considerations and targets

- Employee needs and resources from HR

Your sales strategy and forecasts are directly tied to your financial success, so an accurate sales forecast is essential to creating an effective financial projection.

3. Operating expenses

Whereas the costs of goods solds (aka Cost of Sales or COGS) account for variable costs associated with producing the products or services you produce, operating expenses are the additional costs of running your startup, including everything from payroll and office rent to sales and marketing expenses.

In addition to these fixed costs, you’ll need to anticipate one-time costs, like replacing broken machinery or holiday bonuses. If you’ve been in business for a few years, you can take a look at previous years’ expenses to see what one-time costs you ran into, or estimate a percentage of your total expenses that contributed to variable costs.

4. Cash flow statements

Cash flow statements (CFS) compare a business’s incoming cash totals, including investments and operating profit, to their expected expenses, including operational costs and debt payments.

Cash flow shows a company’s overall money management and is one of three major financial statements, next to balance sheets and income statements. It can be calculated using one of two methods:

- Direct Method : calculates actual cash flow in and out of the company

- Indirect Method : adjusts net income considering non-cash revenue and expenses