- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Is Risk Management & Why Is It Important?

- 24 Oct 2023

Businesses can’t operate without risk. Economic, technological, environmental, and competitive factors introduce obstacles that companies must not only manage but overcome.

According to PwC’s Global Risk Survey , organizations that embrace strategic risk management are five times more likely to deliver stakeholder confidence and better business outcomes and two times more likely to expect faster revenue growth.

If you want to enhance your job performance and identify and mitigate risk more effectively, here’s a breakdown of what risk management is and why it’s important.

Access your free e-book today.

What Is Risk Management?

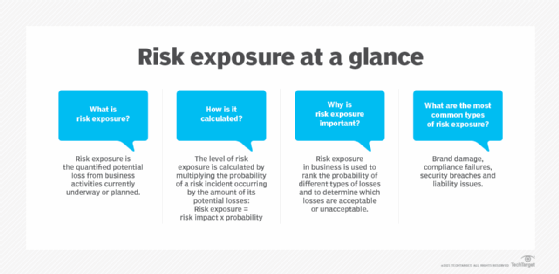

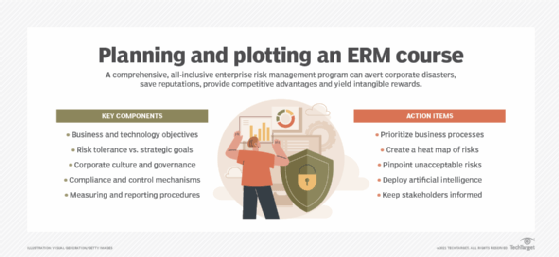

Risk management is the systematic process of identifying, assessing, and mitigating threats or uncertainties that can affect your organization. It involves analyzing risks’ likelihood and impact, developing strategies to minimize harm, and monitoring measures’ effectiveness.

“Competing successfully in any industry involves some level of risk,” says Harvard Business School Professor Robert Simons, who teaches the online course Strategy Execution . “But high-performing businesses with high-pressure cultures are especially vulnerable. As a manager, you need to know how and why these risks arise and how to avoid them.”

According to Strategy Execution , strategic risk has three main causes:

- Pressures due to growth: This is often caused by an accelerated rate of expansion that makes staffing or industry knowledge gaps more harmful to your business.

- Pressures due to culture: While entrepreneurial risk-taking can come with rewards, executive resistance and internal competition can cause problems.

- Pressures due to information management: Since information is key to effective leadership , gaps in performance measures can result in decentralized decision-making.

These pressures can lead to several types of risk that you must manage or mitigate to avoid reputational, financial, or strategic failures. However, risks aren’t always obvious.

“I think one of the challenges firms face is the ability to properly identify their risks,” says HBS Professor Eugene Soltes in Strategy Execution .

Therefore, it’s crucial to pinpoint unexpected events or conditions that could significantly impede your organization’s business strategy .

Related: Business Strategy vs. Strategy Execution: Which Course Is Right for Me?

According to Strategy Execution , strategic risk comprises:

- Operations risk: This occurs when internal operational errors interrupt your products or services’ flow. For example, shipping tainted products can negatively affect food distribution companies.

- Asset impairment risk: When your company’s assets lose a significant portion of their current value because of a decreased likelihood of receiving future cash flows . For instance, losing property assets, like a manufacturing plant, due to a natural disaster.

- Competitive risk: Changes in the competitive environment can interrupt your organization’s ability to create value and differentiate its offerings—eventually leading to a significant loss in revenue.

- Franchise risk: When your organization’s value erodes because stakeholders lose confidence in its objectives. This primarily results from failing to control any of the strategic risk sources listed above.

Understanding these risks is essential to ensuring your organization’s long-term success. Here’s a deeper dive into why risk management is important.

4 Reasons Why Risk Management Is Important

1. protects organization’s reputation.

In many cases, effective risk management proactively protects your organization from incidents that can affect its reputation.

“Franchise risk is a concern for all businesses,“ Simons says in Strategy Execution . “However, it's especially pressing for businesses whose reputations depend on the trust of key constituents.”

For example, airlines are particularly susceptible to franchise risk because of unforeseen events, such as flight delays and cancellations caused by weather or mechanical failure. While such incidents are considered operational risks, they can be incredibly damaging.

In 2016, Delta Airlines experienced a national computer outage, resulting in over 2,000 flight cancellations. Delta not only lost an estimated $150 million but took a hit to its reputation as a reliable airline that prided itself on “canceling cancellations.”

While Delta bounced back, the incident illustrates how mitigating operational errors can make or break your organization.

2. Minimizes Losses

Most businesses create risk management teams to avoid major financial losses. Yet, various risks can still impact their bottom lines.

A Vault Platform study found that dealing with workplace misconduct cost U.S. businesses over $20 billion in 2021. In addition, Soltes says in Strategy Execution that corporate fines for misconduct have risen 40-fold in the U.S. over the last 20 years.

One way to mitigate financial losses related to employee misconduct is by implementing internal controls. According to Strategy Execution , internal controls are the policies and procedures designed to ensure reliable accounting information and safeguard company assets.

“Managers use internal controls to limit the opportunities employees have to expose the business to risk,” Simons says in the course.

One company that could have benefited from implementing internal controls is Volkswagen (VW). In 2015, VW whistle-blowers revealed that the company’s engineers deliberately manipulated diesel vehicles’ emissions data to make them appear more environmentally friendly.

This led to severe consequences, including regulatory penalties, expensive vehicle recalls, and legal settlements—all of which resulted in significant financial losses. By 2018, U.S. authorities had extracted $25 billion in fines, penalties, civil damages, and restitution from the company.

Had VW maintained more rigorous internal controls to ensure transparency, compliance, and proper oversight of its engineering practices, perhaps it could have detected—or even averted—the situation.

Related: What Are Business Ethics & Why Are They Important?

3. Encourages Innovation and Growth

Risk management isn’t just about avoiding negative outcomes. It can also be the catalyst that drives your organization’s innovation and growth.

“Risks may not be pleasant to think about, but they’re inevitable if you want to push your business to innovate and remain competitive,” Simons says in Strategy Execution .

According to PwC , 83 percent of companies’ business strategies focus on growth, despite risks and mixed economic signals. In Strategy Execution , Simons notes that competitive risk is a challenge you must constantly monitor and address.

“Any firm operating in a competitive market must focus its attention on changes in the external environment that could impair its ability to create value for its customers,” Simons says.

This requires incorporating boundary systems —explicit statements that define and communicate risks to avoid—to ensure internal controls don’t extinguish innovation.

“Boundary systems are essential levers in businesses to give people freedom,” Simons says. “In such circumstances, you don’t want to stifle innovation or entrepreneurial behavior by telling people how to do their jobs. And if you want to remain competitive, you’ll need to innovate and adapt.”

Netflix is an example of how risk management can inspire innovation. In the early 2000s, the company was primarily known for its DVD-by-mail rental service. With growing competition from video rental stores, Netflix went against the grain and introduced its streaming service. This changed the market, resulting in a booming industry nearly a decade later.

Netflix’s innovation didn’t stop there. Once the steaming services market became highly competitive, the company shifted once again to gain a competitive edge. It ventured into producing original content, which ultimately helped differentiate its platform and attract additional subscribers.

By offering more freedom within internal controls, you can encourage innovation and constant growth.

4. Enhances Decision-Making

Risk management also provides a structured framework for decision-making. This can be beneficial if your business is inclined toward risks that are difficult to manage.

By pulling data from existing control systems to develop hypothetical scenarios, you can discuss and debate strategies’ efficacy before executing them.

“Interactive control systems are the formal information systems managers use to personally involve themselves in the decision activities of subordinates,” Simons says in Strategy Execution . “Decision activities that relate to and impact strategic uncertainties.”

JPMorgan Chase, one of the most prominent financial institutions in the world, is particularly susceptible to cyber risks because it compiles vast amounts of sensitive customer data . According to PwC , cybersecurity is the number one business risk on managers’ minds, with 78 percent worried about more frequent or broader cyber attacks.

Using data science techniques like machine learning algorithms enables JPMorgan Chase’s leadership not only to detect and prevent cyber attacks but address and mitigate risk.

Start Managing Your Organization's Risk

Risk management is essential to business. While some risk is inevitable, your ability to identify and mitigate it can benefit your organization.

But you can’t plan for everything. According to the Harvard Business Review , some risks are so remote that no one could have imagined them. Some result from a perfect storm of incidents, while others materialize rapidly and on enormous scales.

By taking an online strategy course , you can build the knowledge and skills to identify strategic risks and ensure they don’t undermine your business. For example, through an interactive learning experience, Strategy Execution enables you to draw insights from real-world business examples and better understand how to approach risk management.

Do you want to mitigate your organization’s risks? Explore Strategy Execution —one of our online strategy courses —and download our free strategy e-book to gain the insights to build a successful strategy.

About the Author

Home — Essay Samples — Business — Risk Management — The Importance of Risk Management

The Importance of Risk Management

- Categories: Risk Management

About this sample

Words: 549 |

Published: Sep 1, 2023

Words: 549 | Page: 1 | 3 min read

Cite this Essay

To export a reference to this article please select a referencing style below:

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Verified writer

- Expert in: Business

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

1 pages / 413 words

2 pages / 868 words

1 pages / 416 words

3 pages / 1419 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Risk Management

Khan, Mohammad, Robert Breitenecker, and Erich Schwarz. “Adding fuel to the fire.” Management Decision 53.1 (2015): 75-99. Print. Kurlick, Gary. “Stop, drop, and roll: workplace hazards of local government firefighters.” [...]

Deepwater Disaster Plan Failure Risk management failures were a core factor leading to one of the largest oil well disaster in the Gulf of Mexico, US. The Deepwater explosion, in May 2010, killed 11 men and left miles of [...]

The COSO cube helps us look at the whole organizations enterprise risk management model and focus on individual parts. Enterprise risk management (ERM) is the process of planning, organizing, leading and controlling the [...]

Risk management procedures facilitate the protection of a company’s reputation as the company’s involved often concentrate on ethical procedures when assessing and creating awareness on the potential risks in the company (Hopkin [...]

According to the USA state law, critical structures are mainly defined as any asset, system of resource that is of indispensable importance to the welfare and well-being of the country. The destruction of these critical [...]

Amongst many dilemmas that we face today, although communication is easier than ever, yet it is being increasingly difficult for us to maintain conversations face to face. Interaction is becoming increasingly digitalized, where [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Risk Management - Free Essay Examples And Topic Ideas

Risk management involves identifying, assessing, and controlling threats to an organization’s capital and earnings. These threats could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents, and natural disasters. An essay on risk management might cover strategies to mitigate risks, the impact of risk management on business performance, and the evolution of risk management practices over time. This topic might also touch on various risk assessment models, the ethical aspects of risk management, and case studies illustrating the consequences of inadequate risk management. We have collected a large number of free essay examples about Risk Management you can find in Papersowl database. You can use our samples for inspiration to write your own essay, research paper, or just to explore a new topic for yourself.

Risk Management in Nursing Practice

Bowers (2014) identifies the need for the preservation of safety as the most crucial objective for mental health nursing. However, this is a very isolative environment with seclusion being a part of this treatment and intervention. Clifton et al (2017) argues that this could lead to possible deterioration of social inclusion, independence and communication. Shared decision-making (SDM) is a frequently utilized model for the purpose of approaching sensitive decisions (Stiggelbout et al, 2015). This process is where clinicians and patients […]

Risk Management of Innovation Projects

Abstract A company’s ability to create new products and services that differentiate them from the competition is becoming a key factor to ensure a business’ longevity in this ever-growing market. Because of this, organizations have continuously tried to launch innovation projects that ultimately fail in most cases due to the higher than normal levels of risk and uncertainty associated with these types of ventures. The purpose of this paper is to review and analyze the characteristics of radical innovation projects […]

Discuss the Importance of Data Management in Research

1. Definiton of Key terms Data management is a general term which refers to a part of research process involving organising, structuring, storage and care of data generated during the research process. It is of prime importance in that it is part of good research practice and it has a bearing on the quality of analysis and research output. The University of Edinburgh (2014) defines data management as a general term covering how you organize, structure, store and care for […]

We will write an essay sample crafted to your needs.

What is Risk Management?

A risk is any unverifiable event or condition that may influence our task(project). Not all dangers are negative. A few occasions or conditions can encourage our task. At the point when this occurs, we consider it a chance; however it's as yet dealt with simply like a hazard. A proactive task group attempts to determine potential issues previously they happen. This is the craft of hazard administration. The motivation behind hazard administration is to recognize the hazard factors for a […]

Effective Risk Management

Uncertainty bounds today's economy, and every organization needs a structured process for effective risk management to sustain a competitive edge (K. J., A., V. R., and U., 2017). Numerous corporate governance regulations, like the SOX Act 2002, COSO Enterprise Risk Management Framework 2004, Companies Act 2013, and Clause 49 of SEBI, have made the existence of a risk management committee mandatory. A risk management committee, a person, or a group of persons, is required at the top management level for […]

Citizen and Government Collaboration in Addressing Natural Disasters in Japan

Natural hazards are indeed inevitable, even during this time of pandemic. A massive 7.3 magnitude earthquake has jolted the northeastern coast of Japan, leaving 150 injured people last February 13, 2021. It’s considered an aftershock of the 2011 Great East Japan Earthquake because it happened just weeks before its 10th anniversary. The 7.3 magnitude earthquake caused widespread blackouts, affecting 950,000 households, and displaced around 240 people in Miyagi and Fukushima prefectures from their homes. The Japanese Intensity Scale logged it […]

Futuram’s Risk Management Strategy

Read the following story about this agricultural biotech firm carefully, then answer the questions at the end of the case. This story, all names, characters, and incidents described are fictitious. No identification with actual persons, companies, places, or products is intended or should be inferred. Normally, when Futuram is mentioned in newspapers, it's usually for a new genetically engineered seed. Yet this agricultural biotech firm, based in California, has turned to financial engineering to ensure its profits. At its January 2017 […]

IT Risk Management Techniques

Introduction In life, only two things are true about failure. One, it is common and second, nobody likes them. Failure is something that cannot be completely avoided but it is not absolute as well. Past failures become better lessons on which such failures doesn’t occur in the future. Modifications and changes made due to failures signal positive changes in the entity and scopes for improvement. The only irony in this case is that each failure comes at a certain cost. […]

Risk Policy, Management and Communication

I would like to thank the Municipal Administration and Water Supplies Department, State Government of Tamil Nadu, India for inviting me to speak about the current scenario and to give my recommendations for making P.N.Palayam a model town with regard to Sanitation. I am Priscilla, an Environmental Scientist, representing Bill and Melinda Gates Foundation, India. I have done my master’s in environmental science in 1996 and completed my Doctoral degree in Environmental Health at Johns Hopkins Bloomberg School of Public […]

Disaster Risk Management

"Disasters can happen to anyone at any time, but research says even the best disaster-recovery plans will not work exactly as envisioned (Drew & Tysiac, 2013). Huge amounts of destruction and suffering can lead to mental health and other issues for employees. This is why organizations should focus on their people's needs. Firms in the state of Florida and other natural disaster areas are well-advised to have business interruption insurance, which is structured to compensate businesses for time-frames when they […]

Effective Teamwork: Risk Management

Risk is the presence of uncertainty of results regarding present actions ( Shastri and Shastri, 2014 ). Risk arises due to occurrence of chance events, incubating and culminating in the changing dynamics of the environment. All functional areas of an organization are affected by risk. A single event can unleash a variety of risks. Risk is omnipresent, omnipotent and omniscient. Risk management is a process effected by the entity’s board of directors, management and other personnel, applied in strategy setting […]

Hazard Management in Foreign Exchange

Back Back is a term portraying the investigation and arrangement of cash, ventures, and other money related instruments. A few people want to isolate back into three unmistakable classifications: open fund, corporate fund, and individual fund. There is additionally the as of late rising region of social back. Conduct fund tries to distinguish the intellectual (e.g. enthusiastic, social, and mental) explanations for money related choices. Outside Exchange Outside trade is the transformation of one nation's money into another. In a […]

Impact of Natural Disasters on Risk Management

Research says threats of natural disasters may continue to rise due to the increase in the average temperature of the water in oceans (Tennyson & Diala, 2016). Weather events will be intense and frequent due to global warming. This will result in rising sea levels and other environmental changes. According to Tennyson and Diala, disaster preparedness is the total of all measures that have been taken and the policies that have been adopted to address a disaster before it occurs […]

Risk Management in Online Transactions

Abstract There has been a significant increase in the number of online transactions on various platforms. Online transactions are boosting the global economy by offering convenience and speed of the money transactions between merchants and customers. For online transactions to be successful, there is a need to have a reliable network that is enhanced by a security system to safeguard the information of the transactions. The networks used to secure online transactions are not entirely effective hence there is need […]

Risk Management in a Banking System

A risk is an essential part of our daily lives. Despite the complexity of this concept, we often and easily operate it in practice, describing a particular life situation. For us, a risk is primarily a possible profit or loss of something. Commercial activities, as well as any other activities related to the formulation and achievement of certain goals, include: situation analysis; strategy formulation; resource planning; organization of a process; measurement and evaluation of results; operational corrective strategic and tactical actions […]

Risk Management – Essential and Complete Corporate Governance System

Risk management is a known element of an essential and complete corporate governance system. It is defined as a mix of activities that effectively reduce the negative impact of risk exposure on the company's projected profits, cash flow, and consequently, the value of the organization. Effective risk management is regarded as an important factor that determines the survival and success of an organization. While risk management is not a new concept, it has recently garnered attention and become moreassertive in […]

Identifying and Managing Business Risks

Introduction A risk is a probability that something with an undesirable effect will occur. Risk management involves steps and policies taken by a company to eliminate these risks or reduce the possibility of their occurrence. A risk management plan is prepared to predict the risks, estimate their impact and severity, and suggest possible responses. Health Network allows clients to access the kind of healthcare services they require over the internet at the right locations. It faces several risks that can […]

The Effects Automation Technology has on Risk Management

Automation technology is the system of controlling a process by highly automatic means, resulting in reduced human intervention. This technology was created to relieve operators from continuous input. Automation benefits users by increasing safety, profitability, and productivity. By the use of machinery products are more predictable, consistent, and the cycle time of production is shorter than it would be if done by man. Though the idea of automatic technology seems fool proof there are disadvantages to it as well. Since […]

Risk Management Techniques for Satellite Programs

Successfully placing a satellite into space requires many elements of a very complicated process coming together, to allow for an on-schedule launch, and nominal operations of the system once on-orbit. Modern day government organizations and private sector companies have become adept at this process, as space launches occur with regularity all over the world. Despite the high success rates seen in the launch and operation of modern satellite systems, risk still pervades these programs, from writing requirements to the ready-for-launch' […]

Enterprise Risk Management Project

Coca-Cola Bottling Company Consolidated was formed 116 years ago in Greensboro North Carolina. Here they started to begin to produce and deliver an ironic brand there. It was all started by J.B. Harrison where he started selling the bottles. In 1955 they started to make 10,12, and 26 ounce family size and king sized bottles. In 1982 they first introduced the idea of Diet Coke. Also, in 2002 they celebrated their 100 year of business. Currently, the company's corporate offices […]

Assessment Credit Risk Management

Credit risk management practices is an issue of concern in financial institutions today and there is needto develop improved processes and systems to deliver better visibility into future performance. There have been controversies among researchers on the effect of credit management techniques adopted by various institutions. According to Saunders and Allen (2002), good selection strategy for risk monitoring is adopted by the credit unions implies good pricing of the products in line with the estimated risk which greatly affect their […]

Issue, Risk and Reputation Management

The proactive behavior, commonly associated with the initiative, creativity, and innovation, is required in today's organizations. It can be a positive differential in times of market turmoil and uncertainty. According to Coombs, the best way to prevent a crisis in an organization is to have a proactive management. Proactive behavior is an element of change and it impacts the company's performance. A proactive management seeks deliberately for changes and improvements, it anticipates the problems and chooses its own course to […]

Risk Management: Role in Security and Establishes the Importance of Assets Within a Company

According to the Principles of Information Security, "risk management is the process of identifying risk, assessing its relative magnitude, and taking steps to reduce it to an acceptable level." Risk management plays an important role in security and establishes the importance of assets within a company. Financial and economic decisions made by a company are heavily influenced by the way risk management is handled. There are many important aspects to risk management, such as: risk identification, risk assessment, and risk […]

Risk Management Section of your Company’s

Read the Risk Management section of your company's 10-K. Do not print the 10-K. In your own words, summarize the risk management strategy. Tie this into the Risk Factors that you wrote in Project 1. Netflix's risk management strategy includes the following: Retaining and expanding its customer base: Subscription fees are the major revenue source for Netflix. Its ability to produce and acquire quality content depends directly on retaining its current customers and attracting new ones. If Netflix cannot satisfy […]

Essay about Risk Management Techniques for Satellite Programs

Either way, this helps to burn down the consequence of only have a sole dedicated relay through redundancy. Another aspect a program manager should consider when assessing risk with ground relays points to the operations crews that run them. An example of a human error causing a space disaster is showcased in the 2009 collision of an Iridium Communications satellite and a defunct Russian communications satellite. With the Russian satellite out of commission, it rested on the Iridium satellite to maneuver […]

Risk Management and Insurance

As people, we are faced with the possibility of loss in our everyday lives. Be it a car accident, illness, Property loss, or even death. As early as the millennia B.C, modern profit insurance was demonstrated in a contract of a loan of trading capital to traveling merchants. The first insurance company formed in the United States was in Charleston, South Carolina during 1732. Later in 1752, Benjamin Franklin helped spread insurance by creating the Philadelphia Contributionship which ensured that […]

Facilities Management

Introduction In any big gathering, crowd control is essential. Sports facilities are protected through crowd control since, where there are many people gathered together there is a high chance for a danger to take place. Secondly, the crowd needs to be managed because when people are in a crowd they always take for granted that other people have the responsibility (Ammon & Unruh 2010). Thirdly, big gathering makes people assimilate changes at a lower phase since they make the process […]

Health Data Breach Response Plan: a Managed Care Organization’s Comprehensive Plan

Response plan on health data breach Introduction Security imperatives of preventing, responding to, and detecting breaches will finally end with good reason and appropriate rejoinder criteria implemented. Breaches in various companies have become inevitable despite efforts put in place to prevent their continuous occurrence. Once there is an unauthorized disclosure, compromise of protected data, or hacking of information that is protected, an organization is obliged to respond. Putting an effective response plan in place is not a small feat. Organization's […]

Network Infrastructure: Analyzing NT1310 Unit 6 Assignment

Introduction The study of network infrastructure is super important for getting how modern digital communication works. NT1310 Unit 6 Assignment dives into the nitty-gritty of network design, setup, and management, giving students a complete look at what makes connectivity tick. This essay wants to break down the main parts of the assignment, including its goals, methods, and what it means for network pros. We'll look at both the theory and the practical side of network infrastructure, making sure the analysis […]

The Confluence of AAA4 Insurance and Virtual Reality Innovation

In today's fast-paced world, insurance remains a bedrock of financial security, shielding individuals from the uncertainties that life often throws our way. Among the plethora of insurance products, AAA4 insurance is notable for its specialized coverage options tailored to unique needs. When we merge the concept of AAA4 insurance with the burgeoning field of virtual reality (VR), an intriguing narrative unfolds, highlighting the transformative potential and unforeseen synergies between these two domains. AAA4 insurance is characterized by its bespoke coverage, […]

Additional Example Essays

- Reasons Why I Want to Study Abroad

- "Mother to Son" by Langston Hughes

- The Cask of Amontillado Literary Analysis

- A Class Divided

- “Allegory of the Cave”

- Cinderella Marxism

- Rhetorical Analysis of Steve Jobs’ Commencement Address

- The Girl (Jig) Character Analysis in Hills Like White Elephants

- Dental Hygiene Application Essay

- Their Eyes Were Watching God Literary Analysis

- Things Fall Apart: Character Analysis Okonkwo

- Symbolism in Nathaniel Hawthrone’s “Young Goodman Brown”

1. Tell Us Your Requirements

2. Pick your perfect writer

3. Get Your Paper and Pay

Hi! I'm Amy, your personal assistant!

Don't know where to start? Give me your paper requirements and I connect you to an academic expert.

short deadlines

100% Plagiarism-Free

Certified writers

Enterprise Risk Management: A Literature Review and Agenda for Future Research

- November 2020

- Journal of Risk and Financial Management 13(11):281

- Universitatea Alexandru Ioan Cuza

Abstract and Figures

Discover the world's research

- 25+ million members

- 160+ million publication pages

- 2.3+ billion citations

- Siti Aminah Ahmad

- Poh-Chuin Teo

- Nataliya Skopenko

- Iryna Fedulova

- Tetiana Mostenska

- Larysa Kapinus

- Abhulimen Adedeji Adeniran

- Obiki-Osafiele

- Wasim ULLAH

- Ahmad Shauqi Mohamad Zubir

- Akmalia M. Ariff

- Soha Mamdouuh Elkhouly

- Elsayeda Said Elwakeil

- Basma Abdelmogy Ismail

- Manag Finance

- Sorabh Lakhanpal

- Rishabh Jain

- Maxwell Nana Ameyaw

- Courage Idemudia

- Toluwalase Vanessa Iyelolu

- Pablo Durán Santomil

- Aracely Tamayo Herrera

- ANN OPER RES

- Thomas R. Berry-Stölzle

- Weerawan Siripong

- On-anong Sattayarak

- Sutira Limroscharoen

- J Model Manag

- Fazeeda Mohamad

- Ilies Bensaada

- J Risk Finance

- Recruit researchers

- Join for free

- Login Email Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google Welcome back! Please log in. Email · Hint Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google No account? Sign up

- Search Menu

Sign in through your institution

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Anglo-Saxon and Medieval Archaeology

- Archaeological Methodology and Techniques

- Archaeology by Region

- Archaeology of Religion

- Archaeology of Trade and Exchange

- Biblical Archaeology

- Contemporary and Public Archaeology

- Environmental Archaeology

- Historical Archaeology

- History and Theory of Archaeology

- Industrial Archaeology

- Landscape Archaeology

- Mortuary Archaeology

- Prehistoric Archaeology

- Underwater Archaeology

- Urban Archaeology

- Zooarchaeology

- Browse content in Architecture

- Architectural Structure and Design

- History of Architecture

- Residential and Domestic Buildings

- Theory of Architecture

- Browse content in Art

- Art Subjects and Themes

- History of Art

- Industrial and Commercial Art

- Theory of Art

- Biographical Studies

- Byzantine Studies

- Browse content in Classical Studies

- Classical History

- Classical Philosophy

- Classical Mythology

- Classical Numismatics

- Classical Literature

- Classical Reception

- Classical Art and Architecture

- Classical Oratory and Rhetoric

- Greek and Roman Papyrology

- Greek and Roman Epigraphy

- Greek and Roman Law

- Greek and Roman Archaeology

- Late Antiquity

- Religion in the Ancient World

- Social History

- Digital Humanities

- Browse content in History

- Colonialism and Imperialism

- Diplomatic History

- Environmental History

- Genealogy, Heraldry, Names, and Honours

- Genocide and Ethnic Cleansing

- Historical Geography

- History by Period

- History of Emotions

- History of Agriculture

- History of Education

- History of Gender and Sexuality

- Industrial History

- Intellectual History

- International History

- Labour History

- Legal and Constitutional History

- Local and Family History

- Maritime History

- Military History

- National Liberation and Post-Colonialism

- Oral History

- Political History

- Public History

- Regional and National History

- Revolutions and Rebellions

- Slavery and Abolition of Slavery

- Social and Cultural History

- Theory, Methods, and Historiography

- Urban History

- World History

- Browse content in Language Teaching and Learning

- Language Learning (Specific Skills)

- Language Teaching Theory and Methods

- Browse content in Linguistics

- Applied Linguistics

- Cognitive Linguistics

- Computational Linguistics

- Forensic Linguistics

- Grammar, Syntax and Morphology

- Historical and Diachronic Linguistics

- History of English

- Language Evolution

- Language Reference

- Language Acquisition

- Language Variation

- Language Families

- Lexicography

- Linguistic Anthropology

- Linguistic Theories

- Linguistic Typology

- Phonetics and Phonology

- Psycholinguistics

- Sociolinguistics

- Translation and Interpretation

- Writing Systems

- Browse content in Literature

- Bibliography

- Children's Literature Studies

- Literary Studies (Romanticism)

- Literary Studies (American)

- Literary Studies (Asian)

- Literary Studies (European)

- Literary Studies (Eco-criticism)

- Literary Studies (Modernism)

- Literary Studies - World

- Literary Studies (1500 to 1800)

- Literary Studies (19th Century)

- Literary Studies (20th Century onwards)

- Literary Studies (African American Literature)

- Literary Studies (British and Irish)

- Literary Studies (Early and Medieval)

- Literary Studies (Fiction, Novelists, and Prose Writers)

- Literary Studies (Gender Studies)

- Literary Studies (Graphic Novels)

- Literary Studies (History of the Book)

- Literary Studies (Plays and Playwrights)

- Literary Studies (Poetry and Poets)

- Literary Studies (Postcolonial Literature)

- Literary Studies (Queer Studies)

- Literary Studies (Science Fiction)

- Literary Studies (Travel Literature)

- Literary Studies (War Literature)

- Literary Studies (Women's Writing)

- Literary Theory and Cultural Studies

- Mythology and Folklore

- Shakespeare Studies and Criticism

- Browse content in Media Studies

- Browse content in Music

- Applied Music

- Dance and Music

- Ethics in Music

- Ethnomusicology

- Gender and Sexuality in Music

- Medicine and Music

- Music Cultures

- Music and Media

- Music and Religion

- Music and Culture

- Music Education and Pedagogy

- Music Theory and Analysis

- Musical Scores, Lyrics, and Libretti

- Musical Structures, Styles, and Techniques

- Musicology and Music History

- Performance Practice and Studies

- Race and Ethnicity in Music

- Sound Studies

- Browse content in Performing Arts

- Browse content in Philosophy

- Aesthetics and Philosophy of Art

- Epistemology

- Feminist Philosophy

- History of Western Philosophy

- Meta-Philosophy

- Metaphysics

- Moral Philosophy

- Non-Western Philosophy

- Philosophy of Language

- Philosophy of Mind

- Philosophy of Perception

- Philosophy of Science

- Philosophy of Action

- Philosophy of Law

- Philosophy of Religion

- Philosophy of Mathematics and Logic

- Practical Ethics

- Social and Political Philosophy

- Browse content in Religion

- Biblical Studies

- Christianity

- East Asian Religions

- History of Religion

- Judaism and Jewish Studies

- Qumran Studies

- Religion and Education

- Religion and Health

- Religion and Politics

- Religion and Science

- Religion and Law

- Religion and Art, Literature, and Music

- Religious Studies

- Browse content in Society and Culture

- Cookery, Food, and Drink

- Cultural Studies

- Customs and Traditions

- Ethical Issues and Debates

- Hobbies, Games, Arts and Crafts

- Natural world, Country Life, and Pets

- Popular Beliefs and Controversial Knowledge

- Sports and Outdoor Recreation

- Technology and Society

- Travel and Holiday

- Visual Culture

- Browse content in Law

- Arbitration

- Browse content in Company and Commercial Law

- Commercial Law

- Company Law

- Browse content in Comparative Law

- Systems of Law

- Competition Law

- Browse content in Constitutional and Administrative Law

- Government Powers

- Judicial Review

- Local Government Law

- Military and Defence Law

- Parliamentary and Legislative Practice

- Construction Law

- Contract Law

- Browse content in Criminal Law

- Criminal Procedure

- Criminal Evidence Law

- Sentencing and Punishment

- Employment and Labour Law

- Environment and Energy Law

- Browse content in Financial Law

- Banking Law

- Insolvency Law

- History of Law

- Human Rights and Immigration

- Intellectual Property Law

- Browse content in International Law

- Private International Law and Conflict of Laws

- Public International Law

- IT and Communications Law

- Jurisprudence and Philosophy of Law

- Law and Politics

- Law and Society

- Browse content in Legal System and Practice

- Courts and Procedure

- Legal Skills and Practice

- Legal System - Costs and Funding

- Primary Sources of Law

- Regulation of Legal Profession

- Medical and Healthcare Law

- Browse content in Policing

- Criminal Investigation and Detection

- Police and Security Services

- Police Procedure and Law

- Police Regional Planning

- Browse content in Property Law

- Personal Property Law

- Restitution

- Study and Revision

- Terrorism and National Security Law

- Browse content in Trusts Law

- Wills and Probate or Succession

- Browse content in Medicine and Health

- Browse content in Allied Health Professions

- Arts Therapies

- Clinical Science

- Dietetics and Nutrition

- Occupational Therapy

- Operating Department Practice

- Physiotherapy

- Radiography

- Speech and Language Therapy

- Browse content in Anaesthetics

- General Anaesthesia

- Clinical Neuroscience

- Browse content in Clinical Medicine

- Acute Medicine

- Cardiovascular Medicine

- Clinical Genetics

- Clinical Pharmacology and Therapeutics

- Dermatology

- Endocrinology and Diabetes

- Gastroenterology

- Genito-urinary Medicine

- Geriatric Medicine

- Infectious Diseases

- Medical Toxicology

- Medical Oncology

- Pain Medicine

- Palliative Medicine

- Rehabilitation Medicine

- Respiratory Medicine and Pulmonology

- Rheumatology

- Sleep Medicine

- Sports and Exercise Medicine

- Community Medical Services

- Critical Care

- Emergency Medicine

- Forensic Medicine

- Haematology

- History of Medicine

- Browse content in Medical Skills

- Clinical Skills

- Communication Skills

- Nursing Skills

- Surgical Skills

- Browse content in Medical Dentistry

- Oral and Maxillofacial Surgery

- Paediatric Dentistry

- Restorative Dentistry and Orthodontics

- Surgical Dentistry

- Medical Ethics

- Medical Statistics and Methodology

- Browse content in Neurology

- Clinical Neurophysiology

- Neuropathology

- Nursing Studies

- Browse content in Obstetrics and Gynaecology

- Gynaecology

- Occupational Medicine

- Ophthalmology

- Otolaryngology (ENT)

- Browse content in Paediatrics

- Neonatology

- Browse content in Pathology

- Chemical Pathology

- Clinical Cytogenetics and Molecular Genetics

- Histopathology

- Medical Microbiology and Virology

- Patient Education and Information

- Browse content in Pharmacology

- Psychopharmacology

- Browse content in Popular Health

- Caring for Others

- Complementary and Alternative Medicine

- Self-help and Personal Development

- Browse content in Preclinical Medicine

- Cell Biology

- Molecular Biology and Genetics

- Reproduction, Growth and Development

- Primary Care

- Professional Development in Medicine

- Browse content in Psychiatry

- Addiction Medicine

- Child and Adolescent Psychiatry

- Forensic Psychiatry

- Learning Disabilities

- Old Age Psychiatry

- Psychotherapy

- Browse content in Public Health and Epidemiology

- Epidemiology

- Public Health

- Browse content in Radiology

- Clinical Radiology

- Interventional Radiology

- Nuclear Medicine

- Radiation Oncology

- Reproductive Medicine

- Browse content in Surgery

- Cardiothoracic Surgery

- Gastro-intestinal and Colorectal Surgery

- General Surgery

- Neurosurgery

- Paediatric Surgery

- Peri-operative Care

- Plastic and Reconstructive Surgery

- Surgical Oncology

- Transplant Surgery

- Trauma and Orthopaedic Surgery

- Vascular Surgery

- Browse content in Science and Mathematics

- Browse content in Biological Sciences

- Aquatic Biology

- Biochemistry

- Bioinformatics and Computational Biology

- Developmental Biology

- Ecology and Conservation

- Evolutionary Biology

- Genetics and Genomics

- Microbiology

- Molecular and Cell Biology

- Natural History

- Plant Sciences and Forestry

- Research Methods in Life Sciences

- Structural Biology

- Systems Biology

- Zoology and Animal Sciences

- Browse content in Chemistry

- Analytical Chemistry

- Computational Chemistry

- Crystallography

- Environmental Chemistry

- Industrial Chemistry

- Inorganic Chemistry

- Materials Chemistry

- Medicinal Chemistry

- Mineralogy and Gems

- Organic Chemistry

- Physical Chemistry

- Polymer Chemistry

- Study and Communication Skills in Chemistry

- Theoretical Chemistry

- Browse content in Computer Science

- Artificial Intelligence

- Computer Architecture and Logic Design

- Game Studies

- Human-Computer Interaction

- Mathematical Theory of Computation

- Programming Languages

- Software Engineering

- Systems Analysis and Design

- Virtual Reality

- Browse content in Computing

- Business Applications

- Computer Security

- Computer Games

- Computer Networking and Communications

- Digital Lifestyle

- Graphical and Digital Media Applications

- Operating Systems

- Browse content in Earth Sciences and Geography

- Atmospheric Sciences

- Environmental Geography

- Geology and the Lithosphere

- Maps and Map-making

- Meteorology and Climatology

- Oceanography and Hydrology

- Palaeontology

- Physical Geography and Topography

- Regional Geography

- Soil Science

- Urban Geography

- Browse content in Engineering and Technology

- Agriculture and Farming

- Biological Engineering

- Civil Engineering, Surveying, and Building

- Electronics and Communications Engineering

- Energy Technology

- Engineering (General)

- Environmental Science, Engineering, and Technology

- History of Engineering and Technology

- Mechanical Engineering and Materials

- Technology of Industrial Chemistry

- Transport Technology and Trades

- Browse content in Environmental Science

- Applied Ecology (Environmental Science)

- Conservation of the Environment (Environmental Science)

- Environmental Sustainability

- Environmentalist Thought and Ideology (Environmental Science)

- Management of Land and Natural Resources (Environmental Science)

- Natural Disasters (Environmental Science)

- Nuclear Issues (Environmental Science)

- Pollution and Threats to the Environment (Environmental Science)

- Social Impact of Environmental Issues (Environmental Science)

- History of Science and Technology

- Browse content in Materials Science

- Ceramics and Glasses

- Composite Materials

- Metals, Alloying, and Corrosion

- Nanotechnology

- Browse content in Mathematics

- Applied Mathematics

- Biomathematics and Statistics

- History of Mathematics

- Mathematical Education

- Mathematical Finance

- Mathematical Analysis

- Numerical and Computational Mathematics

- Probability and Statistics

- Pure Mathematics

- Browse content in Neuroscience

- Cognition and Behavioural Neuroscience

- Development of the Nervous System

- Disorders of the Nervous System

- History of Neuroscience

- Invertebrate Neurobiology

- Molecular and Cellular Systems

- Neuroendocrinology and Autonomic Nervous System

- Neuroscientific Techniques

- Sensory and Motor Systems

- Browse content in Physics

- Astronomy and Astrophysics

- Atomic, Molecular, and Optical Physics

- Biological and Medical Physics

- Classical Mechanics

- Computational Physics

- Condensed Matter Physics

- Electromagnetism, Optics, and Acoustics

- History of Physics

- Mathematical and Statistical Physics

- Measurement Science

- Nuclear Physics

- Particles and Fields

- Plasma Physics

- Quantum Physics

- Relativity and Gravitation

- Semiconductor and Mesoscopic Physics

- Browse content in Psychology

- Affective Sciences

- Clinical Psychology

- Cognitive Psychology

- Cognitive Neuroscience

- Criminal and Forensic Psychology

- Developmental Psychology

- Educational Psychology

- Evolutionary Psychology

- Health Psychology

- History and Systems in Psychology

- Music Psychology

- Neuropsychology

- Organizational Psychology

- Psychological Assessment and Testing

- Psychology of Human-Technology Interaction

- Psychology Professional Development and Training

- Research Methods in Psychology

- Social Psychology

- Browse content in Social Sciences

- Browse content in Anthropology

- Anthropology of Religion

- Human Evolution

- Medical Anthropology

- Physical Anthropology

- Regional Anthropology

- Social and Cultural Anthropology

- Theory and Practice of Anthropology

- Browse content in Business and Management

- Business Ethics

- Business Strategy

- Business History

- Business and Technology

- Business and Government

- Business and the Environment

- Comparative Management

- Corporate Governance

- Corporate Social Responsibility

- Entrepreneurship

- Health Management

- Human Resource Management

- Industrial and Employment Relations

- Industry Studies

- Information and Communication Technologies

- International Business

- Knowledge Management

- Management and Management Techniques

- Operations Management

- Organizational Theory and Behaviour

- Pensions and Pension Management

- Public and Nonprofit Management

- Social Issues in Business and Management

- Strategic Management

- Supply Chain Management

- Browse content in Criminology and Criminal Justice

- Criminal Justice

- Criminology

- Forms of Crime

- International and Comparative Criminology

- Youth Violence and Juvenile Justice

- Development Studies

- Browse content in Economics

- Agricultural, Environmental, and Natural Resource Economics

- Asian Economics

- Behavioural Finance

- Behavioural Economics and Neuroeconomics

- Econometrics and Mathematical Economics

- Economic History

- Economic Systems

- Economic Methodology

- Economic Development and Growth

- Financial Markets

- Financial Institutions and Services

- General Economics and Teaching

- Health, Education, and Welfare

- History of Economic Thought

- International Economics

- Labour and Demographic Economics

- Law and Economics

- Macroeconomics and Monetary Economics

- Microeconomics

- Public Economics

- Urban, Rural, and Regional Economics

- Welfare Economics

- Browse content in Education

- Adult Education and Continuous Learning

- Care and Counselling of Students

- Early Childhood and Elementary Education

- Educational Equipment and Technology

- Educational Strategies and Policy

- Higher and Further Education

- Organization and Management of Education

- Philosophy and Theory of Education

- Schools Studies

- Secondary Education

- Teaching of a Specific Subject

- Teaching of Specific Groups and Special Educational Needs

- Teaching Skills and Techniques

- Browse content in Environment

- Applied Ecology (Social Science)

- Climate Change

- Conservation of the Environment (Social Science)

- Environmentalist Thought and Ideology (Social Science)

- Management of Land and Natural Resources (Social Science)

- Natural Disasters (Environment)

- Pollution and Threats to the Environment (Social Science)

- Social Impact of Environmental Issues (Social Science)

- Sustainability

- Browse content in Human Geography

- Cultural Geography

- Economic Geography

- Political Geography

- Browse content in Interdisciplinary Studies

- Communication Studies

- Museums, Libraries, and Information Sciences

- Browse content in Politics

- African Politics

- Asian Politics

- Chinese Politics

- Comparative Politics

- Conflict Politics

- Elections and Electoral Studies

- Environmental Politics

- Ethnic Politics

- European Union

- Foreign Policy

- Gender and Politics

- Human Rights and Politics

- Indian Politics

- International Relations

- International Organization (Politics)

- Irish Politics

- Latin American Politics

- Middle Eastern Politics

- Political Behaviour

- Political Economy

- Political Institutions

- Political Methodology

- Political Communication

- Political Philosophy

- Political Sociology

- Political Theory

- Politics and Law

- Politics of Development

- Public Policy

- Public Administration

- Qualitative Political Methodology

- Quantitative Political Methodology

- Regional Political Studies

- Russian Politics

- Security Studies

- State and Local Government

- UK Politics

- US Politics

- Browse content in Regional and Area Studies

- African Studies

- Asian Studies

- East Asian Studies

- Japanese Studies

- Latin American Studies

- Middle Eastern Studies

- Native American Studies

- Scottish Studies

- Browse content in Research and Information

- Research Methods

- Browse content in Social Work

- Addictions and Substance Misuse

- Adoption and Fostering

- Care of the Elderly

- Child and Adolescent Social Work

- Couple and Family Social Work

- Direct Practice and Clinical Social Work

- Emergency Services

- Human Behaviour and the Social Environment

- International and Global Issues in Social Work

- Mental and Behavioural Health

- Social Justice and Human Rights

- Social Policy and Advocacy

- Social Work and Crime and Justice

- Social Work Macro Practice

- Social Work Practice Settings

- Social Work Research and Evidence-based Practice

- Welfare and Benefit Systems

- Browse content in Sociology

- Childhood Studies

- Community Development

- Comparative and Historical Sociology

- Disability Studies

- Economic Sociology

- Gender and Sexuality

- Gerontology and Ageing

- Health, Illness, and Medicine

- Marriage and the Family

- Migration Studies

- Occupations, Professions, and Work

- Organizations

- Population and Demography

- Race and Ethnicity

- Social Theory

- Social Movements and Social Change

- Social Research and Statistics

- Social Stratification, Inequality, and Mobility

- Sociology of Religion

- Sociology of Education

- Sport and Leisure

- Urban and Rural Studies

- Browse content in Warfare and Defence

- Defence Strategy, Planning, and Research

- Land Forces and Warfare

- Military Administration

- Military Life and Institutions

- Naval Forces and Warfare

- Other Warfare and Defence Issues

- Peace Studies and Conflict Resolution

- Weapons and Equipment

Riskwork: Essays on the Organizational Life of Risk Management

Professor of Accounting

- Cite Icon Cite

- Permissions Icon Permissions

This collection of essays deals with the situated management of risk in a wide variety of organizational settings—aviation, mental health, railway project management, energy, toy manufacture, financial services, chemicals regulation, and NGOs. Each chapter connects the analysis of risk studies with critical themes in organization studies more generally based on access to, and observations of, actors in the field. The emphasis in these contributions is upon the variety of ways in which organizational actors, in combination with a range of material technologies and artefacts, such as safety reporting systems, risk maps, and key risk indicators, accomplish and make sense of the normal work of managing risk— riskwork . In contrast to a preoccupation with disasters and accidents after the event, the volume as a whole is focused on the situationally specific character of routine risk management work. It emerges that this riskwor k is highly varied, entangled with material artefacts which represent and construct risks and, importantly, is not confined to formal risk management departments or personnel. Each chapter suggests that the distributed nature of this riskwork lives uneasily with formalized risk management protocols and accountability requirements. In addition, riskwork as an organizational process makes contested issues of identity and values readily visible. These ‘back stage/back office’ encounters with risk are revealed as being as much about emotional as they are rationally calculative. Overall, the collection combines constructivist sensibilities about risk objects with a micro-sociological orientation to the study of organizations.

Personal account

- Sign in with email/username & password

- Get email alerts

- Save searches

- Purchase content

- Activate your purchase/trial code

- Add your ORCID iD

Institutional access

Sign in with a library card.

- Sign in with username/password

- Recommend to your librarian

- Institutional account management

- Get help with access

Access to content on Oxford Academic is often provided through institutional subscriptions and purchases. If you are a member of an institution with an active account, you may be able to access content in one of the following ways:

IP based access

Typically, access is provided across an institutional network to a range of IP addresses. This authentication occurs automatically, and it is not possible to sign out of an IP authenticated account.

Choose this option to get remote access when outside your institution. Shibboleth/Open Athens technology is used to provide single sign-on between your institution’s website and Oxford Academic.

- Click Sign in through your institution.

- Select your institution from the list provided, which will take you to your institution's website to sign in.

- When on the institution site, please use the credentials provided by your institution. Do not use an Oxford Academic personal account.

- Following successful sign in, you will be returned to Oxford Academic.

If your institution is not listed or you cannot sign in to your institution’s website, please contact your librarian or administrator.

Enter your library card number to sign in. If you cannot sign in, please contact your librarian.

Society Members

Society member access to a journal is achieved in one of the following ways:

Sign in through society site

Many societies offer single sign-on between the society website and Oxford Academic. If you see ‘Sign in through society site’ in the sign in pane within a journal:

- Click Sign in through society site.

- When on the society site, please use the credentials provided by that society. Do not use an Oxford Academic personal account.

If you do not have a society account or have forgotten your username or password, please contact your society.

Sign in using a personal account

Some societies use Oxford Academic personal accounts to provide access to their members. See below.

A personal account can be used to get email alerts, save searches, purchase content, and activate subscriptions.

Some societies use Oxford Academic personal accounts to provide access to their members.

Viewing your signed in accounts

Click the account icon in the top right to:

- View your signed in personal account and access account management features.

- View the institutional accounts that are providing access.

Signed in but can't access content

Oxford Academic is home to a wide variety of products. The institutional subscription may not cover the content that you are trying to access. If you believe you should have access to that content, please contact your librarian.

For librarians and administrators, your personal account also provides access to institutional account management. Here you will find options to view and activate subscriptions, manage institutional settings and access options, access usage statistics, and more.

Our books are available by subscription or purchase to libraries and institutions.

| Month: | Total Views: |

|---|---|

| October 2022 | 15 |

| October 2022 | 2 |

| October 2022 | 5 |

| October 2022 | 2 |

| October 2022 | 1 |

| October 2022 | 3 |

| October 2022 | 1 |

| October 2022 | 2 |

| October 2022 | 4 |

| October 2022 | 104 |

| October 2022 | 3 |

| October 2022 | 2 |

| October 2022 | 1 |

| October 2022 | 1 |

| October 2022 | 1 |

| October 2022 | 1 |

| November 2022 | 4 |

| November 2022 | 2 |

| November 2022 | 4 |

| November 2022 | 12 |

| November 2022 | 1 |

| November 2022 | 1 |

| November 2022 | 2 |

| November 2022 | 50 |

| November 2022 | 2 |

| November 2022 | 4 |

| November 2022 | 1 |

| November 2022 | 9 |

| November 2022 | 1 |

| November 2022 | 1 |

| December 2022 | 3 |

| December 2022 | 9 |

| December 2022 | 2 |

| December 2022 | 8 |

| December 2022 | 104 |

| December 2022 | 2 |

| December 2022 | 3 |

| December 2022 | 4 |

| December 2022 | 1 |

| December 2022 | 5 |

| December 2022 | 2 |

| December 2022 | 5 |

| January 2023 | 2 |

| January 2023 | 2 |

| January 2023 | 2 |

| January 2023 | 9 |

| January 2023 | 3 |

| January 2023 | 2 |

| January 2023 | 2 |

| January 2023 | 2 |

| January 2023 | 9 |

| January 2023 | 3 |

| January 2023 | 2 |

| January 2023 | 2 |

| January 2023 | 2 |

| January 2023 | 2 |

| January 2023 | 2 |

| January 2023 | 2 |

| January 2023 | 131 |

| January 2023 | 2 |

| January 2023 | 3 |

| February 2023 | 1 |

| February 2023 | 7 |

| February 2023 | 2 |

| February 2023 | 12 |

| February 2023 | 3 |

| February 2023 | 13 |

| February 2023 | 12 |

| February 2023 | 4 |

| February 2023 | 230 |

| February 2023 | 2 |

| February 2023 | 2 |

| February 2023 | 23 |

| February 2023 | 5 |

| February 2023 | 2 |

| February 2023 | 7 |

| March 2023 | 14 |

| March 2023 | 28 |

| March 2023 | 4 |

| March 2023 | 1 |

| March 2023 | 104 |

| March 2023 | 1 |

| March 2023 | 3 |

| March 2023 | 2 |

| March 2023 | 7 |

| March 2023 | 8 |

| March 2023 | 4 |

| March 2023 | 3 |

| March 2023 | 2 |

| April 2023 | 5 |

| April 2023 | 37 |

| April 2023 | 41 |

| April 2023 | 6 |

| April 2023 | 29 |

| April 2023 | 3 |

| April 2023 | 1 |

| April 2023 | 3 |

| April 2023 | 23 |

| April 2023 | 4 |

| April 2023 | 2 |

| April 2023 | 25 |

| April 2023 | 1 |

| April 2023 | 18 |

| May 2023 | 2 |

| May 2023 | 39 |

| May 2023 | 2 |

| May 2023 | 28 |

| May 2023 | 6 |

| May 2023 | 3 |

| May 2023 | 29 |

| May 2023 | 1 |

| May 2023 | 21 |

| May 2023 | 18 |

| May 2023 | 11 |

| May 2023 | 25 |

| May 2023 | 4 |

| June 2023 | 7 |

| June 2023 | 4 |

| June 2023 | 2 |

| June 2023 | 12 |

| June 2023 | 4 |

| June 2023 | 2 |

| June 2023 | 6 |

| June 2023 | 2 |

| June 2023 | 6 |

| July 2023 | 2 |

| July 2023 | 3 |

| July 2023 | 7 |

| July 2023 | 1 |

| July 2023 | 5 |

| July 2023 | 2 |

| July 2023 | 1 |

| July 2023 | 1 |

| July 2023 | 1 |

| July 2023 | 1 |

| August 2023 | 2 |

| August 2023 | 4 |

| August 2023 | 2 |

| August 2023 | 6 |

| August 2023 | 1 |

| August 2023 | 2 |

| August 2023 | 1 |

| August 2023 | 2 |

| August 2023 | 2 |

| August 2023 | 4 |

| August 2023 | 2 |

| September 2023 | 5 |

| September 2023 | 2 |

| September 2023 | 1 |

| September 2023 | 2 |

| September 2023 | 7 |

| September 2023 | 1 |

| September 2023 | 1 |

| September 2023 | 4 |

| September 2023 | 2 |

| September 2023 | 1 |

| September 2023 | 2 |

| October 2023 | 3 |

| October 2023 | 4 |

| October 2023 | 1 |

| October 2023 | 8 |

| October 2023 | 4 |

| October 2023 | 1 |

| October 2023 | 1 |

| October 2023 | 1 |

| November 2023 | 1 |

| November 2023 | 2 |

| November 2023 | 21 |

| November 2023 | 1 |

| November 2023 | 2 |

| December 2023 | 1 |

| December 2023 | 4 |

| January 2024 | 4 |

| January 2024 | 5 |

| January 2024 | 70 |

| January 2024 | 1 |

| February 2024 | 2 |

| February 2024 | 9 |

| February 2024 | 3 |

| February 2024 | 1 |

| February 2024 | 51 |

| February 2024 | 1 |

| February 2024 | 1 |

| February 2024 | 2 |

| February 2024 | 20 |

| February 2024 | 1 |

| February 2024 | 1 |

| February 2024 | 4 |

| March 2024 | 2 |

| March 2024 | 7 |

| March 2024 | 1 |

| March 2024 | 3 |

| March 2024 | 11 |

| March 2024 | 1 |

| March 2024 | 2 |

| March 2024 | 1 |

| April 2024 | 3 |

| April 2024 | 14 |

| April 2024 | 5 |

| April 2024 | 2 |

| April 2024 | 1 |

| April 2024 | 13 |

| April 2024 | 1 |

| April 2024 | 2 |

| April 2024 | 2 |

| April 2024 | 2 |

| April 2024 | 1 |

| April 2024 | 6 |

| April 2024 | 18 |

| May 2024 | 2 |

| May 2024 | 5 |

| May 2024 | 18 |

| May 2024 | 2 |

| May 2024 | 4 |

| May 2024 | 4 |

| May 2024 | 20 |

| May 2024 | 1 |

| May 2024 | 3 |

| May 2024 | 3 |

| May 2024 | 4 |

| May 2024 | 14 |

| May 2024 | 3 |

| June 2024 | 7 |

| June 2024 | 7 |

| June 2024 | 3 |

| June 2024 | 19 |

| June 2024 | 8 |

| June 2024 | 10 |

| June 2024 | 12 |

| June 2024 | 9 |

| June 2024 | 3 |

| June 2024 | 15 |

| June 2024 | 1 |

| June 2024 | 2 |

| June 2024 | 4 |

| June 2024 | 9 |

| June 2024 | 8 |

| June 2024 | 1 |

| June 2024 | 13 |

| June 2024 | 8 |

| June 2024 | 9 |

| June 2024 | 13 |

| July 2024 | 1 |

| July 2024 | 1 |

| July 2024 | 2 |

| July 2024 | 7 |

| July 2024 | 4 |

| July 2024 | 2 |

| July 2024 | 1 |

| July 2024 | 3 |

| July 2024 | 3 |

| July 2024 | 3 |

| July 2024 | 3 |

| July 2024 | 2 |

| August 2024 | 1 |

| September 2024 | 4 |

| September 2024 | 8 |

| September 2024 | 4 |

| September 2024 | 2 |

| September 2024 | 5 |

| September 2024 | 2 |

| September 2024 | 2 |

| September 2024 | 2 |

| September 2024 | 1 |

| September 2024 | 6 |

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Rights and permissions

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

Essay on Risk Management

Students are often asked to write an essay on Risk Management in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Risk Management

What is risk management.

Risk Management is the process of identifying, assessing, and controlling threats to an organization’s capital and earnings. These threats or risks could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents, and natural disasters.

Importance of Risk Management

Risk Management is important because it prepares an organization to face uncertainties. It helps to understand potential risks and to make plans to minimize their impact. Proper risk management can reduce not only the likelihood of an event occurring, but also the magnitude of its impact.

Steps in Risk Management

Risk Management involves several steps. The first step is identifying the risks. The next step is analyzing the risk to understand its potential impact. The third step is evaluating or ranking the risk. The final step is treating or controlling the risk.

Risk Management Techniques

There are several techniques for managing risk. One is risk avoidance, where the aim is to eliminate all risks. Another technique is risk reduction, where steps are taken to reduce the severity of the loss. Risk retention and risk transfer are other techniques used in risk management.

250 Words Essay on Risk Management

Risk Management is a process that helps identify, assess, and control threats that could harm an organization. These threats or risks could be anything from financial problems, accidents, natural disasters, or even legal issues. The main goal of Risk Management is to lessen the impact of these risks.

Risk Management follows four main steps. First, we identify the risks. This means we look at what could possibly go wrong. Next, we assess the risks. We try to figure out how likely it is that these risks will happen and how much damage they could cause. Then, we work on ways to control these risks. This could mean coming up with a plan to prevent the risk or lessen its impact. Finally, we monitor the risks. We keep an eye on them to see if they change or if new risks come up.

Risk Management is very important because it helps organizations prepare for the unexpected. It helps them make plans that can prevent or lessen damage from risks. It also helps them save money that they might lose if these risks were to happen.

In conclusion, Risk Management is a necessary practice for all organizations. It helps them identify, assess, control, and monitor risks. By doing this, organizations can prevent or lessen the impact of these risks, saving them from potential damage and loss.

500 Words Essay on Risk Management

Risk Management is a process that helps you identify and control possible problems that might happen in the future. It’s like a safety net that prepares you for any unexpected events.

Why is Risk Management Important?

Risk Management includes four main steps:

1. Identifying the Risks: The first step is to find out what could go wrong. This could be anything from a machine breaking down to a sudden change in market trends. 2. Analyzing the Risks: Next, you need to understand how big the problem could be. This helps to decide which risks need the most attention. 3. Planning the Response: Once you know the risks, you can make plans to handle them. This could mean avoiding the risk, reducing its impact, or accepting it and making a plan to recover from it. 4. Monitoring the Risks: Finally, you need to keep an eye on the risks and how well your plans are working. This means you can make changes if needed.

Benefits of Risk Management

Risk management in everyday life.

So, Risk Management is a very helpful tool. It prepares us for the future and helps to avoid or reduce problems. It is used in businesses, but also in our everyday lives. By understanding and using Risk Management, we can make better decisions and be ready for whatever comes our way.

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Risk management

- Share this item with your network:

Tech Accelerator