Banking Resume - Examples & How-to Guide for 2024

As someone who works in banking, you’re a trusted professional who knows their way around the finance world.

You give financial advice and guidance to your clients.

But when it comes to creating a job-winning resume, you’re the one who needs advice.

What does a good banking resume look like, anyway?

With so many people competing for the top banking jobs, you can’t afford to leave any questions unanswered.

But don’t worry! Our field-tested resume examples and tips will get your feet through the door of employment.

- A job-winning banking resume example

- How to create a banking resume that hiring managers love

- Specific tips and tricks for the banking industry

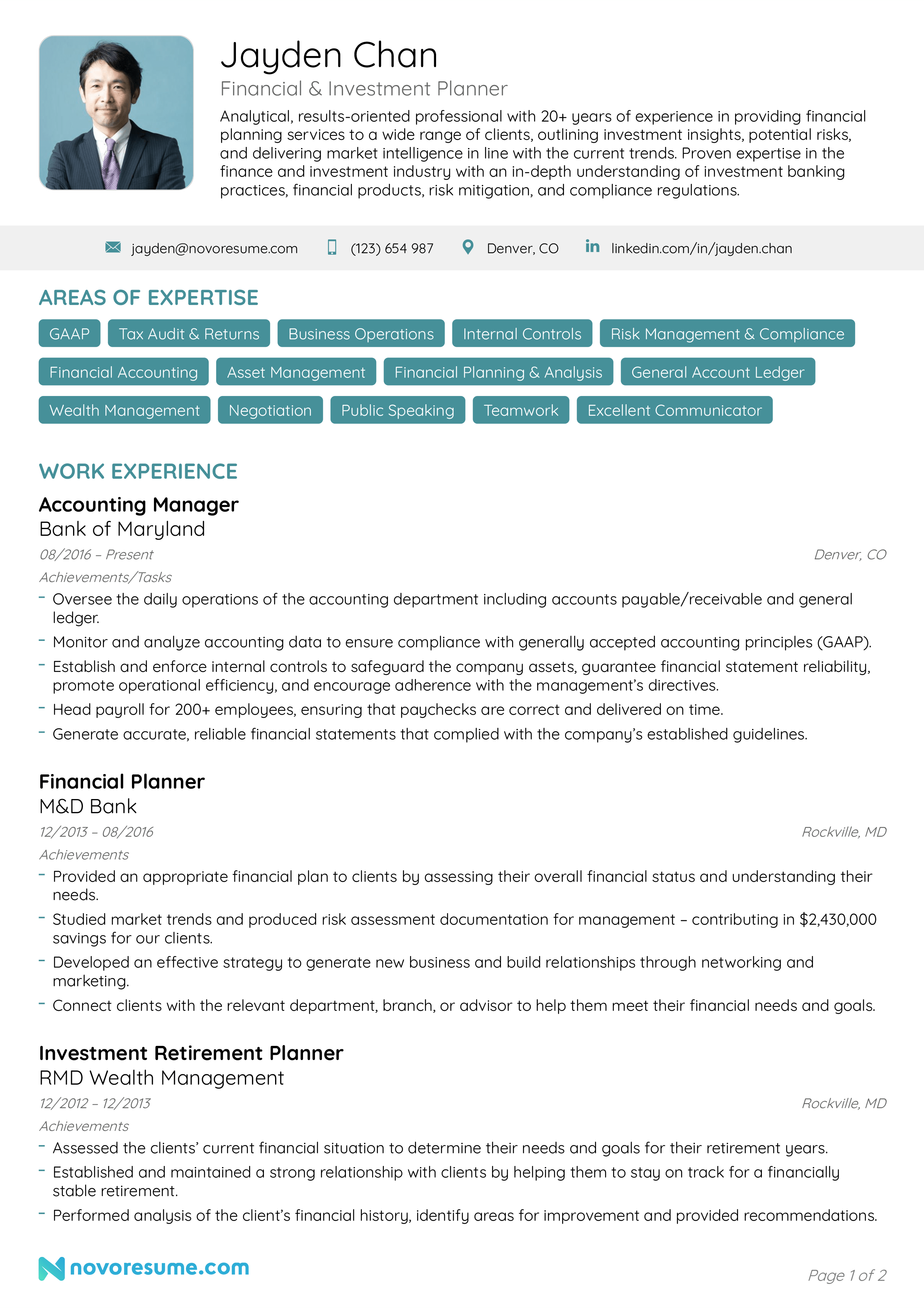

Here’s a banking resume example, built with our own resume builder :

Follow the steps below to create a banking resume of your own.

Are you looking for a resume example for a different job position? Head on over to one of our related resume examples instead:

- Bank Teller Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- Financial Analyst Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

How to Format a Banking Resume

Banking is one of the fiercest industries you can enter.

As such, you really need to put your money where your mouth is.

This involves creating a resume that stands out from the competition.

But before you can get writing, you need to choose the correct format.

You see, even the richest of experience won’t impress a hiring manager that is struggling to read the content.

Have relevant banking experience? Then you’ll want to use the most popular format, known as the “ reverse-chronological ” format. It starts with your most recent work experience and then works backward through your banking history and skills.

You may also want to try these two popular formats:

- Functional Resume - This format focuses on your banking skills, which makes it the best format for those who have the relevant skills, but don’t a wealth of experience as a banker.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, making it perfect for those with both the relevant skills AND banking work experience.

- For a professional and precise resume, keep your banking resume to one-page. Feel free to check out our one-page resume templates .

Once the format is sorted, you need to choose the correct resume layout .

We recommend the following layout:

- Margins – Use one-inch margins on all sides

- Font - Pick a professional font that stands out

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates .

- As professional banker, the recruiter expects to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Banking Resume Template

Word is great for a lot of things.

Well, except for building resumes.

You see, you need a banking resume with a professional structure.

Those who have used word to create their own resume will know that one tiny change can ruin the whole structure.

For a professional banking resume, you can use a resume template .

What to Include in a Banking Resume

The main sections in a banking resume are:

- Contact Information

- Work Experience

For a banking resume that rises above the other applications, add these optional sections:

- Awards & Certification

Interests & Hobbies

So that’s a general overview, now it’s time to get specific about each of the sections.

For even more information, check out our guide on What to Put on a Resume .

How to Write Your Contact Information Section

As a banker, you know that accuracy is vital.

And it’s no different than with your contact information section.

In fact, just one digit out of place can render your whole application useless.

For your resume contact information section, include:

- Title – Make this specific to the exact job you’re applying for

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address ([email protected]), NOT that email you created back in school [email protected])

- (Optional) Location - Applying for a job abroad? Mention your location

- Hannah Atkinson - Banker. 101-358-6095. [email protected]

- Hannah Atkinson - Banking Angel. 101-358-6095. [email protected]

How to Write a Banking Resume Summary or Objective

Creating a professional resume that stands out is the #1 goal .

But HOW is this done?

By using an opening paragraph that brings home the bacon!

These opening paragraphs come in two types: resume summary or objective.

Although slightly different, both are introductory paragraphs that sum up the main points of your resume.

The difference between a summary and objective is that:

A resume summary summarizes your most notable banking experiences and achievements. It’s designed for individuals who have multiple years of finance industry experience.

- Experienced banking professional with five years of experience at YZX BANK, where I used analytical and interpersonal skills to maintain a 99.60% customer satisfaction rating. Seeking a chance to leverage my banking skills to maximize the operations and quality of service at BANK XYZ.

A resume objective gives a quick breakdown of your professional goals and aspirations, which makes it perfect for junior bankers. Now, even though you’re talking about your own goals, it’s important to align your message to what the employer wants.

- Enthusiastic finance student looking for a banking role at BANK XYZ. Two years of experience at a local accounting firm. Excellent organization, communication, and analytical skills. Keen to support your banking team, where my interpersonal skills can be leveraged to achieve the best quality of service.

So, which one is best for bankers?

Well, a summary is suited for bankers who have been crunching the numbers for a few years, whereas an objective is suited for individuals who are new to the banking world (student, graduate, or switching careers).

- The hiring manager wants to see the benefits you will bring to the bank, not what it will do for your career. Also, banks want employees who have strong quantitative and communication skills, so use powerful action verbs and be as specific as possible.

How to Make Your Banking Work Experience Stand Out

What’s the best way to impress a recruiter?

Work experience!

Sure, the recruiter wants to hear about your education and skill-set, but nothing proves your talents like a wealth of banking experience.

Use this layout in your experience section:

- Position name

- Company Name

- Responsibilities & Achievements

02/2017 - 01/2020

- Voted “Banker of the Year” in 2018 and 2019

- Followed best practises to process over 1000 loan applications

- Studied market trends and produced risk assessment documentation for management – contributing in $430,000 savings for our clients

- Trained and empowered a team of eight new bank tellers

For a resume that shows your best qualities, make sure to mention your achievements, rather than your daily responsibilities.

Instead of saying:

“Risk assessment”

“Studied market trends and produced risk assessment documentation for management – contributing to $430,000 in savings for our clients”

So, how exactly do the two differ?

Well, the second statement goes into much greater detail. It’s a clear example of how your abilities will have a direct impact on the success of the bank.

What if You Don’t Have Work Experience?

Maybe you’ve got a finance degree but have yet to work in a bank?

Or maybe you’re transitioning from a junior position at a competing bank?

Whatever your personal situation, you have options.

You see, despite a lack of bank experience, you are still able to include relevant skills and experiences from other previous jobs.

For example, if you’ve worked as a junior accountant, you can talk about the crossover experiences. Just like a banker, you would have to pay great attention to detail, work with customers, and enjoy working with numbers.

For the students reading this, you’ll enjoy our guide on how to make a student resume !

Use Action Words to Make Your Banking Resume POP!

- “Responsible for”

- “Worked with”

You’ll find these exact words on nearly all banking resumes.

And since you need your banking resume stand out, we’d recommend using some power words instead:

- Spearheaded

- Conceptualized

How to List Your Education Correctly

Up next in your banker resume comes the education section.

Now, there’s more than one educational path to becoming a bank employee.

The bank manager just wants to know your education to date.

Follow this format:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Chicago State University

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Financial Management, Risk Analysis, Finance and Economics, Bank Lending and the Legal Environment, Quantitative Methods for Banking, and more]

Still have questions? If so, here are the most frequently asked questions:

What if I’m still studying?

- No matter if you’re still studying or not, you should still mention every year that you have studied to date

Is my high school education important?

- Only list your high school education if that is your highest form of education

What is more important for a banker, education or experience?

- If you’re an experienced banker, your work experience should be listed before your education

If you still have questions, you can check out our guide on how to list education on a resume .

Top 16 Skills for a Banking Resume

Being a successful banker requires a certain set of skills.

And the bank manager needs to know you have what it takes!

Now, you could be the most skilled banker in the world, but they still need to be clearly displayed on your resume – not locked away in a bank vault!

Here are the main skills a hiring manager wants to see from a banker:

Hard Skills for a Banker:

- Balancing Ledgers

- Risk Assessment

- Mortgages and Loans

- Deposits and Withdrawals

- Account Maintenance

- Foreign Currency Exchange

- Investment Management

- Safety Deposit Boxes

- Cash Handling

Soft Skills for a Banker:

- Excellent Communicator

- Problem Solving

- Confident & Professional Manner

- Organization

- Negotiation

- Time Management

- Although bankers need soft skills, we recommend only including the main skills on your resume. It is also wise to only include soft skills that you posses, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills .

Other Resume Sections You Can Include

By now, you should have a resume that’ll get you through the doors of any bank.

Your #1 goal is a resume that stands above the competition.

And this is not the time to leave your future to chance!

The following sections will set you apart from the other candidates.

Awards & Certifications

Have you been awarded at your previous place of work?

Did you win any competitions at university?

Have you completed any certifications to enhance your expertise?

Whatever your case may be, the manager will want to see any relevant awards and certifications.

Awards & Certificates

- Certified Financial Planner (CFP)

- Certified Financial Analyst (CFA)

- “Learning How to Learn” - Coursera Certificate

- “Banker of the Year” 2019 - XYZ Bank

Able to speak other languages?

Whether or not the job description specifically requires it, the ability to speak another language is an impressive skill.

So if you’re able to speak another language, even to a basic standard, feel free to include it inside your resume, but only if there is space.

Order the languages by proficiency:

- Intermediate

Now, you may be wondering, “ why does the bank manager need to know about my love of golf? ”

Well, the manager doesn’t need to know, but it does show them more about who you really are.

And this is great, as banks want an employee who they’ll get along with.

As such, listing your hobbies and interests can be a good idea, especially if it involves social interaction.

If you want some ideas of hobbies & interests to put on your banking resume , we have a guide for that!

Match Your Cover Letter with Your Resume

You don’t need us to tell you how competitive the finance job market is.

And when competing with experienced professionals, you need an edge.

But HOW can you get one?

Well, with a convincing cover letter!

You see, a letter is the perfect tool for communicating with more depth and personality.

Oh, and it shows that you want THIS banking position in THIS bank.

Just like when building the resume, your cover letter also needs the correct structure.

Here’s how to do that:

We recommend writing the following for each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website.

Hiring Manager’s Contact Information

Their full name, position, location, email

Opening Paragraph

Create a powerful introduction that hooks the reader. Make sure to mention:

- The specific position you’re applying for – Banker

- An impactful summary of your most notable experiences achievements

Once you’ve impressed the hiring manager with your opener, you can delve deeper into the rest of your working history. Some of the points you can mention here are:

- Why you want to work for this specific bank

- What you know about the bank’s culture and vision

- Your most notable experiences and how they relate to this job

- If you’ve worked in similar positions at other banks

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragraph

- Thank the hiring manager for reading

- End with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “ Sincerely ” or “ Best regards. ”

Now, if you’re not a professional wordsmith, creating a job-winning cover letter is a difficult task. But don’t worry, you can use our how to write a cover letter article for guidance.

Key Takeaways

You’ve now unlocked the bank vault and discovered how to create a job-winning resume.

Let’s quickly review everything we’ve covered:

- Based on your specific circumstances, choose the correct format. We recommend starting with a reverse-chronological format, and then following the best layout practices

- Use a captivating resume summary or objective

- In the work experience section, highlight your most notable achievements, not your daily duties

- Match your banking resume with a convincing cover letter

Suggested Reading:

- How to Write a Bank Teller Resume in 2024

- How to Ace Interviews with the STAR Method [9+ Examples]

- 26+ Biggest Interview Mistakes (To Avoid in 2024)

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

Top 23 Banking Resume Objective Examples You Can Apply

This post provides great banking resume objective examples that you can apply in making one for your resume and increase your chances of being hired for the banking job that you are applying for.

To make your banking resume or cv effective, you must pay attention to the quality of the objective statement that you write.

Being the first thing the employer would read when they pick up your resume to assess your suitability for the banking job, you really need to put your best into creating a statement that can win their heart to believe you could be the one they are looking for.

Your objective will be able to convince employers if it has what they are looking for. So how do you know that?

The answer is simply, “From the content of the banking job description that is published.”

You can learn a lot about the experience, skills, and knowledge that the hirer is expecting the right candidates for the job to have from the job description that they published.

With such information, you will be able to craft a career objective statement that the employer cannot resist responding favorably to.

The examples below have been carefully selected to help you understand better how to write a winning objective statement for a banking job resume or cv, to improve your chances of being selected for an interview:

1. Individual with a good reputation looking to work in a banking firm; bringing strong ability to adhere to rules and regulations guiding the company, and also to obey legal laws in the process of working for the company.

2. Desire to secure a banking job with Gadling investment. Looking forward to utilizing enormous knowledge of the banking industry and the ability to answer to all questions related to finances, in working for the organization.

3. Looking to obtain a banking position in a fast-paced organization where I will utilize my experience of five years in the banking sector in checking company progress by comparing its financial history with its current financial status.

4. Seeking a banking position with Equobank; an expanding organization that could use a banking specialist with the capacity to proffer recommendations on the best way to accomplish financial goals.

5. To secure a banking position with Jerry Establishment. Bringing 6 years of banking experience in taking care of different types of financial transactions without stress.

6. Result-oriented and intelligent professional with banking and finance degree from Oxford; coming with 5 years of banking experience in a financial institution. Looking to obtain a banking position with a reputable organization like Orwell where my skills will be fully utilized.

7. Dedicated banking specialist with in-depth knowledge of banking strategies and methods. Hoping to secure a position as a banker in an organization where my abilities will be maximized.

8. A highly committed individual with the ability to accurately keep records of every transaction. Seeking a banking position to utilize my accounting expertise.

9. To work as a banker; bringing experience in client handling, as well as knowledge of loan disbursement in accordance with set policies and standards.

More Banking Resume Objective Examples [10-17]

10. Experienced banker with expertise in handling numerous account numbers, as well as ability to avoid misplacements or error while making transactions. Looking for a banking position at Diamond bank to utilize my abilities.

11. Proactive individual with numbering precision and tabulating proficiency, seeking a banker position with IBCT to ensure accurate accounts.

12. Enthusiastic professional with sound knowledge of financial information technology. Seeking a banking position at GTB to use my brilliant IT skills to significantly improve company’s financial tasks.

13. Sound-minded individual seeking a banking job position in a company that needs an expert who can efficiently and effectively handle various banking needs.

14. To take up responsibility as a banker, coming with determination to produce excellent financial outcome at Emerald Bank.

15. To join UUB as a banking specialist, bringing uncommon expertise in financial management, as well as ability to ensure compliance with standard banking procedures.

16. Desire a banking position at Dreamcast Bank. Bringing ability to provide banking services that optimizes productivity and increases finances.

17. Resourceful banking specialist with 7 years of active experience in banking management and broad, and knowledge of handling cash. Looking for a banking position in a dynamic organization where my skills will be fully utilized.

Additional Examples [18-23]

18. Looking forward to gain a position as a banker in Stratford Bank. Comes with exceptional ability to explain and clarify all issues related to banking services to customers.

19. Dedicated professional with 5 years of experience in the banking and finance sector. Hoping to obtain a banking position at Iconic bank to apply strong experience working in various departments of banks for the benefit of the company.

20. Looking to secure a banking position in a healthy organization where strong knowledge of banking services and operations will be utilized for the greater benefit.

21. Proficient and forward-thinking individual, coming with high professionalism in dealing with banking issues and relating with managers in an organization.

22. Banking specialist with experience in providing healthy customer services. Looking forward to holding a banking position at Winter Bank and revamping the bank’s customer service department to meeting higher goals.

23. Seeking a banking position in a challenging but rewarding organization, bringing proven ability to effectively handle customer complaints and ensuring crisis situations are well resolved.

Without doubt, the objective statement plays a great role in determining the success of a resume or cv.

You can learn how to write effective objectives for your banking job resume by applying the sample objectives provided in this post.

In fact, you can simply pick any of the examples that best suit your personality, modify, and insert it in your resume. They are free for use.

Related Posts

This Site Uses Cookies

Privacy overview.

Top 16 Banking Officer Resume Objective Examples

Updated July 11, 2023 14 min read

A resume objective is an important part of a banking officer’s resume as it provides the hiring manager with a concise overview of your qualifications and why you are the best candidate for the position. When writing a resume objective for a banking officer position, consider emphasizing skills like financial analysis, customer service, and problem-solving abilities. You should also include any relevant experience or education that makes you stand out from other applicants. For example, “Highly motivated banking professional with 5+ years of experience in financial analysis, customer service, and problem solving. Seeking to leverage my knowledge and expertise to contribute to the success of XYZ Bank as a Banking Officer.” This statement clearly communicates your qualifications and sets you apart from other candidates. Additionally, it shows that you understand what the role requires and are confident in your ability to perform it successfully.

or download as PDF

Top 16 Banking Officer Resume Objective Samples

- To secure a position as a Banking Officer in a reputable financial institution where I can utilize my knowledge and experience to contribute to the success of the organization.

- To obtain a Banking Officer role that will allow me to utilize my expertise in customer service, financial analysis, and problem solving.

- Seeking an entry-level Banking Officer position with ABC Bank to apply my banking knowledge and skills in providing excellent customer service.

- To work as a Banking Officer for XYZ Bank where I can use my strong background in finance, accounting, and customer service.

- Seeking an opportunity as a Banking Officer at ABC Bank where I can utilize my knowledge of banking regulations, policies, and procedures.

- To gain employment as a Banking Officer at XYZ Bank where I can apply my strong interpersonal skills and financial acumen.

- Looking for an opportunity to join ABC Bank as a Banking Officer to leverage my experience in banking operations and customer service.

- Desire to obtain a position as a Banking Officer at XYZ Bank where I can utilize my exceptional communication skills and financial knowledge.

- Seeking an entry-level role as a Banking Officer with ABC Bank that will allow me to develop my banking skills while contributing to the success of the organization.

- Aiming for an opportunity as a Banking Officer at XYZ Bank that will enable me to utilize my expertise in customer relations, financial services, and problem solving.

- To obtain employment as a Banking Officer with ABC Bank that offers opportunities for growth while utilizing my knowledge of banking processes and procedures.

- Searching for an opportunity with XYZ Bank as a Banking Officer where I can apply my strong organizational skills and attention to detail.

- Looking for an entry-level role as a Banking Officer with ABC Bank that will enable me to gain experience in the banking industry while providing quality customer service.

- Seeking an opportunity with XYZ Bank as a Banking Officer so I can put into practice my analytical abilities along with excellent communication skills.

- Aiming for an entry-level role at ABC Bank as a Banking Officer so I can make use of my knowledge of financial products and services while delivering outstanding customer service.

- Applying for the position of Banking Officer at XYZ Bank so I may employ my extensive background in finance, accounting, and customer relations within the banking sector

How to Write a Banking Officer Resume Objective

A banking officer resume objective is an important part of a resume, as it serves to introduce the applicant to potential employers and give them a better understanding of who they are and what they have to offer. A well-crafted banking officer resume objective should be tailored to the specific job opening, highlighting your qualifications and experience that make you an ideal fit for the position.

When writing a banking officer resume objective, you should begin by considering the job description and identifying key skills that the employer is looking for. These may include knowledge of financial regulations, customer service experience, or mathematical aptitude. Once you have identified these qualities, you should craft a statement that emphasizes how your qualifications match up with the requirements of the position.

Your statement should be concise but also paint a complete picture of who you are as a professional. Include any certifications or degrees that are relevant to the job at hand. You can also mention any past successes in similar positions that demonstrate your ability to perform well in this role. Additionally, it’s important to emphasize your passion for banking and commitment to delivering exceptional customer service.

By taking these steps when writing a banking officer resume objective, you can create an effective summary that will help you stand out from other applicants. This statement will provide employers with a glimpse into your qualifications and show them why you’re uniquely suited for the position at hand.

Related : What does a Banking Officer do?

Key Skills to Highlight in Your Banking Officer Resume Objective

As a banking officer, your resume objective should not only convey your career goals but also highlight the key skills that make you an ideal candidate for the position. These skills can range from financial analysis and risk management to customer service and communication abilities. By emphasizing these competencies in your objective statement, you demonstrate to potential employers that you possess the necessary expertise to excel in the role. This section will delve into the crucial skills to spotlight in your banking officer resume objective.

1. Risk assessment

A Banking Officer is often responsible for making critical decisions about loans, credit strategies, and investments. Risk assessment is a crucial skill in this role as it involves evaluating the potential risks involved in these decisions. This could include assessing the financial stability of a client or the potential return on an investment. By demonstrating this skill in a resume objective, it shows potential employers that the candidate is capable of making informed, strategic decisions that can protect the bank's assets and contribute to its profitability.

2. Financial analysis

A Banking Officer needs to have a strong skill in financial analysis as they are responsible for managing, overseeing and handling various financial transactions and decisions within the bank. This includes assessing loan applications, investment strategies, risk management and other banking activities. Understanding financial analysis allows them to make informed decisions that can affect the profitability and financial stability of the bank. Therefore, highlighting this skill in a resume objective shows potential employers that the candidate is capable of effectively managing and improving the bank's financial performance.

3. Credit evaluation

A banking officer often deals with providing loans or credit to customers. Therefore, having the skill of credit evaluation is crucial as it allows them to assess the creditworthiness of a potential borrower, determining whether they will be able to repay the loan on time. This involves analyzing financial data such as income, expenses and employment history. By including this skill in a resume objective, it shows potential employers that the candidate is capable of making informed decisions regarding loan approval, which can help minimize financial risk for the bank.

4. Regulatory compliance

A Banking Officer is responsible for ensuring that all banking activities and operations are carried out in compliance with local, state, and federal regulations. Therefore, having a skill in regulatory compliance is crucial. It demonstrates the ability to understand, implement, and adhere to complex banking laws and regulations. This skill can help prevent legal issues, financial penalties or potential damage to the bank's reputation due to non-compliance. It also shows a strong commitment to ethical practices and integrity in handling the bank's operations.

5. Customer service

A Banking Officer often interacts directly with customers, handling various financial transactions and addressing customer inquiries or concerns. Excellent customer service skills are crucial in this role to ensure customer satisfaction, build strong relationships, and maintain the bank's positive reputation. These skills can help attract and retain customers, directly impacting the bank's success. Including customer service skills in a resume objective demonstrates an understanding of its importance and shows potential employers that the candidate is capable of providing high-quality service to their clients.

6. Loan processing

A Banking Officer often deals with various aspects of loan management, including application review, approval or denial, and loan disbursement. Proficiency in loan processing is crucial as it demonstrates the ability to handle these responsibilities efficiently. This skill shows the candidate's familiarity with banking procedures and regulations, attention to detail, decision-making abilities, and customer service skills. Including this in a resume objective can make a strong impression on potential employers about the candidate's competence for the role.

7. Cash management

A banking officer is responsible for handling various financial transactions, including cash deposits, withdrawals, and transfers. Proficiency in cash management indicates that the candidate is capable of accurately processing these transactions, maintaining proper records, and ensuring the bank's cash flow is well managed. This skill also demonstrates the ability to identify any discrepancies or potential issues, which is crucial for maintaining the bank's financial integrity and customer trust. Therefore, including cash management as a skill in a resume objective can make a candidate more appealing to potential employers in the banking sector.

8. Relationship building

A Banking Officer often interacts with a wide range of clients, colleagues, and other stakeholders. The ability to build and maintain strong relationships is crucial for understanding client needs, providing excellent customer service, and collaborating effectively with team members. This skill can also aid in attracting new clients and retaining existing ones, ultimately contributing to the bank's profitability and reputation. Hence, highlighting this skill in a resume objective can demonstrate an applicant's potential to succeed in the role.

9. Fraud detection

A Banking Officer is often responsible for managing and overseeing various financial transactions, which can include monitoring for any suspicious or fraudulent activity. Having a strong skill in fraud detection is crucial as it ensures the protection of both the bank's and customers' assets. It demonstrates an ability to maintain security, uphold banking regulations, and prevent potential financial losses. This skill also shows a high level of attention to detail, critical thinking, and problem-solving abilities - all of which are vital in the banking industry. Including this on a resume objective can highlight one's capability to effectively manage risks and safeguard the institution's integrity.

10. Microsoft Excel

A Banking Officer often needs to manage, analyze, and interpret large volumes of financial data. Microsoft Excel is a powerful tool that can aid in these tasks with features like formulas, charts, and pivot tables. Proficiency in Excel demonstrates the ability to handle data efficiently and accurately, which is crucial for making informed financial decisions and strategies. Thus, including this skill in a resume objective will show potential employers that the candidate has the necessary technical skills for the job.

In conclusion, it is crucial to strategically highlight your key skills in your Banking Officer resume objective. This not only showcases your abilities and expertise but also sets you apart from other candidates. Remember, the goal is to present yourself as a well-rounded candidate who possesses a blend of technical knowledge, interpersonal skills, and industry-specific competencies. Your resume objective should effectively communicate your potential to prospective employers, paving the way for successful career advancement in the banking sector.

Related : Banking Officer Skills: Definition and Examples

Common Mistakes When Writing a Banking Officer Resume Objective

Writing a resume objective for a banking officer position can be tricky. A resume objective is a short, concise statement that summarizes your career goals and outlines how you plan to reach them. It should be tailored specifically to the job you are applying for and demonstrate why you are the best candidate for the role. Unfortunately, many job seekers make mistakes when writing their resume objectives, which can hurt their chances of getting an interview.

The first common mistake is not customizing the objective to the job description. Many applicants simply copy and paste generic statements from other resumes, which does not demonstrate that they have read or understood what the job entails. Instead, take some time to research the company and its mission statement so that you can craft an objective that demonstrates your understanding of the role and how you can contribute to it. Additionally, incorporate keywords from the job posting into your resume objective; this will help show employers that you have taken the time to tailor your application specifically for their position.

Another mistake is using overly generic language in your objective statement. While it’s important to be clear and concise in your writing, try to avoid using stock phrases such as “hardworking individual” or “strong communication skills” as these don’t help illustrate why you are uniquely qualified for this particular role. Instead, use concrete examples that demonstrate how past experiences have prepared you for this banking officer job. For example, if you previously worked as a loan processor at another bank, mention this in your objective with specific details about what tasks and responsibilities were part of that position.

Finally, many applicants make the mistake of focusing too much on themselves in their objectives instead of on how they can benefit the company they are applying for. A good resume objective should include both elements; explain why this role is attractive to you while also demonstrating why hiring managers should choose you over other candidates by highlighting relevant skills or experience related to banking operations or customer service management.

By avoiding these common mistakes when writing a banking officer resume objective, job seekers will increase their chances of standing out from other applicants and receiving an invitation for an interview.

Related : Banking Officer Resume Examples

A right resume objective for a banking officer would be to demonstrate strong organizational and customer service abilities in order to efficiently manage customer accounts, while a wrong resume objective for a banking officer would be to gain a high-level position with the company.

Editorial staff

Brenna Goyette

Brenna is a certified professional resume writer, career expert, and the content manager of the ResumeCat team. She has a background in corporate recruiting and human resources and has been writing resumes for over 10 years. Brenna has experience in recruiting for tech, finance, and marketing roles and has a passion for helping people find their dream jobs. She creates expert resources to help job seekers write the best resumes and cover letters, land the job, and succeed in the workplace.

Similar articles

- Top 16 Banking Assistant Resume Objective Examples

- Top 16 Investment Banking Analyst Resume Objective Examples

- Top 10 Banking Officer Certifications

- What does a Banking Officer do?

- Top 18 Banking Analyst Resume Objective Examples

- Top 17 Banking Consultant Resume Objective Examples

28 Entry Level Bank Teller Resume Objective Examples

A resume objective is a short statement that comes to the top of a resume. It is more about the employer and less about the job seeker. That being said, the entry-level bank teller resume objective should highlight what the applicant has to offer.

How to Write a Professional Objective for Entry-Level Bank Teller With No Experience?

- Research the prospective bank/organization first and customize the objective statement accordingly.

- Include your most relevant skills and knowledge.

- Show your enthusiasm and energy to work for the employer.

Here are 21 sample objective statements for an entry-level bank teller position.

Sample Objectives for Entry Level Bank Teller Resume

1. Detail-oriented bank teller, enthusiastic to provide customers at ABC Bank with respectful, informed, and friendly service by using my cash handling, accounting, communication, and customer service skills. Bilingual: English/Spanish.

2. New accounting graduate with a keen interest in working as a Bank Teller at AA Bank. Exceptionally talented in servicing current client accounts, and serving clients by processing transactions using good judgment.

3. Dedicated and self-motivated Bank Teller with strong numeracy, communication, and customer service skills. Excited to join the team of TDC Bank where I can significantly contribute by using my accounting skills. A strong sense of commitment, and the ability to serve clients in a courteous and professional manner.

4. New finance graduate with full of energy and ideas, desires to obtain a Bank Teller position at Stockman Bank. Bringing deep know-how in processing transactions, verifying payments, and resolving discrepancies.

5. To contribute to the Bank of America in the capacity of an entry-level bank teller. Bringing understanding of processing bank transactions using attention to detail. Positive attitude with a passion to exceed customer satisfaction milestones by using my interpersonal and communication skills.

6. To obtain a Bank Teller position at the Bank of Colorado. Bringing knowledge of providing exceptional customer service by efficiently completing account transactions. Talented in upselling bank products, responding to inquiries, and informing customers about new products and services.

7. Highly motivated Bank Teller looking for a challenging role at Pinnacle Bank, where I can use my finance background to serve the bank’s clients in the most efficient way.

8. Uniquely talented Bank Teller, seeking an opportunity to use my ability to service accounts, accept loan payments, and process retail banking products at Commonwealth Central Credit Union.

9. Results-driven Bank Teller eager to work for US Bank where my strong accounting background and cash handling and mathematics skills will be used to ensure clients’ satisfaction.

10. Fresh and energetic Bank Teller with an excellent educational record. Seeking to leverage my excellent customer service, problem-solving, and transaction processing knowledge for the success of ABC Bank.

11. Results-oriented, diligent professional seeking a Bank Teller position at First Financial Corporation. Bringing knowledge of accurately performing transactions in accordance with policies while ensuring client confidentiality.

12. An energetic individual looking for a position as a Bank Teller at Fulton Financial Corporation. Offers knowledge of performing cash and balancing functions with client satisfaction as the central concentration.

13. Looking for a full-time Bank Teller position at First Midwest Bank. Offering a well-developed understanding of banking functions and client services.

14. To obtain a Bank Teller position at Marine Bank utilizing expertise in processing checks, validating the information, and handling cash drawer balancing duties.

15. To work as a Bank Teller for First American Bank. Enthusiastic to provide the highest level of quality services to clients by meeting their banking needs in a friendly, positive, and professional manner.

16. A recent high school graduate with a solid interest in working as a Teller. Looking to leverage exceptional skills in assisting customers in processing transactions, and motivating them to invest.

17. To start my professional journey as a Teller for US Bank. Bringing the ability to handle cash, process transactions, and provide information in a proactive manner.

18. Detail-oriented accounting graduate seeking employment as a Teller at The Bank of Michigan. Analytic self-starter, with an inherent interest to provide outstanding customer service by using my talents in processing bank transactions such as deposits, withdrawals, and payments.

19. To work with Tri Counties Bank in the capacity of a bank teller. Offering knowledge of serving customers by completing account transactions. Good understanding of basic banking principles and report generation.

20. Self-motivated and passionate Teller with a track record of providing superb customer service in different retail sales capacities. Presently looking for a position at HAPO Community Credit Union.

21. Bank Teller with an excellent understanding of processing bank transactions, and knowledge of bank products and services, seeking employment at the Royal Bank of Canada. Offering excellent interpersonal skills and a solid ability to build rapport and develop a regular clientele.

22. Recent high school graduate seeking a Bank Teller position at Royal Bank of Canada. Offring exceptional math skills and the ability to provide excellent services aimed at customer satisfaction and retention.

23. To obtain a challenging position as a Bank Teller at JP Morgan. Bringing sound public relations capabilities and strong accounting acumen to assist clients efficiently in a banking environment. Poised to exceed customers’ expectations.

24. To work as a Bank Teller for the Financial Bank of Idaho. Offers the ability to accurately handle cash and manage bank-related bookkeeping tasks in a swift and efficient manner.

25. Seeking a position as a Bank Teller with Indiana Investment Bank. Offering sound knowledge of deposits, withdrawals, and foreign currency targeted at providing clients with excellent services.

26. Strong desire to obtain a Bank Teller position with ABC Credit Union where my solid knowledge of credit expenditure and sound customer service skills will be used.

27. To obtain a Bank Teller position at Prudential Financial Bank of America, employing exceptional abilities to assist clients with basic banking functions.

28. Looking for a position as a Bank Teller at the Bank of America. Bringing good communication and customer service skills to interact with clients professionally and fulfill their banking needs.

Don’t Use a Selfish Objective Statement In Your Resume

Positioning yourself to the employer’s wants is the purpose of a bank teller’s resume objective.

Let us look at some selfish examples of objectives that must NOT be used in a resume:

WRONG OBJECTIVES

- My goal is to find employment with your company so that I can achieve…

- To obtain a challenging position as a teller with your bank so that I can build up my skills…

- Looking for a dynamic bank teller role where I can grow and learn…

There is one thing common in all three – they concentrate on the candidate and not the employer. These kinds of objectives will hurt your candidacy. Therefore, NEVER use selfish objectives in a bank teller resume.

Final Thought

Your objective statement must have some direction. You should focus on what you have to offer to the prospective bank or financial institute in terms of cash services, deposits, and complaint management.

- 10 Entry Level Bank Teller Resume Summary Examples – No Experience

- Bank Teller Resume Objective and Summary: 25 Examples

- Entry-Level Bank Teller Resume No Experience

- Top 10 Career Objective Examples for Bank Job

IMAGES

VIDEO

COMMENTS

A well-crafted resume objective is essential when creating a successful banker resume. It should clearly state the job you are applying for, highlight your qualifications, and show potential employers why they should hire you.

You can learn how to write effective objectives for your banking job resume by applying the sample objectives provided in this post. In fact, you can simply pick any of the examples that best suit your personality, modify, and insert it in …

This article provides examples of effective resume objectives for top bank managers, including sample language and tips for crafting an effective resume objective.

This article provides examples of effective resume objectives for top banking officers to help them stand out in their job search.

In this post, we have compiled a list of the top 10 Personal Banker resume objective examples to inspire and guide you in creating your own. These examples cover a range of skills, from …

Sample Objectives for Entry Level Bank Teller Resume 1. Detail-oriented bank teller, enthusiastic to provide customers at ABC Bank with respectful, informed, and friendly service …