Tally Practical Assignment with Solutions PDF

Tally Practical Assignment including GST with Solutions PDF for free download. Super Success Institute Tally computer training coaching classes day by day task. Notes is very useful for learn and practice the tally ERP 9 with GST. We found that student face problem to find the practice assignment of Tally. The Training Faculty of Super Success Institute compiled the practice task in this PDF for self study of students.

Our Tally Coaching Class Assignment / task includes following:-

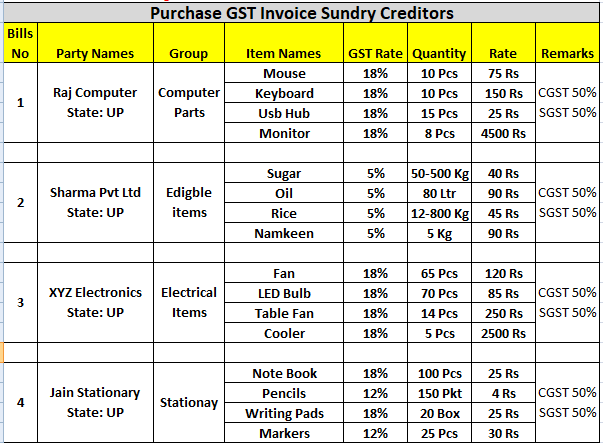

Purchase Invoice Bills Sundry Creditors Sales Invoice Bills Sundry Debtors Purchase Invoice Bills Batch Wise Details

Brief of GST Business For Purchase & Sales Of Goods Business for Service providing Who are Compulsory For GST Registration Document Required For GST Registration GST What is GSTIN Number Types of GST Rates GST Rates How GST Apply in Tally How GST Apply in Invoice SGST (State Tax) & CGST (Central Tax) IGST (Interstate Tax) – Purchase GST Invoice Sundry Creditors Sale GST Invoice Sundry Debtors

Purchase Entry

Purchase Invoice with GST (Sundry Creditors)

Sales Invoice with GST Sundry Debtors

| Bills No | Party Names | Item Names | GST Rate | Quantity | Rate |

| 1 | Raghu Raj State: UP | Mouse | 18% | 8 Pcs | 85 Rs |

| Keyboard | 18% | 10 Pcs | 190 Rs | ||

| Usb Hub | 18% | 12 Pcs | 30 Rs | ||

| Monitor | 18% | 7 Pcs | 5000 Rs |

Entry of 25 Sundry Debater bills are given in the PDF

Download Tally Practice Assignment PDF

Document Name : Tally Practice Assignment with solution

Publisher : S uper Success Institute Muzaffarnagar and https://onlinestudytest.com Author : Super Computer Muzaffarnagar Number of Pdf Pages : 28 Quality Very good

Note : The Tally Practical Assignment with Solutions notes PDF are property of Super Success Institute Muzaffarnagar. We are sharing the google drive download link with due consent of Computer Coaching Institute.

Tally Prime Notes

- Fundamental of Accounting and Tally Prime Notes

- Introduction of Tally Prime Notes

- Groups and Ledgers in Tally Prime Notes

- Voucher Entry in Tally Prime Notes

- Create Stock Item in Tally Prime Notes for Practice

- Bill wise entry in Tally Prime

- Batch wise Details in Tally Prime Notes

- Cost Center in Tally Prime Notes

- Export Import Ledger in Tally Prime

More Tally PDF may be found – Tally Notes PDF Archives – SSC STUDY

Tally Prime Book PDF Free Download – SSC STUDY

Tally ERP9 Question Paper in Hindi – Online Study Test

Related Posts

O level computer course book pdf download, tally computer course notes pdf download, computer book pdf for competitive exams in hindi, computer questions pdf for competitive exams.

Tally Practical Assignment with Solution Pdf Download

Table of Contents

Tally Practical Assignment with Solution PDF Download:- Welcome to our website. Here we are happy to provide you with Tally Solutions . At gurujistudy.com you can easily get Tally Prime Notes PDF, Tally Practical Assignment in PDF, Tally Notes in Hindi and English in PDF, PDF Notes Tally Prime, Download Tally PDF Notes in English & Hindi, Tally Books Notes in Hindi PDF Download, Tally Books Notes in English PDF Download, Tally all study materials and notes in pdf for free. If you are preparing for Banking and RRB then there is a single-stop destination as far as preparation of all of these examinations is concerned. Here in this post, we are happy to provide Chapter Wise & Topic Wise Tally Practical Assignment PDF download.

Brief of GST

Business For Purchase & Sales Of Goods Business for Service providing Who is Compulsory For GST Registration Document Required For GST Registration GST What is GSTIN Number Types of GST Rates GST Rates How GST Apply in Tally How GST Apply to Invoice SGST (State Tax) & CGST (Central Tax) IGST (Interstate Tax) – Purchase GST Invoice, Sundry Creditors Sale GST Invoice Sundry Debtors

Download Tally Practical Assignment in PDF

| Tally Practical Assignment in PDF |

Download Tally Books & Notes in Hindi & English PDF

| Tally Books Notes in Hindi PDF | |

| Tally Books Notes in English PDF |

Download Tally Books Notes in PDF

| Tally Accounting Notes in PDF | |

| Creating Company in Tally Notes Pdf | |

| Short Cut Keys in Tally Notes Pdf | |

| Tally Erp 9 Book Notes in PDF | |

| Tally Payroll Notes in PDF | |

| Tally Practice Set in PDF | |

| Tally Practice Set 2 in PDF |

Tally Practical Assignment in PDF Download

See Also:- “ Click Here ”

Tally Practice Paper

Free related PDFs Related papers

Tax planning is an important thing to do so that the transaction withholding tax and value added tax on reimbursement transactions is not subject to double taxation. With tax planning, taxpayers can streamline the tax payable so that the taxes paid are not too high but in accordance with applicable tax provisions. This study aims to analyze tax planning on withholding taxes and value added tax on reimbursement transactions. Researchers use this type of qualitative explanative research in this study. To obtain the required data, researchers collected data by means of literature study, observation and documentation. The results of this study state that a transaction can be categorized as a reimbursement transaction so that the income and costs of VAT / PPH can be recognized if the invoice made by a third party is addressed to the second party and then the second party makes a new bill to the first party. This study also concludes that there is a reimbursement transaction if it meets 4 cumulative criteria such as: there is an agreement governing reimbursement; proof of bill on behalf of the real burden bearer, proof of invoice submitted to the real burden bearer and there is no mark up / down value or price.

Penelitian ini bertujuan untuk mengetahui pengaruh setiap perspektif pada Balance Scorecard yaitu pengaruh perspektif keuangan, pengaruh perspektif pelanggan, pengaruh perspektif proses bisnis internal, pengaruh perspektif pertumbuhan dan pembelajaran serta pembobotan prioritas pada setiap perspektif diukur dengan metode Analytical Hierarchy Process . Uji yang digunakan dalam penelitian ini adalah uji konsistensi logis dengan menguji indeks konsistensi dan rasio konsistensi. Hasil Penelitian menunjukkan bahwa pembobotan dengan prioritas pertama dengan bobot 0,311 yaitu perspektif pertumbuhan dan pembelajaran, prioritas kedua bobot 0,272 yaitu perspektif keuangan, prioritas ketiga bobot 0,213 perspektif proses bisnis internal, dan prioritas keempat bobot 0,205 perspektif pelanggan. Hasil uji hipotesis dengan uji konsistensi logis diketahui bahwa semua variabel independent berpengaruh positif terhadap variabel dependent yaitu kinerja usaha rintisan startup Heksagonal Trading di Balikp...

Tujuan penelitian ini adalah untuk menganalisis dan mengetahui Sistem Bagi Hasil Produk Penghimpunan Dana di Bank Syariah Mandiri Cabang Blitar. Dalam penelitian ini menggunakan metode deskriptif kualitatif. Data penelitian ini dikumpulkan melalui wawancara dan dokumentasi. Hasil penelitian menunjukkan bahwa produk penghimpunan dana yang menggunakan bagi hasil yaitu produk tabungan mudharabah dan deposito mudharabah. Perhitungan bagi hasil di bank syariah menggunakan sistem revenue sharing. Bagi hasil yang diperoleh bank nasabah berbeda sesuai ketentuan dari setiap produk. Pelaksanaan sistem bagi hasil di bank tersebut sudah sesuai dengan prinsip-prinsop sebagaimana diatur dalam Fatwa DSN-MUI.

Tech-E, 2018

djiwqodjiwqdo

Antrian merupakan suatu garis tunggu dari nasabah (satuan) yang memerlukan layanan dari satu atau lebih pelayan (fasilitas layanan). Pada Kenyataanya, antrian diakibatkan waktu menunggu lebih lama daripada waktu pelayanan. Tujuan dari penelitian ini adalah untuk menganalisis penerapan model M/M/S pada sistem antrian Bank SulutGo cabang utama. Langkah pertama yang dilakukan adalah mengambil data kedatangan antrian nasabah. Hasil perhitungan dengan model M/M/S pada Bank SulutGo cabang utama menerapkan disiplin antrian yaitu first come first serve (FCFS). Pola kedatangan nasabah berdistribusi Poisson dan pola pelayanan berdistribusi Eksponensial. Dari hasil perhitungan rata-rata jumlah nasabah yang menunggu dalam sistem terpanjang pada periode waktu 12.00 -13.00 yaitu sebanyak 5,1353 orang atau = 5 orang. Sedangkan jumlah rata-rata nasabah yang menunggu dalam sistem terpendek terjadi pada periode waktu 08.00 – 09.00 yaitu sebanyak 0,8338 orang atau = 1 orang. Rata-rata jumlah nasabah d...

International Journal of Engineering Research and Technology (IJERT), 2020

https://www.ijert.org/increase-cashflow-position-by-improving-accounts-payables-invoice-matching-process https://www.ijert.org/research/increase-cashflow-position-by-improving-accounts-payables-invoice-matching-process-IJERTV9IS100025.pdf In any retail organization, one of the major issues encountered is on how to improve the effectiveness and efficiency of the Accounts Payables invoice matching process while preventing any loss to the organization. This is due to the limitations of the information system being used for day-today operations. This article provides the details on how the matching process can be effectively improved to meet the client specific requirements to improve the cash flow position and vendor score card.

Ekonomi & Bisnis, 2021

Tujuan penelitian ini untuk menganalisis pengaruh pembiayaan mudharabah dan musyarakah terhadap profitabilitas (ROA) pada 5 Bank Umum Syariah Swasta, yaitu Bank Muamalat Indonesia, Bank Victoria Syariah, Bank Panin Dubai Syariah, Bank Syariah Bukopin, dan Bank BCA Syariah. Metode penelitian menggunakan metode verifikatif kuantitatif dengan data sekunder bersumber dari website resmi Otoritas Jasa Keuangan (OJK) dan juga laman website resmi masing-masing Bank Umum Syariah. Teknik analisis data yang digunakan yaitu analisis linear berganda. Adapun hasil penelitian menunjukkan bahwa: (1) Pembiayaan mudharabah berpengaruh positif terhadap profitabilitas (ROA) pada Bank Umum Swasta Syariah dengan nilai sig. 0,000 < α 0.05 dan nilai t hitung 5,609 > t tabel 2,026. (2) Pembiayaan musyarakah berpengaruh negatif terhadap profitabilitas (ROA) pada Bank Umum Syariah Swasta dengan nilai sig. 0,000 < α 0.05 dan nilai t hitung = -6,090 > t tabel = 2,026. (3) Pembiayaan mudharabah dan m...

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

Global Conference on Business and Management Proceedings, 2022

Jurnal Manajemen dan Sains, 2022

FSFC Report submitted to the Government of Karnataka by the statutory Commission , 2018

JURNAL INFORMASI, PERPAJAKAN, AKUNTANSI DAN KEUANGAN PUBLIK, 2019

International Journal of Academic Research in Business and Social Sciences

NUsantara Islamic Economic Journal

TAX AUDIT: OPPORTUNITY TO REDUCE THE LOAD TAX AND RECOVERY OF CREDIT BY HALF OF THESIS OF EXCLUSION ICMS OF THE BASE IN CALCULATION OF PIS AND OF COFINS (Atena Editora), 2022

International Journal of Communication and Media Science, 2017

International Journal of Digital Entrepreneurship and Business

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Interactivity

- AI Assistant

- Digital Sales

- Online Sharing

- Offline Reading

- Custom Domain

- Branding & Self-hosting

- SEO Friendly

- Create Video & Photo with AI

- PDF/Image/Audio/Video Tools

- Art & Culture

- Food & Beverage

- Home & Garden

- Weddings & Bridal

- Religion & Spirituality

- Animals & Pets

- Celebrity & Entertainment

- Family & Parenting

- Science & Technology

- Health & Wellness

- Real Estate

- Business & Finance

- Cars & Automobiles

- Fashion & Style

- News & Politics

- Hobbies & Leisure

- Recipes & Cookbooks

- Photo Albums

- Invitations

- Presentations

- Newsletters

- Interactive PDF

- Sell Content

- Fashion & Beauty

- Retail & Wholesale

- Presentation

- Help Center Check out our knowledge base with detailed tutorials and FAQs.

- Learning Center Read latest article about digital publishing solutions.

- Webinars Check out the upcoming free live Webinars, and book the sessions you are interested.

- Contact Us Please feel free to leave us a message.

Tally_Assignment

Description: tally_assignment, read the text version.

No Text Content!

F7ÎManufacturing Journal) Also additional cost incurred for producing shirts Wages Rs. 5000/-, Electricity Rs. 500/- and Packaging Rs. 2000/- F11ÎF2ÎUse Multiple Price Levels Company Price Levels : 1) Price costing GOTÆInventory InfoÆPrice List Price Level for Shirt (Garments) Page 50 of 90

bhimgautam345

Related publications.

- Class 6 Maths

- Class 6 Science

- Class 6 Social Science

- Class 6 English

- Class 7 Maths

- Class 7 Science

- Class 7 Social Science

- Class 7 English

- Class 8 Maths

- Class 8 Science

- Class 8 Social Science

- Class 8 English

- Class 9 Maths

- Class 9 Science

- Class 9 Social Science

- Class 9 English

- Class 10 Maths

- Class 10 Science

- Class 10 Social Science

- Class 10 English

- Class 11 Maths

- Class 11 Computer Science (Python)

- Class 11 English

- Class 12 Maths

- Class 12 English

- Class 12 Economics

- Class 12 Accountancy

- Class 12 Physics

- Class 12 Chemistry

- Class 12 Biology

- Class 12 Computer Science (Python)

- Class 12 Physical Education

- GST and Accounting Course

- Excel Course

- Tally Course

- Finance and CMA Data Course

- Payroll Course

Interesting

- Learn English

- Learn Excel

- Learn Tally

- Learn GST (Goods and Services Tax)

- Learn Accounting and Finance

- GST Tax Invoice Format

- Accounts Tax Practical

- Tally Ledger List

- GSTR 2A - JSON to Excel

Are you in school ? Do you love Teachoo?

We would love to talk to you! Please fill this form so that we can contact you

You are learning...

Click on any of the links below to start learning from Teachoo ...

Learn Latest Tally ERP9 with GST free at Teachoo. Notes and videos provided on how to put ledgers, learn in which head the ledger will come, important tally features, reports and errors in Tally, how to prepare files for return filing

To practice GST Return Filing with Tally, take our Tally course .

In this Tally Tutorial, we cover

- Basics - What is Tally, How to install Tally for GST, Creating Company in Tally ERP9

- Ledgers - Creating Ledgers, Heads in which Ledger comes, Seeing Ledgers created, Alter or Changing Ledgers, Putting Opening Balances in Tally

- Passing Entries in Tally - Type of Accounting Vouchers in Tally ERP9, Seeing Entries Passed, Passing Duplicate Entries, Deleting Entries, Passing Receipt, Payment, Contra Entries, Passing Purchase Entries, Sales Entries, Mixed Entries

- Important Tally Features - Tally Shortcuts, Copying Narration in Tally, Copying Tally GST Data in Pendrive, How to Paste or load Tally Data, Mailing Tally Data, Exporting Tally Data in Excel or PDF, Seeing Party or Ledger Balance, Printing Voucher in Tally, Checking Daily Breakup of Transactions in Tally, Deleting Company from Tally

- Important Tally Reports - Debtor Aging Report, Cost Center Reporting/Segment Reporting, BRS (Bank Reconciliation in Tally)

- Common Errors in Tally - Duplicate Ledger, Period not accepting while passing entries in Tally, Difference in opening balances

Get the notes now... Click a topic to start!

You can now watch free videos for these Topics....Click a topic to watch!

You can also download various topics as assignments

Basics of Tally

Ledger creation and alteration, passing entry in tally, important tally features, important tally reports, common errors in tally.

What's in it?

Hi, it looks like you're using AdBlock :(

Please login to view more pages. it's free :), solve all your doubts with teachoo black.

dVIDYA : e-learning | CA/CS/CMA Foundation | CBSE/ISCE/Boards- Class 11-12 | Competitive Exams

Practical Assignments : GST Accounts–Tally

The Practical Assignments-Tax Accounts- covers Basic tasks of Maintaining GST Accounts, from set up, Data Entry to GST Reports, in Tally Prime Rel 3.x.

This assignment is in continuation to Practical Assignments of Basic Financial Accounting & Basic Invoicing & Inventory Accounts. Maintain GST Accounts in the same Company in which Basic Financial Accounts and Basic Invoicing & Inventory Accounts Practical Assignments data were entered.

Perform the operations for each Assignment as explained. Capture the screenshots (Prtscr) and paste it in MS Word file in 1×1 cell. Write the number and Name of screen shot as indicated. Explain the options and operational step.

This way, capture the screenshots and place in MS Word file, in sequence. Don’t repeat same screenshot.

After completing all assignments, take Back up of the data files. Now email to [email protected], attaching the Data Back Up file and screenshot zip file.

GST Accounting – Practical Assignments

Continue in same Company after previous assignments

01-1 Company GST Features

[At Company >Click F11. At Company Features , under section Taxation , set Yes at Enable Goods & Services Tax (GST) . Next, At GST Details screen , under GST Registration Details section, enter the relevant details.]

Capture Screenshot 1-1A : Company Features . 1-1B : Company GST Details set up

For more details, visit

https://dvidya.com/goods-service-tax-gst/ https://dvidya.com/goods-services-tax-gst-set-up-composition-dealers-tally/ https://dvidya.com/goods-services-tax-gst-set-up-regular-dealers-tally/ https://youtu.be/STv3wbduT8A https://youtu.be/RwJJIYC6msE https://youtu.be/VSS48c_LZXY https://youtu.be/OjSvFYUJ_bI https://youtu.be/mLrLyOeDX78 https://youtu.be/7wlTsturfks

02 GST Masters

02-1 Create SGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter SGST; at Under , select Duties & Taxes ; at Tax Type , select SGST/UTGST ; At Inventory Values are affected , set No .

Capture Screenshot 1-2 : SGST Ledger Account Creation.

https://dvidya.com/gst-set-up-accounts-inventory-masters-tally/ https://youtu.be/x8VZLjVEeug https://youtu.be/XVZbi0-ufDY https://youtu.be/Uzsise4yZXg

02-2 Create CGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter CGST; at Under , select Duties & Taxes ; at Tax Type. At Inventory Values are affected , set No . Capture Screenshot 2-2 : CGST Ledger Account Creation.

02-3 Create IGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter IGST; at Under , select Duties & Taxes ; at Tax Type select I GST ; At Inventory Values are affected , set No .

Capture Screenshot 2-3 : CGST Ledger Account Creation.

https://youtu.be/XVZbi0-ufDY

02-4 UQC set up in UoM Master

Set UQC in UoM – Kilograms [Select GoT>Alter> Unit. Select Kilogram. At Unit Alteration , at Unit Quantity Code (UQC) , select KGS-Kilograms from the UQC list. Press Ctrl+A to save].

Capture Screenshot 2-4 : UoM-UQC set up.

https://youtu.be/KAKto78n9fQ

02-5 GST details set up in Stock Item Master

Set GST details in Stock Item Wheat, Select GoT>Alter> Item. Select Wheat, At Stock Item Alteration, Under HSN/SAC & Related Details, at HSN/SAC Details , select Specify Details Here. At HSN Description – Food grains, HSN Code- 1234, At Description of Goods, select Specify Details Here , Under GST Rate and related Details, At GST Rate details, select Specify Details Here . At Taxability Type, select Taxable . At GST Rate, enter the GST Rate applicable for the Item. At Type of Supply, select Goods .

2-5 : Capture Screenshot UoM-UQC set up.

https://youtu.be/U7fuonC9dkI https://youtu.be/LK-df_Oh6Vk

02-6 Set GST details in Supplier Master

At Supplier Ledger Account, enter Tax related details [Select GoT>Alter>Ledger, select ABC & Co. At Ledger Alteration, click F12:Configure. At Ledger Master Configuration screen, under Party Tax Registration details , set Yes at Provide GST Registration details . At Tax Registration details of Ledger Account Master, Enter Registration Type- Regular, GSTIN 19AAAC1234K1ZV. At Set Alter Additional Details, set Yes and then Place of Supply, select the State of the Party.

Capture Screenshot : 2-6A: Ledger Account Master, 2-6B: Ledger Master Configuration screen,

https://youtu.be/1_jlZD8mXkI https://youtu.be/B6jEPMw26Tg

03 GST Invoicing

3-1 Create GST Sales Invoice .

Create Sales Invoice for 10 kg of Wheat @25 per kg sold to ABC & Co on 1-5-21. [Select GoT>Vouchers. Click F8:Sales (or press F8). Select Sales Voucher type from List. Click Ctrl+H and select Item Invoice . Enter Voucher Date 1-5-21 . At Party A/c Name , select ABC & Co . At Sales Ledger, select Sales . At Name of Item , select Wheat , At Quantity , enter 10 kg. at Rate , enter 25/kg. The amount 250 would be shown. In next line, select End of List . Next select SGST, the SGST amount (15.00) would be auto calculated. Next select CGST. the CGST amount (15.00) would be auto calculated. The total Invoice amount (250.00+15.00+15.00 = 280.00) is displayed. Press Ctrl+A to save the Voucher].

Capture Screenshot : 3-1 GST Sales Invoice Entry ,

https://youtu.be/L57aR4Zb7GM https://youtu.be/S0y56oS7r1U

3-2 Print the Sales Voucher

Voucher dated 1-5-23 on ABC Co [Select GoT>Day Book . At Day Book display, press F2 and Date 1-5-23. Select the Sales Voucher from the list to get the Voucher Alteration. Press Ctrl+P to get the Print screen. Click I:Preview to View the Print form of the Invoice on screen]

Capture Screenshot : 3-2 GST Sales Invoice in Print ,

https://youtu.be/L57aR4Zb7GM https://youtu.be/S0y56oS7r1U

03-03 GST Reports

- Display GSTR-1 for 1-4-23 to 31-7-23

[Select GoT>Display more reports>GST Reports>GSTR-1. Click F2:Period (or press F2) and enter Period from 1-4-23 to 31-7-23 to display GSTR-1 Report

Capture Screenshot : 3-3 GSTR-1 Display, https://dvidya.com/gsrt-1-return-filing-tally/

Ask Question, Get Answer

This will close in 0 seconds

COMMENTS

Displaying Tally ERP 9 Assignment.pdf.

rime for GST compliance, you need to activate the GST feature. Once activated, GST-related features are available in ledgers, s. ock items, and transactions, and GST returns can be. enerated.Open the company for which you need to activate GST. Press F. 1 (Features) > set Enable Goods and Services Tax (GST) to Yes.

Download free Tally practice assignment with GST solutions from Super Success Institute. Learn and practice Tally ERP 9 with GST notes, invoices, bills, ledgers, cost centers and more.

If you are preparing for Banking and RRB then there is a single-stop destination as far as preparation of all of these examinations is concerned. Here in this post, we are happy to provide Chapter Wise & Topic Wise Tally Practical Assignment PDF download. Tally Practical Assignment Pdf Download Tally Practical Assignment with Solution Pdf Download

Easy Learning Tool Kit : Digital Book + Tally Data File + Video Tutorials. Video tutorial Link- https://bit.ly/2Ef6etC. Download "Tally Data File" prepared for this project work to verify your progress. Download link is provided in Balance Sheet section of book. You will learn to use Tally with complete project work.

Mundka, Delhi-110041GST No-07AAACF3168K1ZJQ.1. On 1st April 2017 Rent pay Rs.31500 (35000-3500(TDS)) for the. onth of March 2017 to Moh. n (Pan no-DQTPK9758M). Pass the necessary entry.Q.2 On 1st August 2017 Flow mach Pvt. Ltd. Received invoice of cartage from Bala transport Services of Rs.1,10,000 (104.

See Full PDFDownload PDF. Tax planning is an important thing to do so that the transaction withholding tax and value added tax on reimbursement transactions is not subject to double taxation. With tax planning, taxpayers can streamline the tax payable so that the taxes paid are not too high but in accordance with applicable tax provisions.

Check Pages 1-50 of Tally_Assignment in the flip PDF version. Tally_Assignment was published by bhimgautam345 on 2020-02-18. Find more similar flip PDFs like Tally_Assignment. Download Tally_Assignment PDF for free.

Super Success Institute Tally Computer Training Coaching Classes Day by Day Tasks. Notes are very useful to learn and practice Tally ERP 9 with GST. We found that student faces problem in finding practice assignments for Tally. The training faculty of Super Success Institute has compiled practice tasks in this PDF for self-study of students.

You can create a Company profile by using the following procedure : Gateway of Tally.ERP 9 → Create Company (from opening screen) F3) → Create Company It provides the following screen:Finally, confirm company creation by pressing the ENTER k. y/ "Y" key to accept all declaration for the Compan.

A Practical Hands-on Self-Study Approach TallyPrime Book - Rel. 3 & Higher TallyPrime Book Page: (Advanced Usage) 3 Visit us: www.TallyPrimeBook.com - Rel. 3 & Higher Instruction : All are requested to attempt all Practical Assignment given after every Chapter with the help of your

Learn Latest Tally ERP9 with GST free at Teachoo. Notes and videos provided on how to put ledgers, learn in which head the ledger will come, important tally features, reports and errors in Tally, how to prepare files for return filing. To practice GST Return Filing with Tally, take our Tally course. In this Tally Tutorial, we cover.

Accounting Package - Tally Page 10 of 90 Class Room Assignment No.1:- Create a company Milan Trade for the year 2009-10, and pass necessary Journal Entries Journalize the following transactions 1. Commenced business with cash Rs.10, 000. 2. Deposit into bank Rs. 15,000 3. Bought office furniture Rs.3,000 4. Soled goods for cash Rs.2,500 1

Practical Assignments and work review is essential and integral part of dVidya Training. This post describes practical assignments for students covering GST Accounts in Tally Prime. Guidance for performing the tasks included for convenience. The students do the work and submit the report and data files for review.