Accounting Cycle

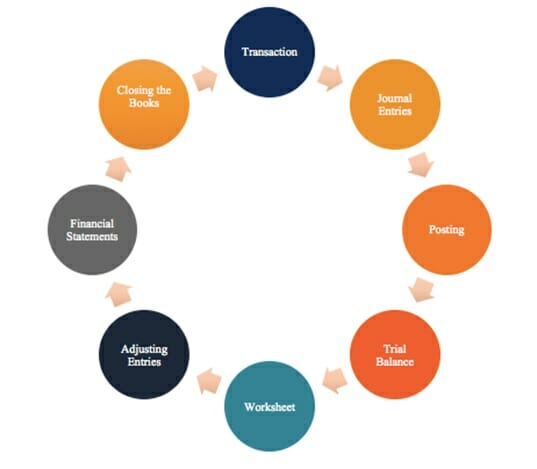

8 steps in the accounting cycle

What is the Accounting Cycle?

The accounting cycle is the holistic process of recording and processing all financial transactions of a company, from when the transaction occurs, to its representation on the financial statements , to closing the accounts. One of the main duties of a bookkeeper is to keep track of the full accounting cycle from start to finish. The cycle repeats itself every fiscal year as long as a company remains in business.

The accounting cycle incorporates all the accounts, journal entries, T accounts , debits, and credits, adjusting entries over a full cycle.

Steps in the Accounting Cycle

#1 transactions.

Transactions: Financial transactions start the process. If there were no financial transactions, there would be nothing to keep track of. Transactions may include a debt payoff, any purchases or acquisition of assets, sales revenue, or any expenses incurred.

#2 Journal Entries

Journal Entries : With the transactions set in place, the next step is to record these entries in the company’s journal in chronological order. In debiting one or more accounts and crediting one or more accounts, the debits and credits must always balance.

#3 Posting to the General Ledger (GL)

Posting to the GL: The journal entries are then posted to the general ledger where a summary of all transactions to individual accounts can be seen.

#4 Trial Balance

Trial Balance: At the end of the accounting period (which may be quarterly, monthly, or yearly, depending on the company), a total balance is calculated for the accounts.

#5 Worksheet

Worksheet: When the debits and credits on the trial balance don’t match, the bookkeeper must look for errors and make corrective adjustments that are tracked on a worksheet.

#6 Adjusting Entries

Adjusting Entries : At the end of the company’s accounting period, adjusting entries must be posted to accounts for accruals and deferrals.

#7 Financial Statements

Financial Statements : The balance sheet, income statement, and cash flow statement can be prepared using the correct balances.

Closing: The revenue and expense accounts are closed and zeroed out for the next accounting cycle. This is because revenue and expense accounts are income statement accounts, which show performance for a specific period. Balance sheet accounts are not closed because they show the company’s financial position at a certain point in time.

General Ledger

The general ledger serves as the eyes and ears of bookkeepers and accountants and shows all financial transactions within a business. Essentially, it is a huge compilation of all transactions recorded on a specific document or in accounting software .

For example, if you want to see the changes in cash levels over the course of the business and all their relevant transactions, you would look at the general ledger, which shows all the debits and credits of cash.

Accounting Cycle Fundamentals

To fully understand the accounting cycle, it’s important to have a solid understanding of the basic accounting principles. You need to know about revenue recognition (when a company can record sales revenue), the matching principle (matching expenses to revenues), and the accrual principle .

The fundamental concepts above will enable you to construct an income statement, balance sheet, and cash flow statement, which are the most important steps in the accounting cycle. To learn more, check out CFI’s free Accounting Fundamentals Course .

Additional Resources

Thank you for reading CFI’s guide on the Accounting Cycle. To keep learning and advancing your career, the following resources will be helpful:

- Financial Accounting Theory

- Hedge Accounting

- Revenue Recognition Principle

- Discontinued Operations

- See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

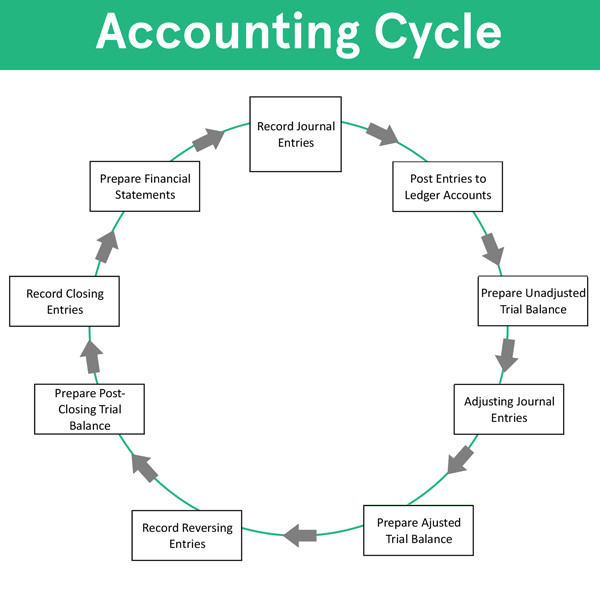

The Accounting Cycle: 8 Steps You Need To Know

Updated: Jun 14, 2024, 7:41pm

Table of Contents

What is the accounting cycle, why is the accounting cycle important, 8 steps in the accounting cycle, frequently asked questions (faqs).

Accurate bookkeeping is a necessity for any business. Disorganized books can lead to bad decisions, failure to fulfill various obligations and sometimes even legal problems. That’s why today we will discuss the eight accounting cycle steps you can follow to ensure accuracy.

The accounting cycle is an eight-step process that accountants and business owners use to manage a company’s books throughout a particular accounting period—typically throughout the fiscal year (FY). The federal government’s fiscal year spans 12 months, beginning on October 1 of one calendar year and ending on September 30 of the next. FY 2023 starts on October 1, 2022 and ends on September 30, 2023.

It starts with recording all financial transactions throughout that accounting period and ends with posting closing entries to close the books and prepare for the next accounting period. It’s worth noting that some businesses also have internal accounting cycles that have a shorter accounting period. These internal accounting cycles follow the same eight accounting cycle steps and can last anywhere from one month to six months.

A shorter internal accounting cycle can make bookkeeping more manageable, especially when the company’s finances are complicated. However, businesses with internal accounting cycles also follow the external accounting cycle of the fiscal year.

Featured Partners

Special Offer: 75% off for 6 months

On Xero's Website

Sage Intacct

On Sage's Website

$15 per month (for the first 3-months, then $30 per month)

Expert help, Invoicing, maximize tax deductions, track mileage

On QuickBooks' Website

The accounting cycle is critical because it helps to ensure accurate bookkeeping . Skipping steps in this eight-step process will likely lead to an accumulation of errors. If these errors aren’t caught and corrected, they can give you and your employees an inaccurate view of your company’s financial situation.

Moreover, if you have inaccurate information, you might inadvertently mislead your lenders, creditors and investors, which can have serious legal consequences. Finally, if your books are disorganized, you might provide inaccurate information when filing taxes . It can get you in trouble with the IRS.

There are eight accounting cycle steps. The first three steps are ongoing. You need to perform these bookkeeping tasks throughout the entire fiscal year.

Meanwhile, the remaining five steps are the bookkeeping tasks you do at the end of the fiscal year. Fortunately, nowadays, you can automate these tasks with accounting software, so doing all this isn’t as time-consuming as it might seem at first glance.

1. Identify Transactions

You need to identify all transactions that occur throughout the fiscal year. The best approach to do that is to create a system where every transaction is automatically captured because that prevents human error. Typically, companies integrate their accounting software with their payment processor and point-of-sale (POS) software to capture revenue.

However, you also need to capture expenses, which you can do by integrating your accounting software with your company’s bank account so that every payment will be charged automatically.

2. Prepare Journal Entries

Double-entry accounting, considered the standard accounting practice worldwide, requires recording each transaction with two journal entries: a credit entry and a debit entry. These words describe the source of the financial benefit (credit) and the destination of the financial benefit (debit).

Making two entries for each transaction means you can compare them later. If they don’t match, you will know there’s an error somewhere. All popular accounting apps are designed for double-entry accounting and automatically create credit and debit entries.

One thing to keep in mind here is that how you should record journal entries depends on whether you are using the cash accounting method or the accrual accounting method :

- Cash accounting. An accounting method that focuses on tracking the business’s cash flow—you record the financial transactions as the money comes in or goes out.

- Accrual accounting. An accounting method that focuses on tracking business transactions as they occur—even if the money exchange related to the transaction in question hasn’t happened yet.

Both of these methods have their advantages and disadvantages. We recommend reading our article on this subject so that you can choose the approach that makes the most sense for your business.

That being said, accrual accounting offers a more accurate picture of the financial state of any given business, which is why in some cases, companies are obligated by law to use this method.

3. Post Journal Entries to General Ledger

You need to post every journal entry to the general ledger. The general ledger is a central database that stores the complete record of your accounts and all transactions recorded in those accounts.

You post an entry to the general ledger by adding it to the relevant account. You can automate this with accounting software.

4. Calculate the Unadjusted Trial Balance

A trial balance is an accounting document that shows the closing balances of all general ledger accounts. You need to calculate the trial balance at the end of the fiscal year. The objective of the trial balance is to help you catch mistakes in your accounting.

The total credit and debit balance should be equal—if they don’t match, there’s an error somewhere. The unadjusted trial balance is the initial version of the trial balance that hasn’t been analyzed for accuracy and adjusted as needed.

5. Post Adjusting Journal Entries to General Ledger

If the total credit and debit balances don’t match, you need to figure out what’s missing, record those transactions and post these adjusting entries to the general ledger.

Also, if you have been using cash accounting but want to create a financial statement that meets IFRS or GAAP standards, you will need to post adjusting entries to bring your general ledger in line with accrual accounting.

6. Calculate the Adjusted Trial Balance

The result of posting adjusting entries should be an adjusted trial balance where the total credit balance and the total debit balance match.

7. Prepare Financial Statements

Once you have the adjusted trial balance, you should use it to create your financial statements. Here are the three most popular types of financial statements:

- An income statement recaps the company’s revenues and expenses over the accounting period.

- A cash flow statement outlines the company’s cash inflows and outflows over the accounting period.

- A balance sheet summarizes what the company owns and owes at the accounting period’s end.

You can then show these financial statements to your lenders, creditors and investors to give them an overview of your company’s financial situation at the end of the fiscal year.

8. Post Closing Journal Entries To Close the Books

Finally, you need to post closing entries that transfer balances from your temporary accounts to your permanent accounts. That’s how you close the books for that fiscal year.

Bottom Line

Following the eight-step accounting cycle can help you accurately record all financial transactions, catch and correct errors and balance your books at the end of each fiscal year before you close them.

What is the accounting cycle?

The accounting cycle is an eight-step process that accountants and business owners use to manage the company’s books throughout a specific accounting period, such as the fiscal year.

What are the eight steps of the accounting cycle?

- Identify transactions

- Prepare journal entries

- Post journal entries to the general ledger

- Calculate the unadjusted trial balance

- Post adjusting journal entries to the general ledger

- Calculate the adjusted trial balance

- Prepare financial statements

- Post closing journal entries to close the books

Is it necessary to follow the accounting cycle?

Yes. Following the accounting cycle is a standard practice that helps to ensure that all financial transactions are accounted for. Not following the accounting cycle would likely lead to an accumulation of bookkeeping errors, which could cause severe problems for your business.

Are bookkeeping and accounting different?

Bookkeeping focuses on recording and organizing financial data, including tasks, such as invoicing, billing, payroll and reconciling transactions. Accounting is the interpretation and presentation of that financial data, including aspects such as tax returns, auditing and analyzing performance.

- Best Accounting Software for Small Business

- Best Quickbooks Alternatives

- Best Online Bookkeeping Services

- Best Accounting Software for Mac

- Best Construction Accounting Software

- Best Free Accounting Software

- Best Accounting Software for Nonprofits

- Best Church Accounting Software

- Best Real Estate Accounting Software

- Best Receipt Scanner Apps

- FreshBooks Review

- Xero Review

- QuickBooks Online Review

- Kareo Review

- Zoho Books Review

- Sage Accounting Review

- Neat Review

- Kashoo Review

- QuickBooks Self-Employed Review

- QuickBooks For LLC Review

- FreshBooks vs. Quickbooks

- Quicken vs. Quickbooks

- Xero vs. Quickbooks

- Netsuite vs. Quickbooks

- Sage vs. Quickbooks

- Quickbooks Pro vs. Premier

- Quickbooks Online vs. Desktop

- Wave vs. Quickbooks

- Gusto vs. Quickbooks

- Zoho Books vs. Quickbooks

- What Is Accounting? The Basics

- How Much Does An Accountant Cost?

- How To Find A Small Business Accountant

- Bookkeeping vs. Accounting

- Small Business Bookkeeping for Beginners

- What is Bookkeeping?

- Accounts Payable vs. Accounts Receivable

- What is a Balance Sheet?

- What is Cost Accounting?

Next Up In Accounting

- Best Accounting Software For Small Business

- Best QuickBooks Alternatives

- Quicken Review

- NeatBooks Review

- Gusto vs Quickbooks

- Quickbooks Online Vs. Desktop: What’s The Difference?

What Is SNMP? Simple Network Management Protocol Explained

What Is A Single-Member LLC? Definition, Pros And Cons

What Is Penetration Testing? Definition & Best Practices

What Is Network Access Control (NAC)?

What Is Network Segmentation?

How To Start A Business In Louisiana (2024 Guide)

Tomas Laurinavicius is a writer and designer. He's a co-founder of Best Writing, an all-in-one platform connecting writers with businesses. He has built multiple online businesses and helps startups and enterprises scale their content marketing operations. He worked with TIME, Observer, HuffPost, Adobe, Webflow, Envato, InVision, and BigCommerce.

- Accounting Cycle

Home › Accounting › Accounting Cycle › Accounting Cycle

- What is the Accounting Cycle?

Accounting Cycle Steps

Accounting cycle flow chart.

The accounting cycle is a series of steps starting with recording business transactions and leading up to the preparation of financial statements . This financial process demonstrates the purpose of financial accounting –to create useful financial information in the form of general-purpose financial statements . In other words, the sole purpose of recording transactions and keeping track of expenses and revenues is turn this data into meaning financial information by presenting it in the form of a balance sheet, income statement, statement of owner’s equity, and statement of cash flows.

The accounting cycle is a set of steps that are repeated in the same order every period. The culmination of these steps is the preparation of financial statements. Some companies prepare financial statements on a quarterly basis whereas other companies prepare them annually. This means that quarterly companies complete one entire accounting cycle every three months while annual companies only complete one accounting cycle per year.

This cycle starts with a business event. Bookkeepers analyze the transaction and record it in the general journal with a journal entry. The debits and credits from the journal are then posted to the general ledger where an unadjusted trial balance can be prepared.

After accountants and management analyze the balances on the unadjusted trial balance, they can then make end of period adjustments like depreciation expense and expense accruals. These adjusted journal entries are posted to the trial balance turning it into an adjusted trial balance.

Now that all the end of the year adjustments are made and the adjusted trial balance matches the subsidiary accounts, financial statements can be prepared. After financial statements are published and released to the public, the company can close its books for the period. Closing entries are made and posted to the post closing trial balance.

At the start of the next accounting period, occasionally reversing journal entries are made to cancel out the accrual entries made in the previous period. After the reversing entries are posted, the accounting cycle starts all over again with the occurrence of a new business transaction.

Here are the 9 main steps in the traditional accounting cycle.

- — Identify business events, analyze these transactions, and record them as journal entries

- — Post journal entries to applicable T-accounts or ledger accounts

- — Prepare an unadjusted trial balance from the general ledger

- — Analyze the trial balance and make end of period adjusting entries

- — Post adjusting journal entries and prepare the adjusted trial balance

- — Use the adjusted trial balance to prepare financial statements

- — Close all temporary income statement accounts with closing entries

- — Prepare the post closing trial balance for the next accounting period

- — Prepare reversing entries to cancel temporary adjusting entries if applicable

Some textbooks list more steps than this, but I like to simplify them and combine as many steps as possible.

After this cycle is complete, it starts over at the beginning. Here is an accounting cycle flow chart.

As you can see, the cycle keeps revolving every period. Note that some steps are repeated more than once during a period. Obviously, business transactions occur and numerous journal entries are recording during one period. Only one set of financial statements is prepared however.

Throughout this section, we’ll be looking at the business events and transactions that happen to Paul’s Guitar Shop, Inc. over the course of its first year in business.

Let’s take a look at how Paul starts his accounting cycle below.

- Journal Entries

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Financial Statements

- Accounting Worksheet

- Closing Entries

- Income Summary Account

- Post Closing Trial Balance

- Reversing Entries

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Financial Accounting Basics

- Accounting Principles

- Financial Statement Prep

- Financial Ratios

Accounting Cycle: Common Steps Exploratory Essay

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

Accounting cycle is a series of activities that that shows the entire process a transaction goes through from start to end. These processes are repeated in each accounting period. The paper discusses the accounting cycle of the office of the chief financial officer. The cycle follows some common steps.

The first step is identification of the transaction and the events which surround the transaction. The second step focuses on the putting together source documents of the transaction. The third step entails examining and putting the transactions into classes. This step entails ascertaining the monetary value of the transactions and identifying the accounts where the transaction will be posted.

At this stage, the persons involved also identify whether to pass a credit or debit entry on the accounts affected. The fourth step involves recording the transactions into journals. These journals depend on the nature of the transactions. The fifth step entails sorting out the entries in the general journal.

Once sorted, the entries are posted to various ledger accounts. It is important to point out that these first five steps occur repeatedly throughout the accounting cycle that is from start to the end of the accounting cycle. The subsequent steps occur at the end of the financial year. The sixth step entails preparation of the trial balance.

The trial balance shows a summary of ledger accounts maintained in an accounting period. It shows the debit and credit balances from the ledger accounts. The trial balance has no significant accounting meaning. It only helps in identifying errors while posting transactions because, in the presence of errors, the debit and credit balances will not be in agreement.

The seventh step entails correcting the errors in the trial balance. The corrections can only be executed if the credit and debit balance are not tallied. The errors can be caused by wrong posting of transactions or omission during posting of transactions (Hunt, Kieso, Weygandt & Warfield, 2010).

The eighth step entails coming up with adjusting entries to correct the errors in the trial balance. The ninth step entails passing the correcting entries in the ledger accounts. The tenth step entails coming up with a trial balance that reflect the adjustments made. This step is similar to the sixth step.

The accountant must ensure that the trial balance is in balance. This should be done severally until the trial balance is in balance. The eleventh step entails preparing the financial statements these are, statement of financial position, income statement, statement of retained earnings, and cash flow statement. The twelfth step entails coming up with closing journal entries to close up the temporary accounts.

The thirteenth step entails passing the closing entries to the ledger accounts. After passing the journal entries, the fourteenth step will entail trial balance to ensure that the debit and credit entries are in balance. The final step involves preparing reversal journal entries.

This stage is option though it helps an accountant to ensure that there is no double accounting of corrective entries done when preparing the books of accounts. More than often, the accounting cycle is often grouped into seven steps. It is best to breakdown down into several smaller steps so as to ensure that all steps are taken into account (Kieso, Weygandt, & Warfield, 2010).

The office of the chief financial officer “formulates and manages annual budget and performance plan, coordinates strategic planning, develops an annual performance and accountability report implement government performance result” (United States Environmental Protection Agency, 2013).

The officer also provides financial services and makes payments on behalf of the state and other agencies. The chief financial officer is Barbara J. Bennett, the deputy is Maryann Froehlich and associate chief financial officer is Joshua Baylson. The office of the chief financial officer comprises of seven sections. The sections represent the activities they carry out. The first section is the office of the budget.

The section is charged with the responsibility of formulating budgets. The office of the budget leadership is led by David bloom as the director. The deputy director is Carol Terris. This office offers the first step of the accounting cycle in the office of the chief financial officer (United States Environmental Protection Agency, 2013).

The second section is the office of planning, analysis and accountability. This section carries out strategic and annual planning, performance management and reporting efforts. The section aligns the strategies to the government budgets. The section is led by Kathy Sedlak O’Brien as the director and Allison Wiedeman as the acting deputy director. The third section carries out the third step of the accounting cycle of office.

The office provides policy, reports, and oversight essential. The section is headed by Steve Silzer and Jeanne Conklin as the deputy director.

The fourth section is the office of technology solutions. The section carries out “technology planning, standard setting and development and deployment of financial and resources management system for the agency” (United States Environmental Protection Agency, 2013).

The section is led by Quentin Jones and Robert Hill as the deputy director. The other sections such as office of the financial services, office of the resources and information management, and center for environmental finance for support services.

Hunt, F., Kieso, E., Weygandt, J., & Warfield, D. (2010). Intermediate accounting problem-solving survival guide . Hoboken, NJ: Wiley.

Kieso, E., Weygandt, J., & Warfield, D. (2010). Intermediate accounting . Hoboken, NJ: Wiley.

United States Environmental Protection Agency. (2013). About the office of the chief financial officer (OCFO) . Web.

- Stakeholders and Financial Accounting Theories

- Financial statement disclosures, cash and cash equivalents

- Distributed Ledger Technology and Governance Issues

- Preparing an Adjusted Trial Balance

- Debit Card Interchange Fees and Routing

- Australia's Intangible Assets Policy Before the IFRS

- Management Accounting in Company

- Financial Reporting Standards in Accounting and Management

- Australian Securities and Investments Commission

- Environmental Factors Which Influence Accounting Systems

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2019, April 13). Accounting Cycle: Common Steps. https://ivypanda.com/essays/accounting-cycle-common-steps/

"Accounting Cycle: Common Steps." IvyPanda , 13 Apr. 2019, ivypanda.com/essays/accounting-cycle-common-steps/.

IvyPanda . (2019) 'Accounting Cycle: Common Steps'. 13 April.

IvyPanda . 2019. "Accounting Cycle: Common Steps." April 13, 2019. https://ivypanda.com/essays/accounting-cycle-common-steps/.

1. IvyPanda . "Accounting Cycle: Common Steps." April 13, 2019. https://ivypanda.com/essays/accounting-cycle-common-steps/.

Bibliography

IvyPanda . "Accounting Cycle: Common Steps." April 13, 2019. https://ivypanda.com/essays/accounting-cycle-common-steps/.

IvyPanda uses cookies and similar technologies to enhance your experience, enabling functionalities such as:

- Basic site functions

- Ensuring secure, safe transactions

- Secure account login

- Remembering account, browser, and regional preferences

- Remembering privacy and security settings

- Analyzing site traffic and usage

- Personalized search, content, and recommendations

- Displaying relevant, targeted ads on and off IvyPanda

Please refer to IvyPanda's Cookies Policy and Privacy Policy for detailed information.

Certain technologies we use are essential for critical functions such as security and site integrity, account authentication, security and privacy preferences, internal site usage and maintenance data, and ensuring the site operates correctly for browsing and transactions.

Cookies and similar technologies are used to enhance your experience by:

- Remembering general and regional preferences

- Personalizing content, search, recommendations, and offers

Some functions, such as personalized recommendations, account preferences, or localization, may not work correctly without these technologies. For more details, please refer to IvyPanda's Cookies Policy .

To enable personalized advertising (such as interest-based ads), we may share your data with our marketing and advertising partners using cookies and other technologies. These partners may have their own information collected about you. Turning off the personalized advertising setting won't stop you from seeing IvyPanda ads, but it may make the ads you see less relevant or more repetitive.

Personalized advertising may be considered a "sale" or "sharing" of the information under California and other state privacy laws, and you may have the right to opt out. Turning off personalized advertising allows you to exercise your right to opt out. Learn more in IvyPanda's Cookies Policy and Privacy Policy .

Accounting Cycle-Definition, Steps, Examples, and Explanation [With PDF]

In this article, we will learn about the accounting cycle , including its definition, various steps, examples, and many more.

What is Accounting Cycle?

The accounting cycle refers to the cycle in which the steps of the accounting process revolve.

According to the going concern concept, a business is expected to continue indefinitely. This indefinite period of time is divided into short periods to determine the business organization’s results and financial status.

The accounting cycle is essentially the periodic expression of an organization’s accounting functions.

Following that, the parties involved in all of the transactions included in the journal are entered into the ledger by categorizing them according to the specific person, organization, income, expenditure, liability, or property account.

A trial balance is then prepared to verify the mathematical accuracy of the account with the ledger’s arrears.

In the end, all financial statements are thoroughly explained and analyzed.

The accounting cycle refers to the regular and periodic rotation and repetition of accounting activities.

Accounting cycle is a series of steps related to accumulating, processing and reporting useful financial information that are performed during an accounting period. Hermanson & Others

As long as a business is in operation, this accounting process continues.

Accounting Cycle Steps

The steps of the accounting cycle depend on how an organization conducts its accounting process. Therefore, the steps of the organization’s accounting cycle can be different. The following are some common steps that can be taken in the accounting cycle:

The diagram below shows the nine steps in the accounting cycle:

If a worksheet is made, steps 4, 5, and 6 are included in it. If reversing entries are prepared, they happen between Steps 9 and 1 .

Step 1: Identification and analysis of business transactions:

The identification of transactions is the first step in the accounting cycle. In a business concern or in any other organization, numerous events take place every day. Although not all events are transactions. There is accounting for the events that are transactions.

The purchase of goods for $15,000 in cash, on the other hand, qualifies as a transaction because it affected the company’s finances.

Step 2: Journalizing:

Various journal books , such as sales books, purchase books, cash books, and so on, are used to record transactions in the primary book of accounts.

Step 3: Ledger posting:

It is possible to obtain various pieces of information regarding business from the balances of the ledger accounts. That is why the ledger is referred to as the king of all accounting books.

For example, salaries are paid at various times during an accounting period. However, the amount of total salary paid within that accounting period at the end of the accounting period can be determined from the salary account.

As a result, the balance of the accounts at the end of the accounting period will show the relevant income, expenditure, assets, liabilities, and capital.

Step 4: Preparation of a trial balance:

Preparing the trial balance is the fourth step of the accounting cycle. A trial balance is prepared using the ledger account balances following the preparation of the ledger accounts.

The purpose of the trial balance is to simplify the financial statement preparation process and demonstrate the ledger account’s accuracy in math.

Step 5: Journalizing and posting adjusting entries:

The fifth step in the accounting cycle is journalizing and posting adjusting entries .

Adjusting journal entries, also known as “adjusting entries,” are used to correct information that was either not accounted for or was incorrectly accounted for.

Step 6: Preparation of an adjusted trial balance:

Preparing an adjusted trial balance is the sixth step in the accounting cycle.

However, the information pertaining to the specific period that affects the financial statements must first be journalized and re-posted in the ledger accounts in order to determine the relevant ledger balances at the end of the period.

The trial balance that is prepared using these ledger balances is known as the adjusted trial balance.

Step 7: Preparation of financial statements:

Income statements and balance sheets are the most important financial statements. At the end of a specific accounting period, financial statements are created to show the precise financial position of an organization.

Step 8: Journalizing and posting closing entries:

The eighth step in the accounting cycle is journalizing and posting closing entries . The periodic expenses and income, along with the remaining balance of the income statement, are generally closed by passing closing entries after the financial statement has been prepared.

Step 9: Preparation of a post-closing trial balance:

Preparing a post-closing trial balance is the last step of the accounting cycle.

Following the journalizing and posting of closing entries, the post-closing trial balance shows the permanent accounts and their balances.

The post-closing trial balance will only include accounts from the permanent balance sheet because all temporary accounts will have zero balances.

Accounting cycle optional steps

The accounting cycle also includes two additional optional steps. As you may already be aware, businesses might use a worksheet when creating adjusting entries and financial statements. They can also use reversing entries, which are covered in more detail below.

1. Worksheet:

Large businesses with a comparatively high number of accounts and adjustments may choose to skip this step of the accounting cycle.

The worksheet is set up to make it simple and accurate to prepare financial statements. A worksheet is created prior to the creation of financial statements.

A worksheet is an addition to the f inancial statements. The worksheet is used to prepare the financial statements.

2. Reversing entries:

Some accountants prefer to make a reversing entry at the start of the following accounting period in order to reverse specific adjusting entries.

An adjusting entry made in the previous period is completely reversed by a reversing entry. Reversing entries is a bookkeeping technique that is optional; it is not an essential step in the accounting cycle.

Accounting Cycle Avoidable Step

Correcting entries:.

Regrettably, mistakes can happen during the recording process. As soon as errors are found, businesses should journal about them and post corrective entries. There is no need for correcting entries if the accounting records are error-free.

Second, businesses only record and journalize adjustments at the end of an accounting period. Contrarily, whenever a mistake is found, businesses make corrective entries.

This makes it easier to determine which accounts and amounts need to be corrected and which ones do not. The accountant compares and then enters a correction to the accounts.

Leave a Comment Cancel reply

- Search Search Please fill out this field.

What Is the Accounting Cycle?

- How It Works

Accounting Cycle vs. Budget Cycle

The bottom line.

- Corporate Finance

Accounting Cycle Definition: Timing and How It Works

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

The accounting cycle is a collective process of identifying, analyzing, and recording the accounting events of a company. It is a standard 8-step process that begins when a transaction occurs and ends with its inclusion in the financial statements and the closing of the books.

The key steps in the eight-step accounting cycle include recording journal entries, posting to the general ledger, calculating trial balances, making adjusting entries, and creating financial statements.

Key Takeaways

- The accounting cycle is a process designed to make the financial accounting of business activities easier for business owners.

- The first step in the eight-step accounting cycle is to record transactions using journal entries.

- The eighth and final step is the closing of the books after preparing financial statements.

- The accounting cycle generally comprises a year or other accounting period.

- Accounting software today mostly automates the accounting cycle.

Investopedia / Joules Garcia

How the Accounting Cycle Works

The accounting cycle is a methodical set of rules that can help ensure the accuracy and conformity of financial statements . Computerized accounting systems and the uniform process of the accounting cycle have helped to reduce mathematical errors.

Today, most software fully automates the accounting cycle, which results in less human effort and errors associated with manual processing.

Steps of the Accounting Cycle

There are eight steps to the accounting cycle .

- Identify Transactions: An organization begins its accounting cycle with the identification of those transactions that comprise a bookkeeping event. This could be a sale, refund, payment to a vendor, and so on.

- Record Transactions in a Journal: Next comes the recording of transactions using journal entries . The entries are based on the receipt of an invoice, recognition of a sale, or completion of other economic events.

- Posting : Once a transaction is recorded as a journal entry, it should post to an account in the general ledger . The general ledger provides a breakdown of all accounting activities by account.

- Unadjusted Trial Balance : After the company posts journal entries to individual general ledger accounts, an unadjusted trial balance is prepared. The trial balance ensures that total debits equal total credits in the financial records.

- Worksheet : The fifth step is to create and analyze a worksheet of debits and credits to identify necessary adjusting entries, if there are discrepancies.

- Adjusting Journal Entries: At the end of the period, adjusting entries are made. These result from corrections made on the worksheet and the passage of time. For example, an adjusting entry may involve interest revenue that has been earned over time.

- Financial Statements : Upon the posting of adjusting entries, a company prepares an adjusted trial balance followed by the actual, formal financial statements.

- Closing the Books : An entity finalizes temporary accounts, revenues, and expenses, at the end of the period using closing entries . These closing entries include transferring net income to retained earnings. Finally, a company prepares the post-closing trial balance to ensure debits and credits match and the cycle can begin anew.

An accounting cycle is used by most but not all businesses. Sole proprietorships, other small businesses, and entrepreneurs may not follow it.

Timing of the Accounting Cycle

The accounting cycle is started and completed within an accounting period , the time in which financial statements are prepared. Accounting periods vary and depend on different factors. However, the most common type of accounting period is the annual period.

During the accounting cycle, many transactions occur and are recorded. At the end of the fiscal year, financial statements are prepared (and are often required by government regulation).

For example, public entities are required to submit financial statements by certain dates. All public companies that do business in the U.S. are required to file registration statements, periodic reports, and other forms to the U.S. Securities and Exchange Commission. Therefore, their accounting cycles are tied to reporting requirement dates.

The accounting cycle is different from the budget cycle. The accounting cycle focuses on historical events and ensures that incurred financial transactions are reported correctly.

Alternatively, the budget cycle relates to future operating performance and planning for future transactions. The accounting cycle assists in producing information for external users, while the budget cycle is mainly used for internal management purposes.

Why Is the Accounting Cycle Important?

It's important because it can help ensure that the financial transactions that occur throughout an accounting period are accurately and properly recorded and reported. This can provide businesses with a clear understanding of their financial health and ensure compliance with federal regulations.

What Are Benefits of the Accounting Cycle?

The accounting cycle can aid a company in keeping accurate books (and not losing important financial information), analyzing financial events, preparing required financial statements, and, overall, managing a business successfully.

Who Is Responsible for Performing the Accounting Cycle?

Usually, accountants are employed to manage and conduct the accounting tasks required by the accounting cycle. If a small business or one-person shop is involved, the owner may handle the tasks, or outsource the work to an accounting firm.

The accounting cycle is a comprehensive accounting process that begins and ends in an accounting period. It involves eight steps that ensure the proper recording and reporting of financial transactions. Once a company's books are closed and the accounting cycle for a period ends, it begins anew with the next accounting period and financial transactions.

U.S. Securities and Exchange Commission. " Filings & Forms ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-537360382-ac79242494e84a5bbfd2336d24f86084.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

BUS103: Introduction to Financial Accounting

The Accounting Cycle

Read each section on this page. You have been exposed to the concepts of recording and journalizing transactions previously, but this explains the rest of the accounting process. The accounting cycle is the repetitive set of steps that must occur in every business every period in order to meet reporting requirements.

What is the Accounting Cycle?

The accounting cycle is performed during the accounting period, to analyze, record, classify, summarize, and report financial information.

Learning Objectives

- Identify and complete the 8 steps in the Accounting Cycle

- Recognize a business transaction

- Analyze a source document

- The accounting cycle has 8 Steps.

- Each transaction must be analyzed to determine whether it qualifies as a business transaction.

- The accounting cycle runs within the accounting period.

- The goal of the accounting cycle is to produce financial statements for the company.

- summarize To give a recapitulation of the salient facts; to recapitulate or review

- source The person, place or thing from which something (information, goods, etc. ) comes or is acquired.

- bookkeeping The skill or practice of keeping books or systematic records of financial transactions, e.g., income and expenses.

As we walk through the steps of the accounting cycle, consider the following example. After a number of years as a successful CPA at a national firm, you decide to quit the rat race and pursue your true love -- yoga. You decide that Atlanta's Virginia-Highland neighborhood would be the perfect place to open an Ashtanga Yoga studio. Even better, your friend Solomon, a certified instructor, has just moved to town and is willing to teach at the studio. You hurriedly prepare to open the studio, Highland Yoga, by July 1.

Pre-opening (before July 1) Prior to opening the business, you make the following transactions:

1. You contribute $4,000 in cash to start the business.

2. You purchase $500 worth of mats and other equipment for use during classes.

3. You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.

4. You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December 31.

July The following transactions take place during July.

1. You receive cash totaling $800 for classes.

2. Your instructor teaches classes for the month. You agree to pay $600 for the classes; $300 is paid on July 15, and $300 will be paid on August 3.

3. You pay rent for July of $1,000 on July 1.

4. You use utilities (electricity and water) totaling $200. This amount is payable on August 15.

August The following transactions take place during August.

1. You receive $1,500 in cash for classes. Of this amount, $1,000 was for classes in August. The remainder is for 2-month passes allowing unlimited classes in August and September.

2. Your instructor again earns $600 teaching classes; $300 due on August 16 and $300 on September 1.

3. Utilities total $150, payable September 15.

4. You pay rent of $1,000 on August 1.

5. You sell inventory costing $150 for a revenue of $225.

6. You are worried about money, so your Uncle Rafael makes you an offer. He agrees to loan you $2,000 in cash. You will need to repay him sometime later, but he doesn't say when.

7. A client is extremely dissatisfied with their class, and demands their money back. Reluctantly, you agree. The class cost $15.

8. After borrowing money, you decide to withdraw some of your investment in the studio to pursue other opportunities. You decide to withdraw $1,000.

The accounting cycle is a series of steps performed during the accounting period (some throughout the period and some at the end) to analyze, record, classify, summarize, and report useful financial information for the purpose of preparing financial statements. In bookkeeping, the accounting period is the period for which the books are balanced and the financial statements are prepared. Generally, the accounting period consists of 12 months. However, the beginning of the accounting period differs according to the company. For example, one company may use the regular calendar year, January to December, as the accounting year, while another entity may follow April to March as the accounting period.

Eight Steps in the Accounting Cycle

There are eight steps in the accounting cycle and they are as follows:

- Analyze transactions by examining source documents.

- Journalize transactions in the journal.

- Post journal entries to the accounts in the ledger.

- Prepare a trial balance of the accounts and complete the worksheet (includes adjusting entries).

- Journalize and post adjusting entries.

- Prepare financial statements.

- Journalize and post closing entries.

- Prepare a post-closing trial balance.

Source Documents

To begin the accounting cycle, it is necessary to understand what constitutes a business transaction. Business transactions are measurable events that affect the financial condition of a business. Business transactions can be the exchange of goods for cash between the business and an external party, such as the sale of a book, or they can involve paying salaries to employees. These events have one fundamental thing in common: they have caused a measurable change in the amounts in the accounting equation, assets = liabilities + stockholders' equity. The evidence that a business event has occurred is a source document. Sales tickets, checks, and invoices are common source documents. Source documents are important because they are the ultimate proof that a business transaction has taken place. After determining, via the source documents, that an event is a business transaction, it is then entered into the company books via a journal entry. After all the transactions for the period have been entered into the appropriate journals, the journals are posted to the general ledger . The trial balance proves that the books are in balance or that the debits equal the credits. From the trial balance, a company can prepare their financial statements. After the financials are prepared, the month end adjusting and closing entries are recorded (journalized) and posted to the appropriate accounts. After those entries are made, a post-closing trial balance is run. The post-closing trial balance verifies the debits equal the credits and that all beginning balances for permanent accounts are in place.

The General Ledger contains all entries from both the General Journal and the Special Journals.

Highland Yoga

As we walk through the steps of the accounting cycle, consider the following example. After a number of years as a successful CPA at a national firm, you decide to quit the rat race and pursue your true love -- yoga. You decide that Atlanta's Virginia-Highland neighborhood would be the perfect place to open an Ashtanga Yoga studio. Even better, your friend Solomon, a certified instructor, has just moved to town and is willing to teach at the studio. You hurriedly prepare to open the studio, Highland Yoga, by July 1. Pre-opening (before July 1) Prior to opening the business, you make the following transactions:

- You contribute $4,000 in cash to start the business.

- You purchase $500 worth of mats and other equipment for use during classes.

- You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.

- You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December 31.

- You receive cash totaling $800 for classes.

- Your instructor teaches classes for the month. You agree to pay $600 for the classes; $300 is paid on July 15, and $300 will be paid on August 3.

- You pay rent for July of $1,000 on July 1.

- You use utilities (electricity and water) totaling $200. This amount is payable on August 15.

- You receive $1,500 in cash for classes. Of this amount, $1,000 was for classes in August. The remainder is for 2-month passes allowing unlimited classes in August and September.

- Your instructor again earns $600 teaching classes; $300 due on August 16 and $300 on September 1.

- Utilities total $150, payable September 15.

- You pay rent of $1,000 on August 1.

- You sell inventory costing $150 for a revenue of $225.

- You are worried about money, so your Uncle Rafael makes you an offer. He agrees to loan you $2,000 in cash. You will need to repay him sometime later, but he doesn't say when.

- A client is extremely dissatisfied with their class, and demands their money back. Reluctantly, you agree. The class cost $15.

- After borrowing money, you decide to withdraw some of your investment in the studio to pursue other opportunities. You decide to withdraw $1,000.

- Undergraduate

- High School

- Architecture

- American History

- Asian History

- Antique Literature

- American Literature

- Asian Literature

- Classic English Literature

- World Literature

- Creative Writing

- Linguistics

- Criminal Justice

- Legal Issues

- Anthropology

- Archaeology

- Political Science

- World Affairs

- African-American Studies

- East European Studies

- Latin-American Studies

- Native-American Studies

- West European Studies

- Family and Consumer Science

- Social Issues

- Women and Gender Studies

- Social Work

- Natural Sciences

- Pharmacology

- Earth science

- Agriculture

- Agricultural Studies

- Computer Science

- IT Management

- Mathematics

- Investments

- Engineering and Technology

- Engineering

- Aeronautics

- Medicine and Health

- Alternative Medicine

- Communications and Media

- Advertising

- Communication Strategies

- Public Relations

- Educational Theories

- Teacher's Career

- Chicago/Turabian

- Company Analysis

- Education Theories

- Shakespeare

- Canadian Studies

- Food Safety

- Relation of Global Warming and Extreme Weather Condition

- Movie Review

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article Critique

- Article Review

- Article Writing

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- GCSE Coursework

- Grant Proposal

- Marketing Plan

- Multiple Choice Quiz

- Personal Statement

- Power Point Presentation

- Power Point Presentation With Speaker Notes

- Questionnaire

- Reaction Paper

- Research Paper

- Research Proposal

- SWOT analysis

- Thesis Paper

- Online Quiz

- Literature Review

- Movie Analysis

- Statistics problem

- Math Problem

- All papers examples

- How It Works

- Money Back Policy

- Terms of Use

- Privacy Policy

- We Are Hiring

Accounting Cycle, Essay Example

Pages: 1

Words: 367

Hire a Writer for Custom Essay

Use 10% Off Discount: "custom10" in 1 Click 👇

You are free to use it as an inspiration or a source for your own work.

A company performance is mostly evaluated by analysing its financial statements. Preparation of financial statements is the responsibility of the accounting department in an organization. This process of taking note of every step involved and recording to finally come up with a financial statement is what is referred to as the accounting cycle. Accounting cycle, also known as bookkeeping cycle therefore incorporates the activities starting from the first bit of the transaction to when it is recorded in the books of accounts.

The general steps involved in an accounting cycle as described by Answers (n.d.) start from data collection and analyzing. This involves recording of daily, weekly or monthly transactions and putting them into their respective classes then entering this information in the general journal or the book of original entry. Ford Motor Company (2009) records would record a $1 million cash sale of a Jaguar in the journal by debiting the cash amount and crediting the sale. The general journal consists of all the transactions so the next step is to transfer these entries in their individual ledgers so $1 million is debited in the cash account and the same figure goes to sales. This helps in classifying them so that the correct balances for the accounts involved are got which are then posted in the unadjusted trial balance.

The accounts here are recorded according to their balance (the cash amount goes to he debit side while the sales balance is credited). Then adjustments (would include additional sales) are put into consideration to make a final preparation of the trial balance which is known as adjusted trial balance. Using the entries in the adjusted trial balance, the financial statements are finally prepared and the accounts closed out and the balancing figure taken to the balance sheet. For instance the profit or loss derived from the difference between revenue and expenses is transferred to the balance sheet. These figures are then posted to the post-closing trial balance to countercheck the accuracy of the closed accounts. These are then presented to the management as complete financial statements.

Answers Corporation (n.d.). Accounting Cycle. Retrieved on February 23, 2010 from http://www.answers.com/topic/acounting-cycle

Ford Motor Company (2009). Ford Vehicles. Retrieved on November 4, 2009 from http://www.ford.com/

Stuck with your Essay?

Get in touch with one of our experts for instant help!

Lawn Business to Earn Income, Essay Example

Channel Marketing in the Retail Grocery Industry, Essay Example

Time is precious

don’t waste it!

Plagiarism-free guarantee

Privacy guarantee

Secure checkout

Money back guarantee

Related Essay Samples & Examples

Relatives, essay example.

Words: 364

Voting as a Civic Responsibility, Essay Example

Words: 287

Utilitarianism and Its Applications, Essay Example

Words: 356

The Age-Related Changes of the Older Person, Essay Example

Pages: 2

Words: 448

The Problems ESOL Teachers Face, Essay Example

Pages: 8

Words: 2293

Should English Be the Primary Language? Essay Example

Pages: 4

Words: 999

Home — Essay Samples — Business — Accounting — Evaluation of the Impact of the Accounting Cycle in a Company

Evaluation of The Impact of The Accounting Cycle in a Company

- Categories: Accounting

About this sample

Words: 687 |

Published: Jan 15, 2019

Words: 687 | Pages: 2 | 4 min read

Cite this Essay

To export a reference to this article please select a referencing style below:

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Dr Jacklynne

Verified writer

- Expert in: Business

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

1 pages / 540 words

2 pages / 795 words

1 pages / 500 words

1 pages / 480 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Accounting neutrality is a fundamental concept in accounting that plays a crucial role in ensuring the integrity and reliability of financial information. It refers to the principle that accounting should be free from bias, [...]

Accounting is a fundamental aspect of financial management that plays a crucial role in both business and personal life. It ensures financial stability, informed decision-making, and compliance with legal regulations. This essay [...]

Accounting is a profession that has been around for centuries and has evolved tremendously over time. It is a valuable profession that requires unique skills and knowledge, provides various opportunities, and plays a crucial [...]

Trader Joe's is a well-known American grocery store chain that has gained a unique position in the market due to its distinctive business model and customer experience. One of the key aspects contributing to the success of [...]

Accounting software is an automated system that helps bookkeepers and accounting professionals report and document a companies financial transactions. Accounting software is a must in today’s business world because almost every [...]

Every enterprise whether big, medium or small, needs finance to carry on its operations and to achieve its targets. In fact, finance is so indispensable today that it is rightly said to be the life blood of an enterprise. [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Accounting Principles and Concepts

The Documentary Cycle in Accounting: How It Enhances Financial Control and Reporting

What is the documentary cycle.

The documentary cycle refers to the systematic flow of documents—such as invoices, purchase orders, receipts, and other financial records—through various stages of the accounting process. Each document is recorded, validated, and used to create accurate financial statements. This cycle is essential for maintaining the accuracy, legality, and reliability of the company's financial information.

2. Key Stages of the Documentary Cycle

Recording transactions.

The cycle begins with the recording of daily transactions. This includes documenting all financial events, such as sales, purchases, or payments, in a journal . Each entry must be accompanied by supporting documentation, like invoices or payment receipts, to ensure accuracy.

Posting to the Ledger

After recording the transactions, they are posted to the general ledger. The ledger organizes the entries into specific accounts such as assets, liabilities, expenses, and revenues, providing a detailed breakdown of financial activities.

Preparing the Trial Balance

Before finalizing the accounts, companies prepare a trial balance to ensure that the debit and credit balances are equal. This step helps identify any discrepancies or errors in the recording process before generating the final financial statements.

Final Adjustments and Reporting

The documentary cycle ends with final adjustments and the creation of financial reports, such as the income statement and balance sheet. These reports are crucial for internal control, tax filing, and strategic decision-making.

Read Also: International Financial Reporting Standards (IFRS) Simply Explained.

Importance of the Documentary Cycle

Enhancing internal control.

The documentary cycle helps ensure internal control by documenting every financial transaction with accurate records. It creates a paper trail that can be audited and verified, reducing the risk of errors, fraud, or financial mismanagement.

Ensuring Compliance and Transparency

A well-managed documentary cycle ensures compliance with regulatory requirements such as tax filings, financial audits, and legal obligations. Proper documentation makes it easier to prove the legitimacy of transactions to stakeholders and authorities.

The Role of Technology in the Documentary Cycle

Traditional vs. automated documentary cycles.

Traditionally, the documentary cycle was paper-based, involving manual logging, filing, and recording. However, modern businesses increasingly use automated systems that streamline processes, reduce errors, and increase efficiency. Automated systems like Wafeq can help businesses maintain real-time control over financial transactions and documents.

Automation speeds up the cycle and ensures better compliance and data security, making it easier to generate reports and audit trails.

Read more: 8 Crucial Accounting Cycle Steps With Examples.

Difference Between the Documentary Cycle and the Accounting Cycle

Although closely related, the documentary cycle and the accounting cycle serve different purposes. The documentary cycle focuses on gathering, recording, and validating financial documents, while the accounting cycle uses this data to produce financial statements and reports. In simple terms, the documentary cycle feeds into the accounting cycle.

Best Practices for Managing the Documentary Cycle

Tips for streamlining the process:.

Digitize Documents: Use accounting software like Wafeq to digitize and automate your documentary cycle, reducing human errors and increasing accuracy.

Regular Audits: Conduct internal audits to ensure that all documents are properly recorded and validated.

Centralized Document Management: Ensure that all departments follow standardized procedures for handling and storing documents.

How Wafeq Can Help in Managing Your Documentary Cycle

Wafeq offers a comprehensive accounting software solution that simplifies the documentary cycle. By automating tasks such as data entry, posting to the ledger, and generating reports, Wafeq helps businesses maintain accurate financial records with minimal effort.

Key Features:

- Automated invoice generation and tracking

- Real-time ledger updates

- Inventory and procurement tracking

- Compliance with VAT and other tax regulations

With Wafeq, businesses can ensure that their documentary cycle is efficient, transparent, and compliant with legal requirements.

Read also: Best VAT Compliant Accounting Software in the UAE .

The documentary cycle is foundational to any company’s financial and administrative control. By systematically documenting every transaction, businesses can ensure transparency, regulatory compliance, and smooth financial operations. Leveraging modern technology like Wafeq can significantly enhance the efficiency of this cycle, offering businesses a competitive edge in financial management.

Ready to streamline your accounting processes? Try Wafeq today and experience seamless management of your documentary cycle. With automated invoicing, real-time ledger updates, and detailed financial reports, Wafeq makes accounting easy.

- Call to +1 844 889-9952

The Roles of Each Step in the Accounting Cycle

| 📄 Words: | 1176 |

|---|---|

| 📝 Subject: | |

| 📑 Pages: | 7 |

| ✍️ Type: | Essay |

Accounting cycle

The business operations of a firm and its financial reports can be demonstrated in financial accounting. Accounting cycle reveals the financial reports of a firm’s operations and transactions. As a result, the components of the accounting cycle include journal entries, an unadjusted trial balance, adjusting entries, the adjusted trial balance, closing entries, and post-closing trial balance.

Journal entries

The journal entry is the first step of a firm’s accounting cycle. A firm’s journal entries document daily operations and financial transactions. As a result, all business transactions that require cash approval are reported in the journal entries. However, the tools for journal entries defer from other accounting steps. As a result, the firm’s financial accountant must identify, analyze, and journalize financial processes in the journal entries. The procedure requires effective planning to ensure accurate documentation.

Ledger account

A ledger account separates a firm’s debit and credit transitions. The ledger account is the second accounting cycle. The ledger account can be prepared with the corresponding journal entries for the organization. As a result, debit and credit transactions are identified and separated to ensure accurate financial accounts. After separating the debit from credit transactions, the total debit is subtracted from the credit sum.

Unadjusted trial balance

The unadjusted trial balance reveals the firm’s balances from the ledger account. The unadjusted trial balance is the third accounting cycle. The trial balance account reveals accounting errors in a firm’s ledger report. As a result, the ledger report is adjusted with entries to ensure accurate results. The features of the trial balance include account number, account name, debit balance, and credit balance.

Adjusting entries

Adjusted entries improve the financial reports of business transactions. As a result, adjusting entries document revenues and expenditures based on the accounting period. Adjusting entries used in the accounting cycle include accruals, prepayments, and non-cash. An accrual account describes income not received by the organization. As a result, account receivable, interest expense, and loan are called accrual payments. Insurance policy account, business license, rents, and office supplies are called prepayments. Bad debts, depreciation, and unearned payments are called non-cash accounts.

Adjusted entries

The adjusted trial balance derives from the ledger account. However, the adjusting entry is directly responsible for the adjusted entries account. Financial auditors and accountants use a firm’s adjusted account to compute the income statement and fiscal balance. However, the adjusted entries have its limitations. The adjusted entries cannot be used to verify a firm’s cash flow statements and financial reports. As a result, the adjusted trial balance can tally a firm’s account on both sides (Credit and debit). The adjusted trial balance cannot be used for auditing because it lacks the requirement of a financial statement.

Closing entries

The accounting cycle describes a firm’s financial growth based on its operations and transactions. As a result, the closing entry transfers a firm’s temporary transaction to the permanent account. However, the business orientation determines the features of its permanent account. The features of the closing entries include expense accounts, revenue account, sales account, profit account, and loss account. The account provides a closing statement of the firm’s financial operations and profit. As a result, auditors can reduce their investment based on the firm’s closing entries.

Post-closing entries

A comprehensive list of payments and transactions from the ledger account is called the post-closing trial balance. Accountants prepare the post-closing trial balance based on the permanent account. As a result, the auditor summarizes the ledger account, temporary account, and the closing entries. The post-closing trial balance signifies the end of the firm’s financial transactions for a particular year. As a result, stakeholders analyze the post-closing entries prior to the next financial calendar.

The impact of missing each step of the accounting cycle

Journal entries reveal the financial status of a firm’s business transactions. As a result, the journal entries provide a financial analysis of debit and credit ratios. However, any omission in the journal entries will have a serious impact on the closing report. The financial report begins with the journal entries, thus, the decision making process depends on the financial statement. As a result, the journal entries omission will affect the company’s financial forecast. Thus, any alteration in the journal entries will affect the remaining accounting steps. As a result, the ledger account, unadjusted entries, adjusting entries, the adjusted trial balance, closing entries, and post-closing trial balance will be affected. Auditors must reconcile each accounting step to avoid journal entry errors.

The ledger account provides the framework for financial reports. As a result, an incomplete ledger account will affect a firm’s accounting cycle. The accounting cycle includes the unadjusted entries, adjusting entries, the adjusted trial balance, closing entries, and post-closing trial balance. Thus, the decision making process of the organizations will be affected by the omission. Consequently, business growth will be affected by the accounting errors. Accountants and auditors must use an effective accounting system, an efficient bookkeeper, and different accounting classes to mitigate these financial errors.

Unadjusted, adjusting, and adjusted trial balance

Unadjusted trial balance reveals the ratio between a firm’s debit and credit account. As a result, any omission in the entry affects the adjusted trial balance. Consequently, the adjusted and adjusting entries describe the weight earnings of the organization. Any omission in the accounting cycle will affect the reversing entries. The effects of accounting omission include dependence, dissemination, update, and transition. However, auditors must implement standard procedures of accounting to avoid financial errors. Secondly, the auditors must be competent and efficient. The audit report must be verified by the financial board to avoid accounting errors.

The closing entries facilitate the decision making process of the organization. As a result, any alteration or omission will affect the firm’s financial records. Stakeholders and investors rely on a firm’s retained earnings for business investments. However, any omission will affect the closing reports of the firm’s business transactions. The omission will affect the income statement report, income statement, cash flow statement, and balance sheet. Thus, auditors must revise each step of the accounting cycle to avoid alterations and omission. Each step must be reported and tested by external auditors before submission. Consequently, the published report must be reviewed and approved by the audit board to avoid financial errors.

Post-closing trial balance

The post-closing trial balance shows the firm’s account statements for the year ending. As a result, accountants reconcile debit and credit balances of accounts. However, errors in the post-closing trial balance will affect the firm’s decision-making process, end-of-year report, and transitional accounts. As a result, auditors must allocate figures based on financial transactions and class type. Consequently, the classes of accounts must be reconciled to avoid accounting errors.

- Baking equipment = $2,500

- Misc. supplies = $50

- Baking supplies = $1,100

- Note payable = $6000

- Total = $9650

The financial statement and its implications

The financial statements revealed various accounting errors in each step. As a result, an efficient auditor will be employed to avoid these errors. The adjusted trial balance must be equal to validate the accounting procedures.

Cite this paper

Select style

- Chicago (A-D)

- Chicago (N-B)

BusinessEssay. (2022, November 21). The Roles of Each Step in the Accounting Cycle. https://business-essay.com/the-roles-of-each-step-in-the-accounting-cycle/

"The Roles of Each Step in the Accounting Cycle." BusinessEssay , 21 Nov. 2022, business-essay.com/the-roles-of-each-step-in-the-accounting-cycle/.

BusinessEssay . (2022) 'The Roles of Each Step in the Accounting Cycle'. 21 November.

BusinessEssay . 2022. "The Roles of Each Step in the Accounting Cycle." November 21, 2022. https://business-essay.com/the-roles-of-each-step-in-the-accounting-cycle/.

1. BusinessEssay . "The Roles of Each Step in the Accounting Cycle." November 21, 2022. https://business-essay.com/the-roles-of-each-step-in-the-accounting-cycle/.

Bibliography

BusinessEssay . "The Roles of Each Step in the Accounting Cycle." November 21, 2022. https://business-essay.com/the-roles-of-each-step-in-the-accounting-cycle/.

- Earnings Manipulation and Discretionary Accrual Model

- An Automated Accounting System for Maidas

- The Problems of Measurement and Disclosure Accounting for Impairment of Fixed Assets

- The Role of New Management Accounting Methods for Development of Financial Performance

- Financial Accounting – Losses and Risks

- International Accounting Standards – Members of IASB

- Impact of Unethical Accounting Practices on Business in the United Kingdom