The Pandemic's Impact on Unemployment and Labor Force Participation Trends

Following early 2020 responses to the pandemic, labor force participation declined dramatically and has remained below its 2019 level, whereas the unemployment rate recovered briskly. We estimate the trend of labor force participation and unemployment and find a substantial impact of the pandemic on estimates of trend. It turns out that levels of labor force participation and unemployment in 2021 were approaching their estimated trends. A return to 2019 levels would then represent a tight labor market, especially relative to long-run demographic trends that suggest further declines in the participation rate.

At the end of 2019, the labor market was hotter than it had been in years. Unemployment was at a historic low, and participation in the labor market was finally increasing after a prolonged decline. That tight labor market came to an abrupt halt with the COVID-19 pandemic in the spring of 2020.

Now, two years later, the labor market has mostly recovered from the depths of the pandemic recession. The unemployment rate is close to pre-pandemic lows, and job openings are at record highs. Yet, participation and employment rates have remained persistently below pre-pandemic levels. This suggests the possibility that the pandemic has permanently reduced participation in the economy and that current participation rates reflect a new normal. In this article, we explore how the pandemic has affected labor markets and whether a new normal is emerging.

What Is "Normal"?

One way to define the normal level of a variable is to estimate its trend and compare the observed data with the estimated trend values. Constructing a trend essentially means drawing a smooth line through the variations in the actual data.

But this means that constructing the trend for a point in time typically involves considering what happened both before and after that point in time. Thus, constructing the trend at the end of a sample is especially hard, since we do not yet know how the data will evolve.

We construct trends for three aggregate labor market ratios — the labor force participation (LFP) rate, the unemployment rate and the employment-population ratio (EPOP) — using methods described in our 2019 article " Projecting Unemployment and Demographic Trends ."

First, we estimate statistical models for LFP and unemployment rates of demographic groups defined by age, gender and education. For each gender and education, we decompose its unemployment and LFP into cyclical components common to all age groups and smooth local trends for age and cohort effects.

Second, we aggregate trends from the estimates of the group-specific trends. Specifically, we construct the trend for the aggregate LFP rate as the population-share-weighted sum of the corresponding estimated trends for demographic groups. We construct the aggregate unemployment rate and EPOP trends from the group-specific LFP and unemployment trends and the groups' population shares.

In our previous work, we estimated the trends for the unemployment rate and LFP rate of a gender-education group separately using maximum likelihood methods. The estimates reported in this article are based on the joint estimation of LFP and unemployment rate trends using Bayesian methods.

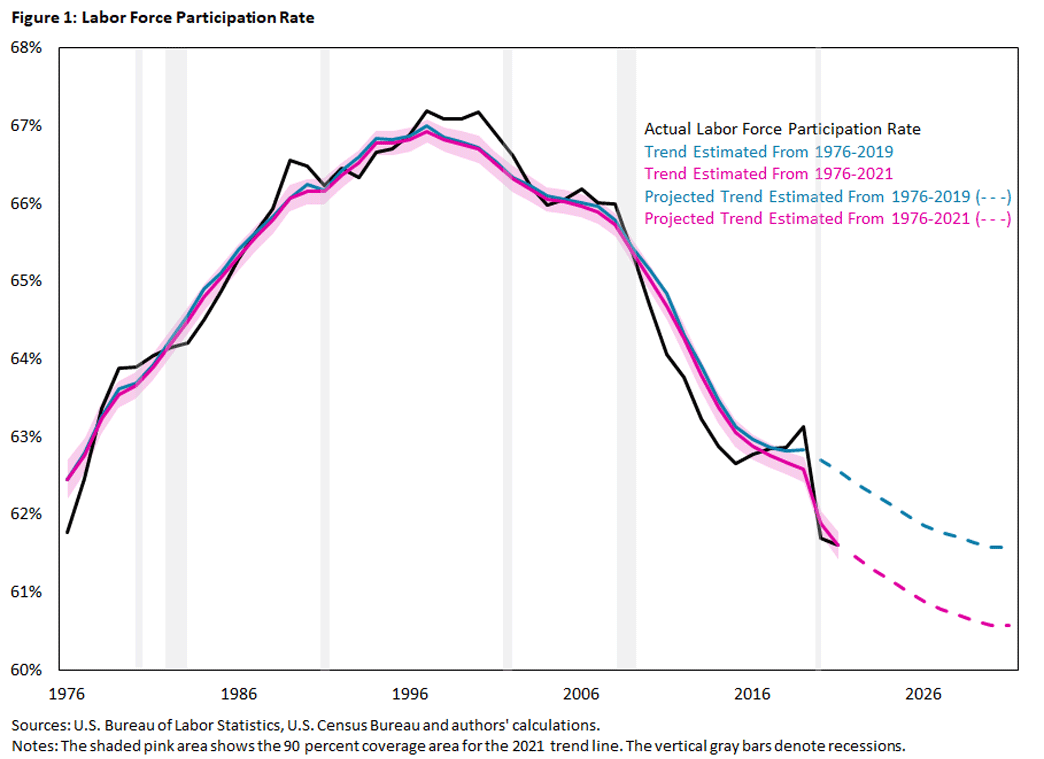

We separately estimate the trends using data from 1976 to 2019 (pre-pandemic) and from 1976 to 2021 (including the pandemic period). Figures 1, 2 and 3 display annual averages for the three aggregate labor market ratios — the LFP rate, the unemployment rate and EPOP, respectively — from 1976 to 2021.

In each figure, the solid black line denotes the observed values, and the blue and pink lines denote the estimated trend using data from 1976 up to and including 2019 and 2021, respectively. The estimated trends are subject to uncertainty, and the plotted trends represent the median estimate of the trend.

For the estimates based on data up to 2021, we also include the 90 percent coverage area shown as the shaded pink area. According to the statistical model, there is a 90 percent probability that the trend is contained in the coverage area. The blue and pink dotted lines represent our projections on how the labor market ratios will evolve until 2031, again based on the estimated trend up to and including 2019 and 2021. The shaded gray vertical areas highlight recessions as defined by the National Bureau of Economic Research (NBER).

Pre-Pandemic Trends: 1976-2019

We start with the pre-pandemic trends for the LFP rate and unemployment rate estimated for data from 1976 through 2019. After a long recovery from the 2007-09 recession, the LFP rate was 63.1 percent in 2019 (slightly above the estimated trend value of 62.8 percent), and the unemployment rate was 3.7 percent (noticeably below its estimated trend value of 4.7 percent).

The LFP rate being above trend and the unemployment rate being below trend reflects the characterization of the 2019 labor market as "hot." But note that even though the LFP rate exceeded its trend value in 2019, it was still lower than during the 2007-09 period. This difference is accounted for by the declining trend in the LFP rate.

As noted in our 2019 article , LFP rates and unemployment rates differ systematically across demographic groups. Participation rates tend to be higher for younger, more-educated workers and for men. Unemployment rates tend to be lower for men and for the older and more-educated population.

Thus, changes in the population composition over time — that is, the relative size of demographic groups — will affect the aggregate LFP and unemployment rates, in addition to changes in the LFP and unemployment rate trends of the demographic groups.

As also noted in our 2019 article, the hump-shaped trend of the aggregate LFP rate reflects a variety of forces:

- Prior to 1990, the aggregate LFP rate was boosted by an upward trend in the LFP rate of women. But after 1990, the LFP rate of women began declining. Combining this with declining trend LFP rates for other demographic groups has reduced the aggregate LFP rate.

- Changes in the age distribution had a limited impact prior to 2005, but the aging population since then has lowered the aggregate LFP rate substantially.

- Increasing educational attainment has contributed positively to aggregate LFP throughout the period.

The steady decline of the unemployment rate trend reflects mostly the contributions from an older and more-educated population and, to some extent, a decline in the trend unemployment rates of demographic groups.

Pre-Pandemic Expectations of Future LFP and Unemployment Trends

Our statistical model of smooth local trends for the LFP and unemployment rates of demographic groups has the property that the best forecast for future trend values of demographic groups is their last estimated trend value. Thus, the model will only predict a change in the trend of aggregate ratios if the population shares of its constituent groups are changing.

We combine the U.S. Census Bureau population forecasts for the gender-age groups with an estimated statistical model of education shares for gender-age groups to forecast population shares of our demographic groups from 2020 to 2031 (the dotted blue lines in Figures 1 and 2).

As we can see, the changing demographics alone imply further reductions of 1 percentage point and 0.2 percentage points in the trend LFP rate and unemployment rate, respectively. This projection is driven by the forecasted aging of the population, which is only partially offset by the forecasted higher educational attainment.

Based on data up to 2019, the same aggregate LFP rates in 2021 as in 2019 would have represented a substantial cyclical deviation upward from the pre-pandemic trends.

It is notable that the unemployment rate is much more volatile relative to its trend than the LFP rate is. In other words, cyclical deviations from trend are much more pronounced for the unemployment rate than for the LFP rate.

In fact, in our estimation, the behavior of the unemployment rate determines the common cyclical component of both the unemployment rate and the LFP rate. Whereas the unemployment rate spikes in recessions, the LFP rate response is more muted and tends to lag recessions. This feature will be important for interpreting how the estimated trend LFP rate changed with the pandemic.

Finally, Figure 3 combines the information from the LFP rate and unemployment rate and plots actual and trend rates for EPOP. On the one hand, given the relatively small trend decline of the unemployment rate, the trend for EPOP mainly reflects the trend for the LFP rate and inherits its hump-shaped path and the projected decline over the next 10 years. On the other hand, EPOP inherits the volatility from the unemployment rate. In 2019, EPOP is notably above trend, by about 1 percentage point.

Unemployment and Labor Force Participation During the Pandemic

The behavior of unemployment resulting from the pandemic-induced recession was different from past recessions:

- The entire increase in unemployment between February and April 2020 was accounted for by the increase in unemployment from temporary layoffs. This differed from previous recessions, when a spike in permanent layoffs led the bulge of unemployment in the trough.

- The recovery started in May 2020, and the speed of recovery was also much faster than in previous recessions. After only seven months, unemployment declined by 8 percentage points.

- The behavior of the unemployment rate is reflected in the 2020 recession being the shortest NBER recession on record: It lasted for two months (March to April 2020).

To summarize, the runup and decline of the unemployment rate during the pandemic were unusually rapid, but the qualitative features were not that different from previous recessions after properly accounting for temporary layoffs, as noted in the 2020 working paper " The Unemployed With Jobs and Without Jobs . "

The decline in the LFP rate was sharp and persistent. The LFP rate dropped from 63.4 percent in February 2020 to 60.2 percent in April 2020, an unprecedented drop during such a short period of time. After a rebound to 61.7 percent in August 2020, the LFP rate essentially moved sideways and remained below 62 percent until the end of 2021.

The large drop in the aggregate LFP rate has been attributed to, among others:

- More people — especially women — leaving the labor force to care for children because of school closings or to care for relatives at increased health risk, as noted in the 2021 work " Assessing Five Statements About the Economic Impact of COVID-19 on Women (PDF) " and the 2021 article " Caregiving for Children and Parental Labor Force Participation During the Pandemic "

- An increase in retirement due to health concerns, as noted in the 2021 working paper " How Has COVID-19 Affected the Labor Force Participation of Older Workers? "

- Generous pandemic income transfers and unemployment insurance programs, as noted in the 2021 article " COVID Transfers Dampening Employment Growth, but Not Necessarily a Bad Thing "

All of these factors might impact the participation trend, but by how much?

The Pandemic's Effect on Trend Estimates for LFP and Unemployment

The aggregate trend assessment for the LFP and unemployment rates has changed considerably as a result of 2020 and 2021. Repeating the estimation of trend and cycle for our demographic groups using data from 1976 up to 2021 yields the pink trend lines in Figures 1 and 2.

The updated trend estimates now put the positive cyclical gap in 2019 for LFP at 0.5 percentage points (rather than 0.3 percentage points) and the negative cyclical gap for the unemployment rate at 1.4 percentage points (rather than 1 percentage point). That is, by this estimate of the trend, the labor market in 2019 was even hotter than by the estimates from the 1976-2019 period.

In 2021, the actual LFP rate is essentially at trend, and the unemployment rate is only slightly above trend. That is, by this estimate of the trend, the labor market is relatively tight.

Notice that even though the new 2021 trend estimates for both the LFP and the unemployment rates differ noticeably from the trend values predicted for 2021 based on data up to 2019, the trend revisions for the LFP rate are limited to more recent years, whereas the trend revisions for the unemployment rate apply to the whole sample.

The difference in revisions is related to how confident we can be about the estimated trends. The 90 percent coverage area is quite narrow for the LFP rate for the entire sample up to the last four years. Thus, there is no need to drastically revise the estimated trend prior to 2017.

On the other hand, the 90 percent coverage area for the trend unemployment rate is quite broad throughout the sample. That is, a wide range of values for trend unemployment is potentially consistent with observed unemployment values. Consequently, the last two observations lead to a wholesale reassessment of the level of the trend unemployment rate.

Another way to frame the 2020-21 trend revisions is as follows. The unemployment rate is very cyclical, deviations from trend are large, and though the sharp increase and decline of the unemployment rate in 2020-21 is unusual, an upward level shift of the trend unemployment rate best reflects the additional pandemic data.

The LFP rate, however, is usually not very cyclical, and it is only weakly related to the unemployment rate. Since the model assumes that the cyclical response does not change over the sample, it then attributes the large 2020-21 drop of the LFP rate to a decline in its trend and ultimately to a decline of the trend LFP rates of most demographic groups.

Finally, the EPOP trend is again mainly determined by the LFP trend, seen in Figure 3. Including the pandemic years noticeably lowers the estimated trend for the years from 2017 onwards. The cyclical gap in 2019 is now estimated to be 1.4 percentage points, and 2021 EPOP is close to its estimated trend.

What Does the Future Hold?

In our framework, current estimates of trend LFP and the unemployment rate for demographic groups are the best forecasts of future rates. Combined with projected demographic changes, this implies a continued noticeable downward trend for the LFP rate and a slight downward trend for the unemployment rate.

The trend unemployment rate is low, independent of how we estimate the trend. But given the highly unusual circumstances of the pandemic, the model may well overstate the decline in the trend LFP rate. Therefore, it is likely that the "true" trend lies somewhere between the trends estimated using data up to 2019 and data up to 2021.

That being a possibility, it remains that labor markets as of now have been unusually tight by most other measures, such as nominal wage growth and posted job openings relative to hires. This suggests that the true trend is closer to the revised 2021 trend than to the 2019 trend. In other words, the LFP rate and unemployment rate at the end of 2021 relative to the 2021 estimate of trend LFP and unemployment rate are consistent with a tight labor market.

Andreas Hornstein is a senior advisor in the Research Department at the Federal Reserve Bank of Richmond. Marianna Kudlyak is a research advisor in the Research Department at the Federal Reserve Bank of San Francisco.

To cite this Economic Brief, please use the following format: Hornstein, Andreas; and Kudlyak, Marianna. (April 2022) "The Pandemic's Impact on Unemployment and Labor Force Participation Trends." Federal Reserve Bank of Richmond Economic Brief , No. 22-12.

This article may be photocopied or reprinted in its entirety. Please credit the authors, source, and the Federal Reserve Bank of Richmond and include the italicized statement below.

V iews expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Receive a notification when Economic Brief is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.

As a new subscriber, you will need to confirm your request to receive email notifications from the Richmond Fed. Please click the confirm subscription link in the email to activate your request.

If you do not receive a confirmation email, check your junk or spam folder as the email may have been diverted.

IMAGES